Hello Everyone,

Algo Trading has been popular in the Indian trading community for a long time now. Once a domain exclusive to institutions, algorithmic trading has quietly transformed India’s markets over the last decade via APIs and integrations with Broking platforms. High-frequency systems, complex strategies, and fast-moving data flows shaped the early years, mostly hidden behind trading desks and proprietary setups.

But times are changing and fast. With SEBI and exchanges paving the way for safer and more structured participation, and algorithms becoming more accessible than ever, algo trading has now found its place in the hands of retail traders.

At Dhan, we’ve seen this transformation up close. From a few users building custom setups with DhanHQ APIs to the introduction of Sandbox Environments and rate-limit-free APIs - retail algo trading is not just a trend, it’s becoming a mainstream strategy.

Today 55% of cash market turnover is done via algorithmic trading. This primarily includes all the large institutions, which deploy large amounts of capital on their models. With the increasing adoption of algos amongst retail traders and their growing contribution, this is set to grow further. And we know that algos are the upcoming way for retailers to trade in the market at large.

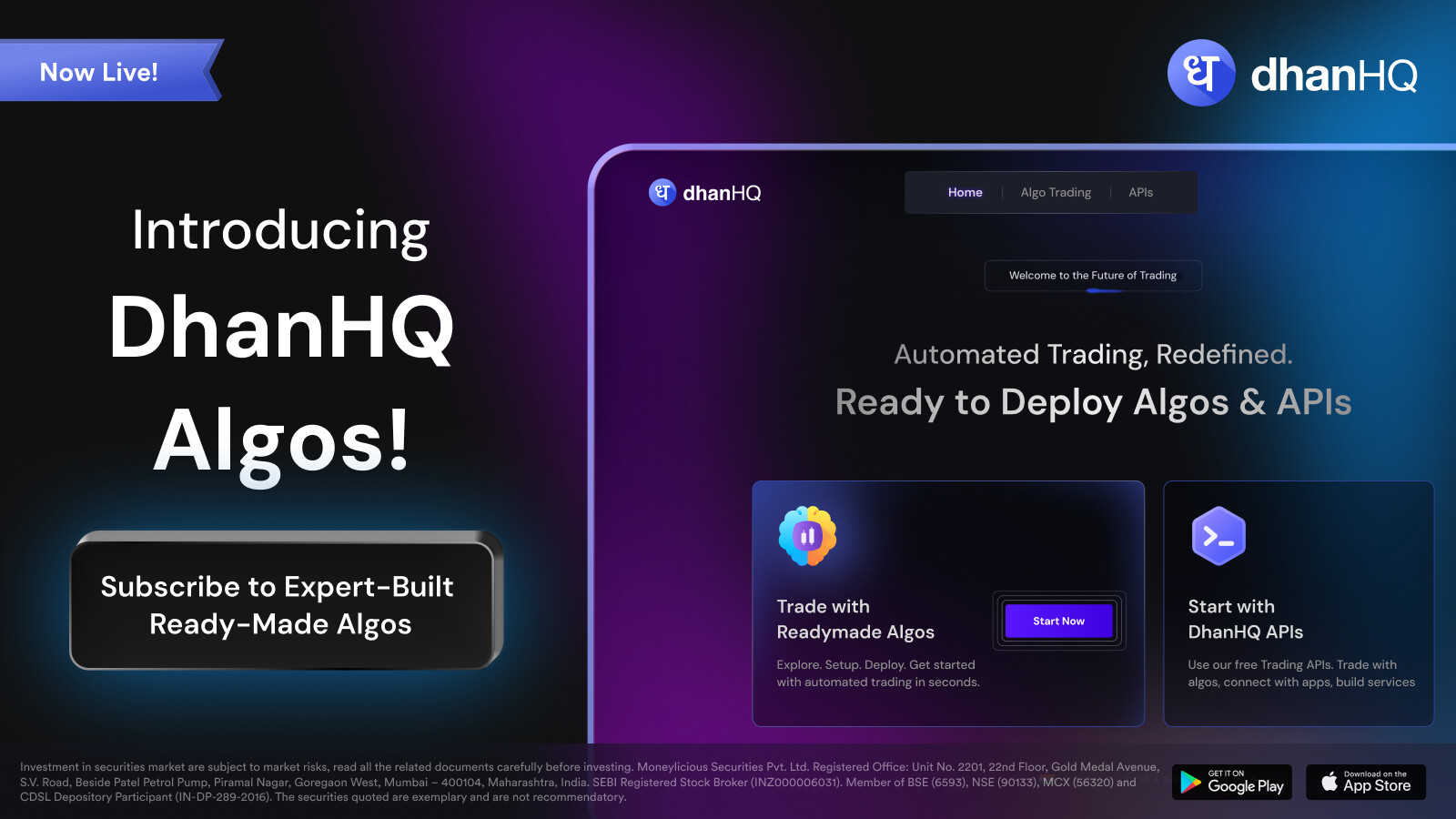

With this belief, we are today introducing DhanHQ Algos.

What is DhanHQ Algos?

DhanHQ Algos is designed to make algo trading simple. It is for anyone and everyone - they can choose from a list of readymade algos, subscribe to the algo and deploy it in their account.

