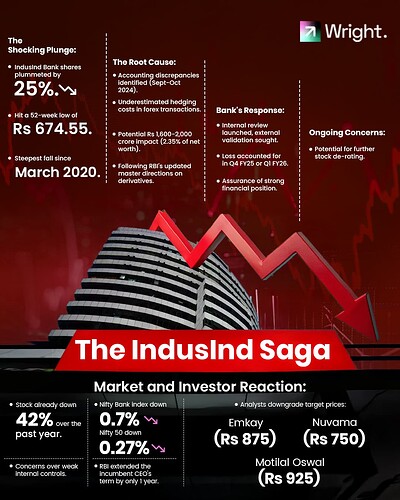

The Indian banking sector witnessed a major shakeup as IndusInd Bank’s stock plummeted by 25%, following revelations of a ₹2,100 crore derivative loss that could impact its net worth by 2.35%.

![]() What happened?

What happened?

- An internal review uncovered discrepancies in accounting forex derivatives/swaps over the past 5-7 years.

- Losses weren’t recognized in NII, while treasury gains were booked in P&L.

= New RBI regulations (April 2024) barred internal hedging, forcing transparency in derivative trades.

![]() The Fallout

The Fallout

- Broking firms downgraded the stock as investors reacted sharply.

- The bank expects a Q4FY25 loss, with RoA dipping by 30 bps to 0.9%.

- An external review is underway, and the RBI was informed about the findings.

![]() The Bigger Picture

The Bigger Picture

IndusInd isn’t alone—this raises critical questions on risk management, transparency, and regulatory oversight in Indian banking. Are banks truly prepared for RBI’s evolving compliance landscape?