Hello Super Traders,

Few days back, we hosted a community meet-up in our office to give a sneak peak of the new Options Trader App 2.0 (Glass Edition). The meet-up, like always, was one more event for us to connect with Traders and users of Dhan and gather valuable feedback. The direct insights and feedback from the trading community has always been instrumental in making our Products and Features better. In fact, it was through such interactions, conversations and feedback from Traders across India that we truly realised the genuine need and demand for a dedicated Options Trading platform.

Options Traders have unique needs, requiring comprehensive data, analytics, tools, charts, and seamless execution capabilities all in one platform. In response to this need, we introduced the Options Trader app in May '22. The response was overwhelming subsequently, early this year in January '23, we introduced the Options Trader web platform with a built-in Custom Strategy Builder.

Today, we are excited to announce the upgraded and enhanced - all New Options Trader Experience with the Glass Edition and Custom Strategy Builder now available on our mobile app.

Learn how to create custom strategy on Options Trader App ![]()

This enhanced Options Trader follows our new design language, introduced with the Dhan app in Jan '23 - The Glass Design. The UI / UX transformation goes beyond just changing the design language; it enhances the overall Product Experience, Features and its Execution Capabilities. This has taken us a while, as it required substantial efforts and resources from us on engineering, design and product to build it to near-perfection. As we always say - Dhan gets better, every day!

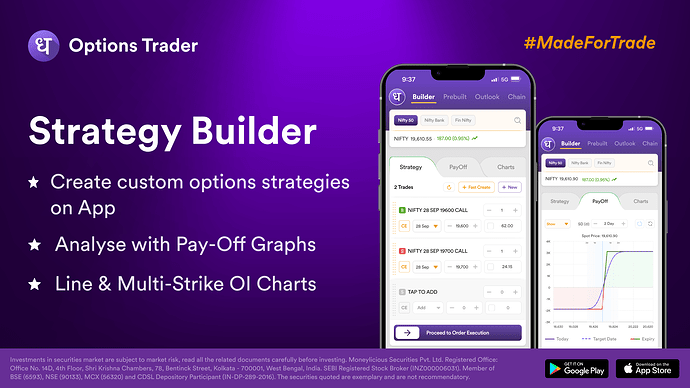

More than the design language and product experience, we have also introduced the Custom Strategy Builder in the mobile app that is built grounds-up. The App-Menu earlier now has a new section called “Strategies” that hosts the Strategy Builder, updated Popular Strategies and also the Market Outlook based Strategies. It was again a task for our team to package the multitude of information in a compact screen of a mobile phone. Below are the details of each component in “Strategies”.

- Creating a Custom Strategy

The first tab is “Builder”. To create strategy select the underlying asset from the top menu. NIFTY, BANKNIFTY, and FINNIFTY are conveniently pinned for quick access, but you also have the flexibility to choose from a wide range of F&O stocks, BSE and NSE tradable Indices, Commodities (Crude Oil, Natural Gas, Gold, Silver), and Currencies (USD-INR) from the search.

This serves as your primary input window for adding and customising legs. You have the freedom to tailor and customise each aspect of the leg to your liking - including Transaction Type (Buy/Sell), Option Type (Call/Put), Expiry Date, Strike Price, Lot, Order Type, and Price. Additionally, you can adjust the order sequence, with the legs executing in the same sequence as arranged in the Strategy Builder.

To add a new leg, simply tap on the greyed-out leg labelled ‘Tap-To-Add’. This will activate the leg, allowing you to make the necessary changes. Once you’ve made your adjustments, tap on ‘+Add Leg’ to incorporate it into your strategy.

Alternatively, you can click on ‘+ New,’ which opens a compact Option Chain. Here, you can add your desired leg to the Strategy Builder.

A third option for strategy creation is ‘Fast Create,’ which opens a dialogue box featuring ready-made popular strategies for your reference. These pre-built strategy templates are grouped based on market views, like Bullish, Bearish, Non-directional, and Any-direction. They serve as a helpful and quick starting point for constructing your own customised strategies.

