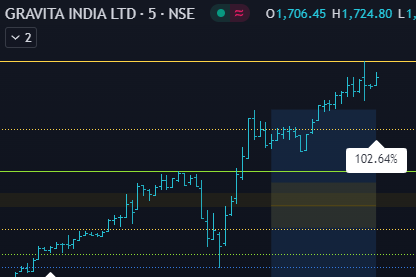

Here is Gravita on the 5min Dhan chart.

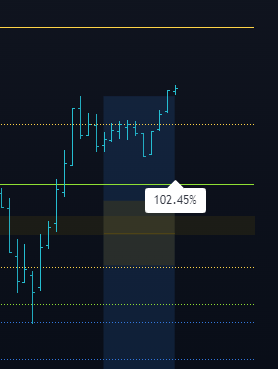

The highlighted portion of steep drop and immediate recovery appears to be a move to stop-out intraday traders or perhaps Budget day volatility. The Blue line is level at which I took long entry and mine is a positional trade.

Basis

The entry was based on this Daily set up which identified 1505.9 as entry price on 5th July 2024. 1608.30 is 6.8% returns level which was the FD interest Banks were paying till recently on Annual Fixed Deposits. When it hits 1743 then that would be 15.8% which is the total returns of Nifty 500 Index since inception. I use these as bench-mark levels. 1813 is 20% level. The levels are plotted automatically by my Script. The stock has gained 9% gain from the entry price as shown by the Gain label.

As a Swing/Positional player, set-up rule says I should stay in the trade till it hits 1, 2 or 3 levels as per my risk-tolerance. I usually get out at 15.8% level. On this trade my exposure is 1L and trade is currently in Green.

Thought that the info shared might be of interest to some of you.

All the best folks!

ps: Looks like Gravita might be attempting to hit UC denoted by the Yellow line today. Let’s see.

ps: It doesn’t happen quite often, but Gravita did hit 20% circuit. Folks that may have traded it, would’ve been happy.