Have You Used MTF to Scale Your Trades? How Do You Decide the Right Exposure While Managing Risk?

Also, Does MTF help you maximize profits effectively, or do you think the risks outweigh the rewards?

would be happy to know from community members about this.

1 Like

No. I am not a fan of trading with debt funding. Besides, if I want to I can get a personal loan at lower rate than MTF interest rates. Also, I don’t trade or invest actively in stocks. I am a pure FnO trader.

Hi @RohanTrader MTF has been the number 1 reason for the progression in my career. Since 2016, I have been using leverage (primarily MTF) in ICICI Direct.

I use MTF as a substitute for F&O, where can I control my position size, multiple entries and exits. During the time of COVID also, I was heavily trading in MTF.

If you have a winning system with proven track record (not backtesting), then you can go for an exposure of 2X and you will see significant performance enhancements.

There are people who say this and then they say they trade exclusively in options or futures. The reality is F&O is the crudest form of leverage and ultimate financial suicide for a poor trader like me. All forms of F&O are the derivatives of the underlying stock. If I buy a stock option for ₹3000 and the lot value is ₹300,000. What do you call it?

I would rather go for an margin of ₹150,000 to ₹300,000 exposure.

Sure, I can’t beat F&O traders in terms of profits in the short term, but in the long term, I hope to build meaningful wealth.

2 Likes

Very good question, thanks @RahulDeshpande for tagging me.

I have been using MTF for quite sometime and find this quite useful to me.

FnO is very niche instrument, though anyone can buy it - not everyone should. It has big capital requirement, secondly risk is even bigger in case of opposite move.

Investment is something which I don’t want to touch too often, also want to stay invested during some downturn like 10-30% as per my analysis.

MTF gives me sweet spot in between. I can play a setup where I see possibility of a move but don’t want to risk too big or too less. Since its not tied to a fixed lot, I can buy quantity as per my appetite.

Managing risk become a more active work with leveraged instrument like MTF. Most of the time, I can’t wait your entire position to hit stop loss. Similarly I don’t enter in one go. So staggered entries and staggered exits. Trailing stop loss is an indespensable way of saving your profit. In case the sharp rise scares me, I book some to break even.

I keep a journal - write my entries, progress, exit and thoughts. Helps me analyse my trades later on to find success, profitability, bad trades, bias etc.

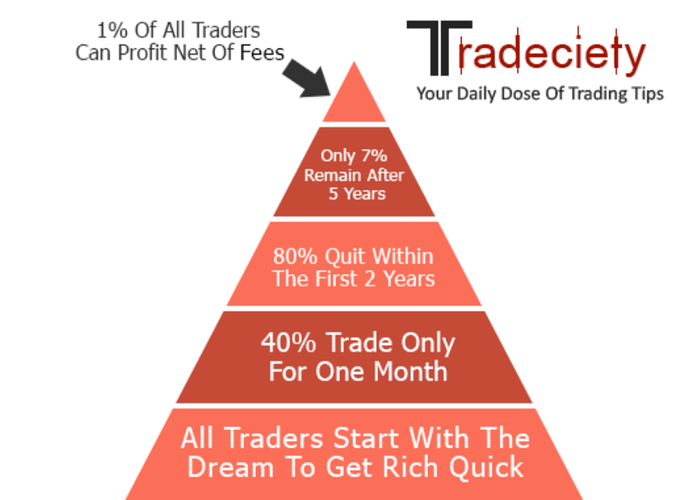

Stock market is probably the only formal channel where people who are not worthy to get a loan is given one. For the risk a very high interest rate is also charged. The funding is given to trade in stocks which can wipe out its value very fast due to micro or macro reasons. Besides as in the SEBI report which mirrors a global reality only a miniscule percentage is really succesful at trading.

It then means that the funding scheme under MTF pose a great amount of risk not just to the broker but also to the whole system if we club all the MTF positions with all brokers. No wonder Dhan RMS team thought to pause it when it thought the risk was too high.

Also at the individual level for mtf based market activity to make any financial sense one has to make more than mtf interest rate + deposit rate which would be approx 24%. Nifty CAGR over the last 25 yrs is around 14.8% only. So unless one falls at higher end of 1% succesful trader bracket MTF doesn’t make any sense. Besides there is this regular pressure to pay the interest and so regular pressure to generate returns from trading which typically leads to irrational decision making while trading.

As for leverage in FnO, that is not what kills traders. Leverage is there in cash market also (5x intraday) We don’t blame the car when an accident occurs. The liability is on the driver. FnO comes with many options to manage and cut down risk if one wants to.

Finally I don’t do stock FnO. I do Index FnO. Most of the activity in the exchange is on the Index FnO side and for good reason.

This is called not being able to comprehend the applications of MTF. It is not so easy that one pulls up a spreadsheet and put the MTF rate at 15% and compares it with a personal loan or Nifty returns. I as a trader, am not here to benchmark what Nifty does. I will have to make money irrespective of Nifty does. My only benchmark is my last month’s earnings.

Firstly, an MTF TRADING POSITION is not meant to be held eternally. At the very maximum it is to be held for a couple of days (2-3) with a position churn of around 4-5 a month. A MTF trade pays off more than 4%. The point of MTF is that it allows overnight flexibility.

Let’s do the math:

Per day MTF interest: 0.045%

No. of days: 3

Interest: 0.135%

Times a month: 5 * 0.135% = 0.675%

Returns a trade (avg): 4%

Returns a month: 4% * 5 = 20%

20% a month for 0.675% outgo.

If as a trader one can’t make more than 8.1% a year better not trade.

@t7support Options trading does kill a trader unless he is using it for hedging purposes for the underlying he holds. If you are doing index options, that is meant to hedge market risk in a portfolio. If it works for you, I’m happy for you.

Strawman arguments. Driving a car has nothing to do with trading.

1 Like

I am yet to meet a trader who consistently makes 20% a month. Prop firm returns are available in MCA website. No one does that much consistently year after year (not even close even with the best tech tools and minds). If you are doing it, you are at the top bracket of successful traders. Great for you. For most people that doesn’t happen as is evident in study after study done globally. Besides higher funding cost is higher funding cost, u look daywise or year wise.

It is not if u see from the lens of the doer. In trading or driving it is the doer that does…

Just for the sake of a balanced summary here. Neither @t7support 's option strategies nor my MTF strategies are designed for a novice trader or for any average trader, as a matter of fact.

There are just too many intricasies with both our strategies and both of our personalities.

A novice or an average trader is better off buying stocks for the long term and all the old money stuff that you will find plenty peddled around everywhere.

True. Inconsistently, but steadily. More to come.

I’ve noticed some swing traders using Dhan’s MTF feature while live streaming. That’s great for them.

I struggled to understand the MTF calculations. It wasn’t that they were unclear, but rather that I was unsure about the limits of this leveraging system. I kept wondering what would happen before someone else, like the RMS, could step in and close my position. The thought of a third party having the ability to interfere with my trades made me hesitant to go through with it.

Since this month’s contract is coming to a close and the margins have increased threefold, I will need to end my Futures Trading in NIFTY for good. If MTF can be used for NIFTYBEES, I’ll give the MTF and NIFTYBEES combination a shot.

Does anyone know if Dhan’s MTF feature is available for NIFTYBEES?

Hey @Brishide ,

You can find a list of all the scrips where MTF is available here.

Thanks,

Pranita

Product @ Dhan

1 Like

Thank you! I checked out the list of instruments available for MTF, and I’m happy to see that NIFTYBEES is included.