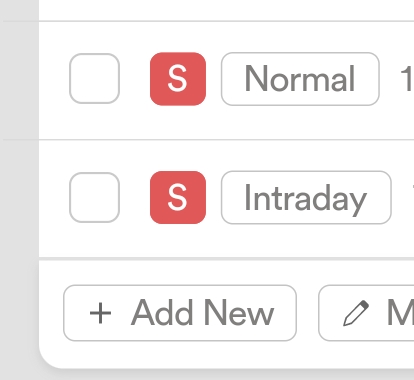

Once you have created your strategy, you can select the Product Type from the “more” option, change the Lot multiples from the lot section below and see the margin required, and also adjust if the Strategy is for Intraday or Carry Forward Position.

- Pay-Off Graph

Navigate to the ‘Pay-Off’ tab to access the graphical representation of your customised strategy’s payoff. This graph illustrates your strategy’s profit and loss (P&L) based on movements in the strike price. The pay-off graph includes three distinct lines:

- The Red-Green Line: Represents your strategy’s P&L on the expiry day.

- The Blue Line: Represents your strategy’s current P&L.

- The Dotted Line: Represents your strategy’s projected P&L on the target date.

To modify the target date and spot price, click on ‘more.’ Here, you can adjust & change the target date, target price, and implied volatility, observing how these adjustments affect your P&L in both the Payoff graph and the P&L table below.

The Pay-off graph also features a shaded blue region, which signifies the standard deviation of the spot price. Additionally, you have the option to overlay Open Interest and the Change in Open Interest column chart onto the Pay-off graph. This powerful analytical tool provides valuable insights to assist you in making well-informed trading decisions.

- Charts & Multistrike OI

The ‘Charts’ tab within the strategy builder offers a comprehensive visual representation. Here, you can view a line chart of the custom strategy you have created, alongside the line chart of the underlying asset for the past five trading days. Furthermore, you have the option to examine the line chart of open interest for each leg individually, easily accessible through the ‘Multistrike OI’ feature.

Further down, you’ll find insightful Payoff simulations, including key metrics like Max Profit, Max Loss, Risk Reward Ratio, and the Breakeven Point. Additionally, a dedicated section displays the strategy’s Greeks, featuring Delta, Theta, Gamma, and Vega, offering a comprehensive understanding of your strategy’s characteristics.

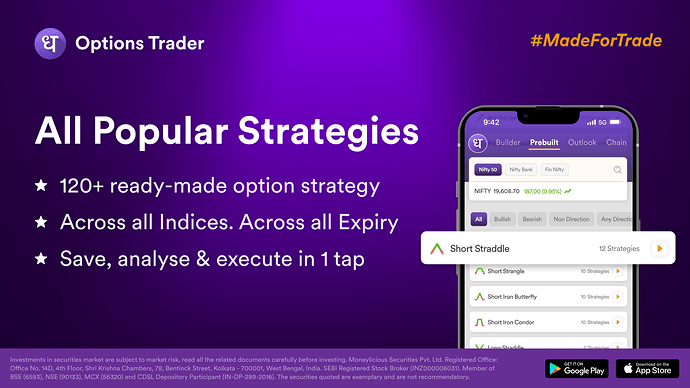

- Popular Strategies

While the Pre-Built section existed in the previous version, this update brings a significant overhaul to the overall user experience, features and also product flow from discovery to execution. Now, it’s simpler than ever to access Pre-Built Strategies.

Just select the underlying asset (Index or F&O Stocks or Commodity or Currency) from the top menu, click on your desired strategy, and a list of strategies will populate. You can also modify the expiry date as needed. Once you’ve chosen a strategy, you’ll encounter clear Calls to Action (CTAs) such as ‘See in Builder,’ ‘Save as Basket,’ or ‘Execute.’

