Over the past few weeks, I stumbled upon the ability of AI to analyze screenshots — almost by accident.

That small discovery opened the door to something far more interesting: could a simple image of a trading chart be enough for an AI to generate a real-time, actionable trade plan?

So, I decided to put it to the test.

The Setup

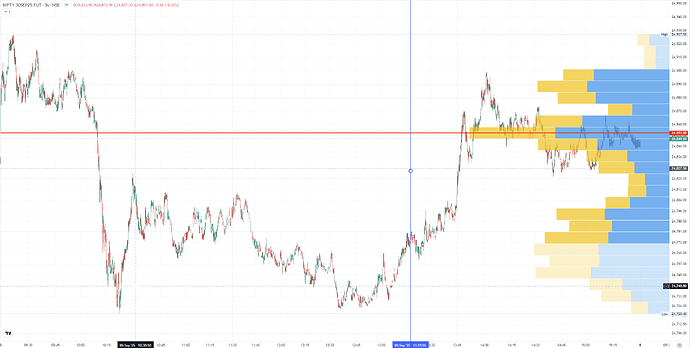

- Instrument: Nifty50 Futures

- Chart Type: Second-based intraday chart

- Indicator: Volume Profile (Visible Range)

- Platform: Screenshot taken directly from a charting tool

Rather than running a backtest or building out a full algo, I kept it simple:

Today I uploaded a screenshot of my chart to an AI platform capable of visual data interpretation.

What Happened

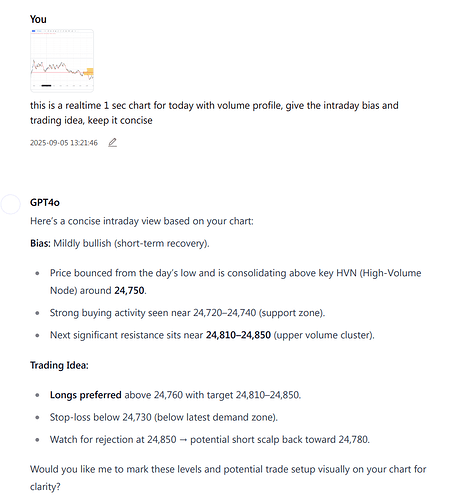

To my surprise, the AI didn’t just “see” the image — it understood it.

It recognized key structural elements of the chart, including:

- Price action context

- High-volume areas

- Possible demand/supply zones

- Likely points of inflection

And based on that, it generated a coherent, real-time intraday trade plan — purely from what was visible on the chart.

How It Works (Technologies Involved)

What made this possible wasn’t just one tool, but a combination of advanced technologies working seamlessly in the background — all triggered by something as simple as uploading a screenshot:

- OCR (Optical Character Recognition) to extract price, time, and volume levels from the image

- Computer Vision to interpret the layout and structure of the chart

- Multimodal Large Language Models (like GPT-4 with vision) to combine that visual data with contextual trading knowledge and generate strategic insights

This wasn’t just “reading a chart” — it was context-aware market interpretation based on the same visual data a human trader would use.

The Outcome

The AI highlighted the key price zone to watch.

A few hours later, the Nifty responded almost exactly at those suggested level.

In the full-day chart I’ve attached below, you’ll see a blue line marking the time when the screenshot was analyzed by AI (timestamp on the output screenshot). The subsequent price action respected the suggested levels, reinforcing the accuracy of the AI-generated plan.

There was no data mining, no hindsight bias — just a clean chart and a real-time suggestion that held up.

Why This Matters

This isn’t about high-frequency trading or opaque black-box systems.

This is about:

- A retail-accessible, no-code workflow

- Built with publicly available AI tools

- Using everyday chart visuals

- And delivering real, actionable clarity

It’s a practical example of how AI can augment trading intuition — not replace it, but enhance it by combining speed, structure, and contextual pattern recognition.

What’s Next?

I believe this is just the beginning of a new kind of trading workflow — where chart screenshots and AI can work together to support faster, smarter decisions.

Disclaimer:

Disclaimer:

The content shared in this post is for educational and research enhancement purposes only. It does not constitute financial advice or a recommendation to buy or sell any financial instruments. Always conduct your own analysis or consult a qualified advisor before making any trading decisions.