Dear Traders and Investors,

We are delighted to share an important update regarding Risk policy changes in the Margin Trading Facility (MTF) segment. Building with continuous feedback from the trading community, we have built MTF to be one of the most exhaustive features on Dhan. It allows users to get up to 5X leverages in 1000+ stocks ( provided you are bringing in non cash collateral ).

- MTF is available on on Dhan as well as OT app & web

- MTF APIs are available for all users who would like to place MTF trades via API

- You can place Forever OCO Orders via MTF

- MTF trades can also be placed via the Trading View console- Dhan as well as Trading View’s native order window

- While placing basket orders, you can select & place MTF orders in scrips of your choice.

- You can convert your MTF positions to Delivery

Keeping with our tradition of building products based on user feedback, we have decided to double the total client-level exposure in the MTF segment, increasing it from the existing 25 lakhs to 50 lakhs. This enhancement aims to provide you with a more versatile investing experience.

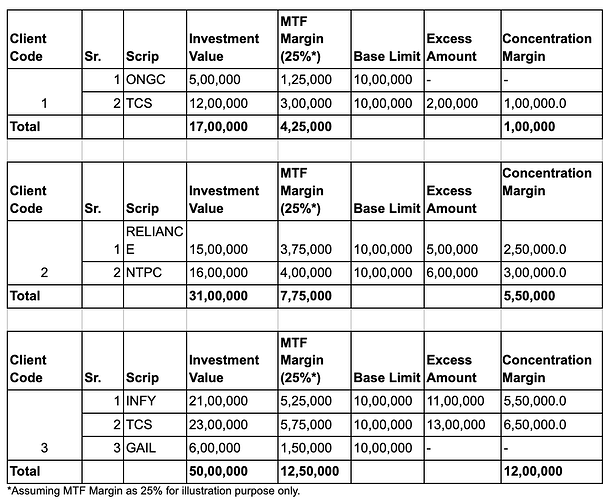

In a practical sense, this implies that you can now construct an MTF portfolio with a maximum value of Rs. 50 lakhs. According to our risk policy, individual stock and group exposure should not exceed 20% of the maximum MTF funding, which means that the maximum exposure for any individual stock or for any corporate group under MTF would be 20% of Rs. 50 lakhs, which is Rs. 10 lakhs. It is crucial to be aware that any exposure surpassing Rs. 10 lakhs will result in an additional concentration margin of 50% applied to the amount exceeding this limit.

For details, please refer the examples illustrated as below

As illustrated,

- Client 1 pays Rs 4,25,000 as margin & will be charged additional Rs. 1,00,000 as concentration margin on TCS as the exposure surpasses the base limit by Rs. 2,00,000. So the total margin blocked is Rs 5,25,000 in this case.

- Client 2 pays 7,75,00 as margin & will be charged additional Rs. 5,50,000 as concentration margin on RELIANCE and NTPC as the exposure surpasses the base limit by Rs. 11,00,000. So the total margin blocked is Rs 13,25,000 in this case.

- Client 3 has completely utilised the maximum MTF exposure and hence cannot take any positions further. So the total margin blocked is Rs 24,50,000 in this case.

Note that if the exposure exceeds Rs. 10,00,000, the additional margin requirement must be fulfilled failing which RMS reserves the right to square off positions.

We hope that with this move, we are able to fulfil the requests of many of our users who have been requesting for higher limits in MTF. Enjoy your MTF trading experience!

Thank You,

Pranita

Product @ Dhan