Hi Traders,

By now, we are all aware that the lot size for index futures and options contracts has increased from November 20, 2024. But has it really? For example, the lot size for Nifty nearest expiry options is still 25, while for the 2nd January options, it is 75, and then it reverts to 25 for the 30 January options.

So, what exactly is the lot size for Nifty and other index derivatives? And if it is changing, when do these changes actually take effect? It is confusing, isn’t it?

No worries. Let us break it down and understand everything around lot size changes in detail. We will take the example of Nifty, which includes all types of expiries—weekly, monthly, quarterly, and half-yearly. And the only index derivatives whose expiry day remains unchanged. ![]()

The story began when SEBI issued a circular on October 1st, aiming to strengthen the equity index derivatives framework. The circular mandated an increase in the lot size for index derivatives. Following this, exchanges released their own circulars (NSE and BSE), specifying the revised lot sizes and their implementation date.

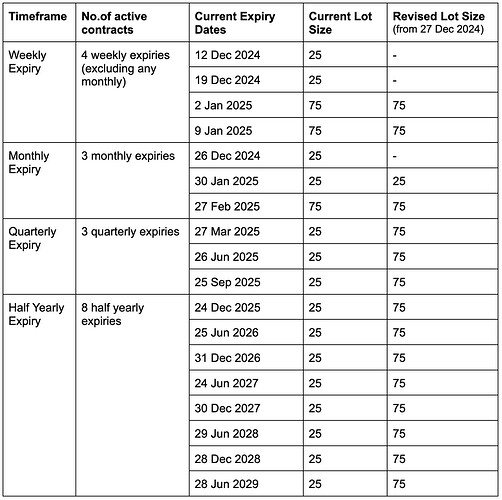

For Nifty, the existing lot size of 25 was revised to 75, but this change applies only to contracts introduced after November 20, 2024. Contracts introduced before this date—including weekly and monthly contracts—retain the old lot size of 25.

The first weekly Nifty options contract introduced after November 20 was the 02 January expiry, so contracts with expiries from January 2 onwards have the revised lot size of 75.

However, the 30 January contract still has the old lot size of 25. This is because the 30 January contract is a monthly expiry, and it was introduced before November 20. Similarly, all quarterly and half-yearly expiries introduced before November 20 have also retained the existing lot size of 25. But there is a catch—active quarterly and half-yearly Nifty contracts will undergo a lot size change from December 27, 2024.

To understand this better, let us go through the active contracts and their revision of lot size.The Trading Cycle of NIFTY :

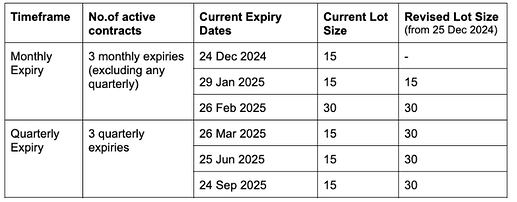

The same applies to BankNifty as well—the lot size for BankNifty quarterly contracts will change from 25 December 2024. Here is the Trading Cycle of BANKNIFTY.

The expiry day for BankNifty is shifting to Thursday from January 2025.

![]() A crucial point to remember– if you carry forward positions in contracts with the current lot size past the due date for the lot size change, you will face challenges in managing those positions. Exiting such positions may not be possible, and even we as a broker will not be able to help. These positions will remain active until expiry. To avoid this, ensure that any positions carried overnight on December 24 for BankNifty and December 26 for Nifty are not affected by the lot size revision. This small precaution will save you from unnecessary complications.

A crucial point to remember– if you carry forward positions in contracts with the current lot size past the due date for the lot size change, you will face challenges in managing those positions. Exiting such positions may not be possible, and even we as a broker will not be able to help. These positions will remain active until expiry. To avoid this, ensure that any positions carried overnight on December 24 for BankNifty and December 26 for Nifty are not affected by the lot size revision. This small precaution will save you from unnecessary complications.

Hope this has clarified all the doubts around the lot size revision. Again, make sure you are not carrying any quarterly & half yearly BankNifty/Nifty positions on lot size revision due date (24 & 26 Dec respectively).

Share this & inform your trader friends,

Till then, Happy Trading