Furthermore, with this update, we’ve introduced a new and enhanced Strategy Execution window that mirrors the order execution window’s format. Here, you will have access to crucial information like margin requirements and other vital details, ensuring you have all the necessary information at your fingertips before Executing the Strategy.

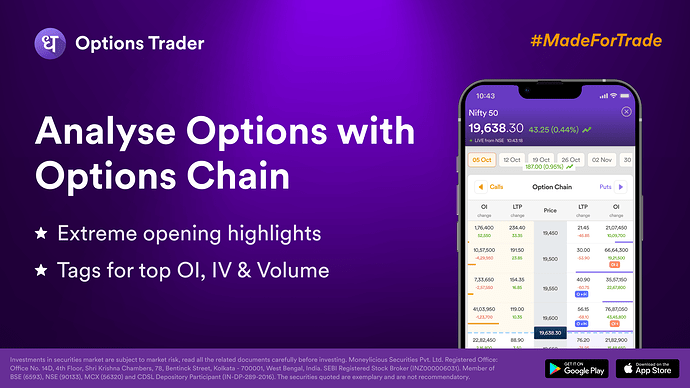

- Options Chain with Insights

Now Insights like O=H, O=L, Highest Volume, Highest OI & Highest IV can be visualised on the Options Chain with tags.

This was launched on the Dhan mobile app recently and now the same has been extended on the Options Trader Mobile app.

- Scans & Screeners

We’ve moved Scans & Screeners to the Watchlist section for your convenience. In addition to this move, we’ve introduced a new scan called ‘Extreme Opening,’ which identifies contracts where the opening price equals either the High or Low.

This feature was highly appreciated in the previous version, and we have retained it with some enhancements. We’ve incorporated additional filters to refine the results, making it even more useful for your trading needs.

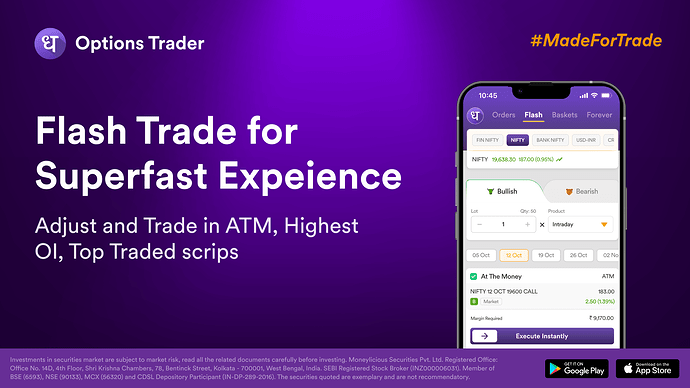

- Flash Trade

With this update, the Flash Trade feature is now available on the Options Trader app as well. This addition is especially advantageous for options buyers whose trading style encompasses scalping to intraday trading. This feature aids traders in pinpointing the optimal options strike for purchase and replicating the trading calls of index on options. It was previously accessible on the Dhan app and web, and now it has been extended to the Options Trader platform.

- Dashboard for Quick Discovery

We’ve undergone a significant restructuring of the home page, introducing dedicated dashboards for each trading segment: Options, Futures, Commodity, and Currency.

These tailored dashboards provide swift access to essential data, analytics, and tools.

As an example, the Options dashboard offers a seamless selection of OI & Price Movers, extreme openings, quick access to the Options Chain for Nifty, FinNifty, and BankNifty.

In addition to the highlighted key features mentioned above, we have also implemented numerous smaller yet impactful enhancements in the new Options Trader app with Custom Strategy Builder - Glass Edition.

Download Options Trader App - bit.ly/OptionsTraderByDhan

We value your feedback and invite you to share any new suggestions, feedback or observations that you may have. Your inputs, as always, are invaluable in helping us refine and enhance your experience on Dhan further. We look forward to hearing from you and working together to continue improving your trading experience.

Till then, Happy Trading!

Pravin