Dear Investors and Traders,

Our goal of building Dhan has always been to help Long-Term Investors and Super Traders get the best of investing and trading experience. We have consistently delivered value to our users via every feature, every product and every platform that forms part of the Dhan ecosystem.

At its very core, Dhan is built for those who believe in our Markets - the same markets that have offered plentiful opportunities for safer and smarter ways to grow wealth in a regulated framework. Over the past nearly 4 years of our journey, we have continuously brought to you many investing opportunities via Stocks, ETFs, Mutual Funds, Pay Later via MTF, and even introduced an all-new platform - ScanX that helps with your market research via Screeners, News, Market Insights, and many more.

With nearly 1 Million Active users on Dhan as per NSE data, we have always asked ourselves what we can do more to help our users get an edge. When we thought of this for Power Traders, we eventually started building our own proprietary trading platform - DEXT, which has now been recognised by Amazon AWS.

We have also developed features and capabilities, such as Instant Pledge and Unpledge, Super Orders, Instant Withdrawals, Mutual Funds in demat format, and Tracking of Banks, External Stocks, and mutual funds, among others, in our journey so far. These initiatives have been key to our growth.

Today, we are very excited to announce Renting Stocks via SLBM on Dhan, which will be available fully online with more features.

Introducing Rent Stocks on Dhan via SLBM

SLBM or Stock Lending and Borrowing Mechanism allows you to rent out stocks in your portfolio holdings to prospective traders and investors who pay you fixed fees (rent /share) in exchange for these shares.

Stock Renting allows you to lend your shares to earn additional income without selling your holdings.

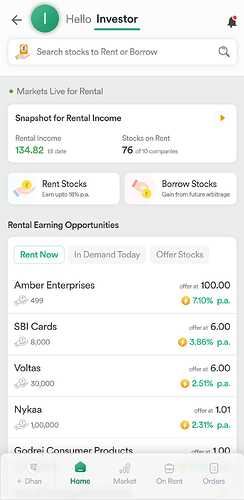

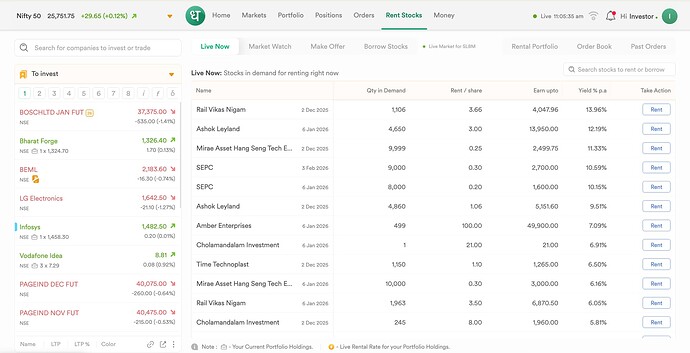

Here’s how it will look on Dhan Products:

Dhan App:

Dhan Web:

Why Renting Stocks via SLBM changes everything:

Dual Income Strategy: You can earn from both capital appreciation and rental yields simultaneously.

Passive Income: Get rental income credited instantly - no waiting involved.

Zero Additional Risk: Your holdings remain 100% safe, settled via SLBM mechanism on exchanges and backed by NSCCL guarantee

Complete Flexibility: Rent only the stocks you choose, recall any time before contract expiry

Market-Leading Rates: You can earn additional income on eligible stocks.

Ever wondered who borrows these stocks when we rent via SLBM?

These are usually large institutional / prop traders who need stocks in their demat holdings for their trading or investing strategies.

Instead of buying a stock at its LTP, they prefer borrowing these instead, which are usually at a fraction of the LTP.

How to get started with Renting Stocks on Dhan?

It is simple, just activate the Renting Stocks via SLBM on Dhan, it typically takes less than a minute for this.

Head over to the Rent Stocks section on Dhan app or web

You can see the Live Demand for stocks, if you have them in their portfolio - you can rent out at Market Demand.

Else, you can Make an Offer for stocks that are in demand or for ones that are in your portfolio.

Are there any fees? If yes - how much!

Yes - there are fees that you should know of. For activation on Rental Stocks via SLBM we require you to activate SLBM as well as DDPI.

For this, we charge you a nominal fee of INR 199 for for SLBM activation and INR 100 for DDPI activation. In both cases, we charge fees only to cover the expenses incurred by Dhan.

When you Rent Stocks from your portfolio, we charge 4.99% as rental brokerage.

For example, let’s assume

You own 100 Stocks of ABC Bank purchased at INR 90 / share and its LTP is INR 200. Your stocks are valued at INR 20,000.

Say you are able to rent all those at INR 20 per share for a period of 25 days, you will make an additional rental income of INR 2000 in this period. Dhan will charge rental brokerage fees of INR 99.80.

Fees are only on one-side of the leg, which means when the stocks return to your portfolio after the rental period has ended - there will be no additional charges.

What happens to the Stock when they are rented?

Once you rent stocks and the order is successful, they move from your Demat account to the Demat account of the user who has borrowed the same from you via the exchange.

Every rental contract has an expiration date. On the expiry date, the stocks exit from the borrower and are sent back by the exchange via clearing corporation to your demat account.

Usually, it takes 24-48 hours for the stocks to reflect back in your demat account after the expiry date of the rental contract.

Dhan has a dedicated Rental Portfolio where you can keep track of all the stocks that you have rented or borrowed.

We have created a detailed walkthrough of Rent Stocks via SLBM on our youtube channel - you can learn more about it here ![]()

As always, Dhan brings you more features so that you can make most out the markets as an Investor and Trader. We are excited about bringing this opportunity of earning extra via Renting Stocks to you on Dhan.

We will keep building and improving your experience on Dhan for Renting and Borrowing of shares based on your usage, feedback and suggestions. Keep sharing these with us.

Thank you,

Tanvi