Dear Investors,

An Offer for Sale (OFS) is a quick and convenient way for publicly traded companies to raise capital by selling shares through an exchange trading platform. The OFS process allows promoters to dilute their holdings and sell shares to a wide range of investors, including retail investors, corporations, Qualified Institutional Buyers (QIBs), and Foreign Institutional Investors (FIIs) on an exchange platform. Many publicly listed & traded private and state-owned companies use this method. In fact, governments have used OFS to sell stakes in public sector companies. By choosing an OFS, promoters can take advantage of the exchange’s bidding platform for price discovery.

How Does the Offer for Sale Work?

- Announcement: The seller announces the OFS and sets a minimum price, also known as the floor price for the shares on the stock exchange.

- Bidding: Investors place bids for the shares at or above the floor price during the bidding period of 2 days.

- Allocation: The seller reviews all the bids and allocates shares based on the bids received based on pre-set criteria set by the SEBI.

- Settlement: 100% of funds are required to be paid upfront and shares are credited to the successful bidders’ accounts upon successful allotment on the settlement day.

The OFS process spans two days:

- Day 1: Open to Non-Retail Bidders. Only bids above ₹2,00,000 are accepted.

- Day 2: Open to Retail Bidders. Bids below ₹2,00,000 are accepted at or above the cut-off price derived from Day 1.

Learn more about OFS on Dhan here ![]()

Key Features of an Offer for Sale (OFS)

- Only shareholders holding more than 10% of a company’s share capital can propose an OFS.

- The OFS mechanism is only available for the top 200 companies by market capitalization.

- 25% of the shares offered through an OFS are reserved for insurance corporations and mutual funds.

- A minimum of 10% of the offering size is reserved for retail investors, who may be offered a discount on the final price.

Some of the Frequently Asked Questions (FAQs) on OFS

-

What is an Offer for Sale (OFS)?

An OFS is a process where promoters of publicly traded companies sell shares through an exchange platform to raise capital. It allows for quick price discovery and efficient share allocation among investors. -

What is the floor price and cut-off price in OFS?

Floor price is the minimum price set by the promoter for the offer. Only bids placed above the floor price are valid. On Day 1 after the non-retail bidding, based on the bids received, a cut-off price is derived which acts as the floor price for Day 2. This essentially means that on Day 2, the retail bidders can bid on or above the cut-off price only. -

What is the bidding time for OFS Bidding?

OFS Bidding is open from 9:20 AM to 3:30 PM. But it is always recommended to apply before 3:00 PM to ensure timely confirmation from the exchange and avoid last minute rush. -

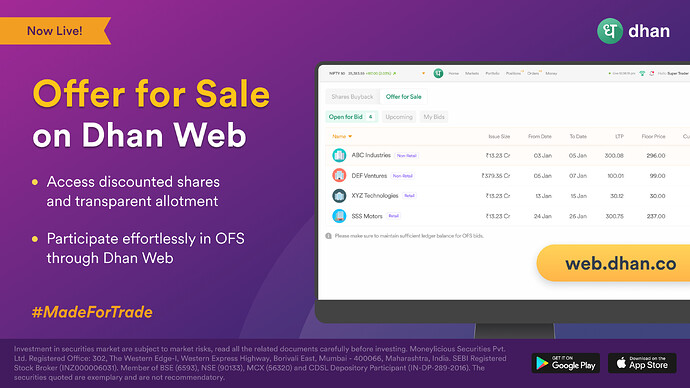

How to apply for OFS on Dhan?

OFS for now is live on Dhan Web. To apply, login to web.dhan.co and go to the Money Section > Shares Buyback & OFS > Offer for Sale > Apply -

I am a Non-Retail Bidder, can I carry forward my bid to the next day?

No, for now you cannot carry forward your bid to the next day. If you do not get allotment under Non-Retail category, you can submit a fresh bid the next day in the retail category. -

Do I get a contract note for the OFS Bid?

Yes, you get a contract note for the OFS Bid which has details of your bidding price and associated charges. -

Can I place more than 1 bid at different prices and quantities?

No. You can place a single bid at a single price for OFS. -

Is Modification to Price and Quantity allowed?

No, you cannot modify your bid once placed. However, you can cancel the bid and reapply with new price of quantity until the bidding window is open -

What are the benefits of OFS for investors?

Investors can get shares at a single price and relatively at a discount from the current market price. At times, the OFS window even offers an opportunity for arbitrage. -

When do I get confirmation of allotment in OFS?

Confirmation for allotment in OFS is available by the end of day. -

When will I receive my shares after an OFS?

Shares are credited to the successful bidders demat accounts on the next day of bidding.

Now that you know how it works, explore the Offer for Sale (OFS) feature live on Dhan!

Happy Investing!

Shrimohan