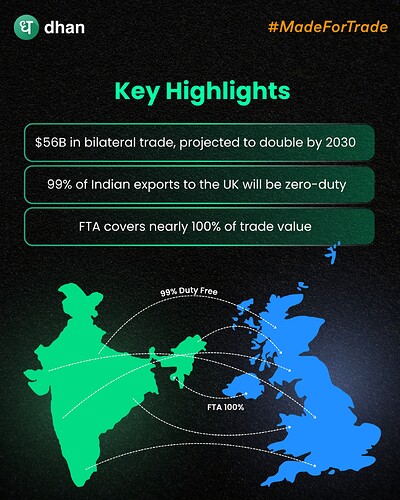

The long-awaited India–UK Free Trade Agreement (FTA), pegged at $34 billion, is one of the most comprehensive economic partnerships signed by India in recent times. Going far beyond mere tariff cuts, this FTA covers nearly 100% of bilateral trade, ensures zero-duty access for 99% of Indian exports, and has the potential to double trade volumes to $56 billion by 2030.

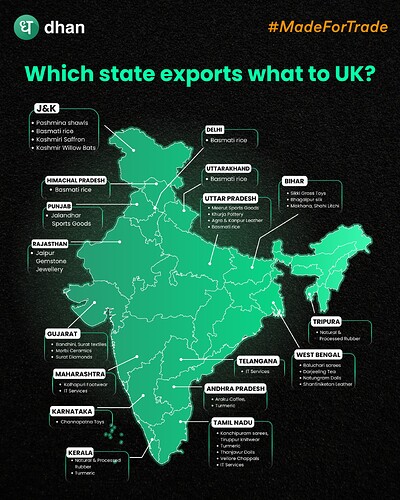

From leather to lithium-ion, agri to aerospace, and pharma to processed food, the implications are vast.

| Sector | Why It Benefits | Projections |

|---|---|---|

| Leather | Zero-duty boosts competitiveness | $900M+ exports |

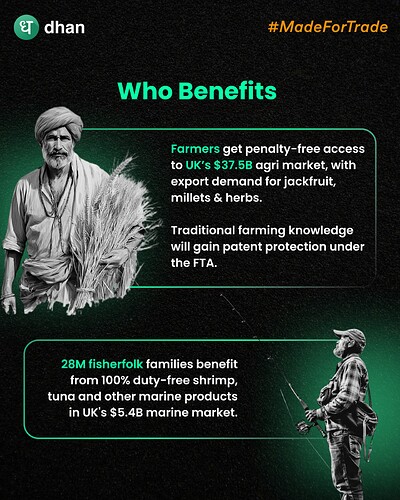

| Agriculture | Access to UK’s $37.5B agri market | 20% export growth in 3 yrs |

| Marine Products | Duty-free shrimp, tuna in UK’s $5.4B market | 28M fisherfolk benefit |

| Engineering | Machinery, tools, components | Could hit $7.5B exports by 2030 |

| Pharma & Med Devices | Duty-free ECG, X-ray, generics | Boost to exports & patents |

| Electronics | Phones, cables, accessories | Tighter India–UK supply chain |

| Jewellery | Handcrafted exports to UK | Expected to double in 3 yrs |

| Chemicals | Industrial, specialty chemicals | $750M by FY26 |

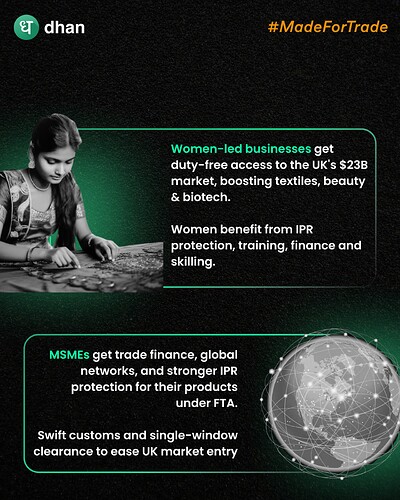

The India–UK FTA isn’t just a geopolitical milestone it’s a green signal for Indian exports, a booster shot for MSMEs, and a long runway for investors and market participants. As global supply chains diversify and FTAs dictate trade flows, those ahead of the curve will benefit the most.

Disclaimer: The sectors and stocks mentioned are for information and educational purposes only. They do not constitute investment advice or recommendations. Please do your own research or consult a professional financial advisor before making any investment decisions.