It removes all complexities from the setup of algo trading, making it seamless to even run multiple algos in a single account. We are curating the list of algos across segments, including equity, futures, and options across exchanges and segments. With DhanHQ Algos, the goal is to democratize algo trading for everyone, making it accessible to everyone who is interested in markets.

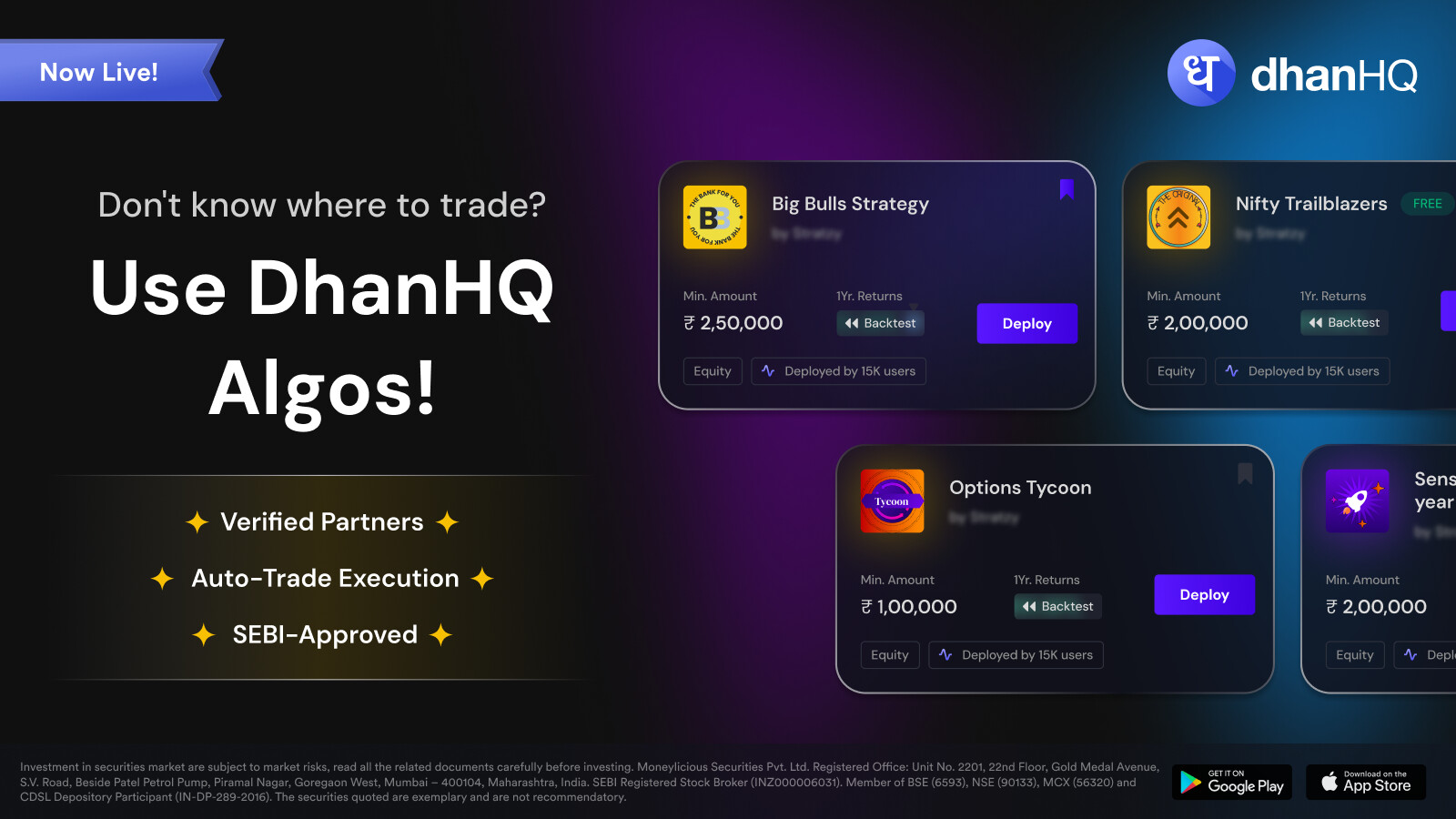

On DhanHQ Algos, we are working with a curated list of partners. These partners have designed algos that are tested across market cycles. All DhanHQ Algos that run for your account are hosted on Dhan servers, ensuring DEXT execution speeds are extended for algos with reliable uptime. While the performance of algos depends on multiple factors, including the logics, alpha and market conditions, we have ensured your account is always ready to execute algos in the market.

We have built the entire experience keeping in mind the simplicity of subscribing and deploying any algo in your Dhan account. We understand how algos can make trading easy for everyone in the market, and this is our first step in that direction, getting expert-curated algos for you.

Before choosing an algo, you can read what the algo is about, and how it has been curated. There is a range of partners that we are working very closely with to stitch together this ecosystem. You will soon be hearing about all these partners here, in the community.

You can explore all the available algos here: https://dhanhq.co/algos

As always - Dhan will continue to improve its DhanHQ Algo platforms with your suggestions and also stay in tune with the ever evolving regulatory framework around it.

So stay tuned. Also, do let us know your feedback about how we can make finding algos that suit your strategy easier and what metrics you would like to track about its performance.

Happy Algo Trading!