Hi Everyone,

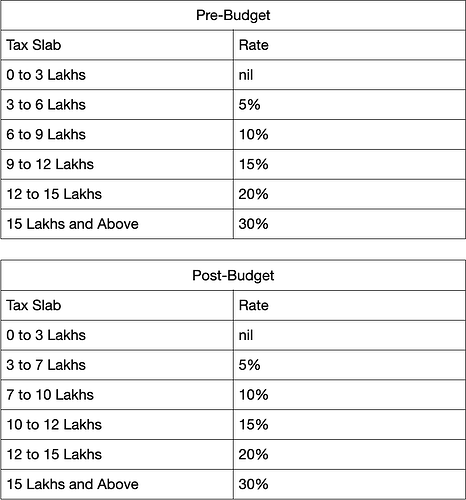

Finance Minister Nirmala Sitharaman proposed changes to the New Tax Regime in the Union Budget that was presented today. Changes are as follows:

There was also a mention of increasing the standard deduction from ₹50,000 to ₹75,000. All of these changes may make the New Tax Regime more favorable.

Side note: the Finance Minister also announced changes in Capital Gains Taxation and STT for the markets.

To salaried professionals who trade and invest, what did you think of Finance Minister Nirmala Sitharaman’s proposed changes to the New Income Tax Regime?