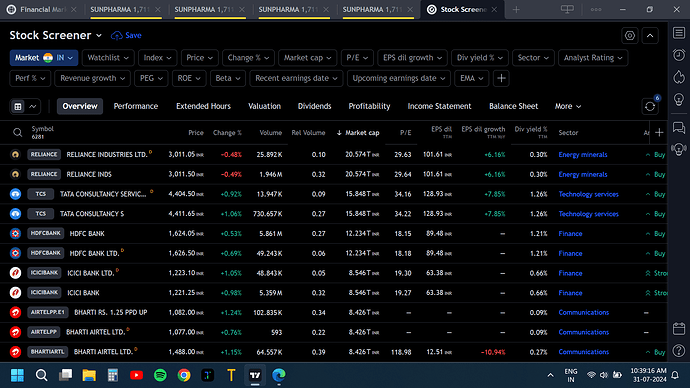

About customization, TV screener which I use on a daily basis is highly customizable and ScanX is the first step in the right direction.

So I was a part of the early access zoom meeting. Shared this same feedback via @Dhan Care Twitter DM on 26th July. Mentioning those in better detail here… @Rahul

Why I still prefer screener.in over scanx:

- There should be an option to export the financial and shareholding data just like screener. to analyse on Excel

- Query box to enter the screener query is very handy feature of screener. Like reading some investment strategy and implementing them to verify. Right now, add filter → select filters → apply → update the value. This is a long process than just typing ROE > 15%.

General updates required:

- The financial statements should be industry relevant like for banking company the PnL should have top line “interest earned” and so on… Right now all the financial statements are in same format. I refer finology ticker to analyse bank’s financial statements.

- The top frame which has the logo and menu navbar should be hidden on scrolling down and the company name row should be fixed. this will increase the screen space for the data view.

- There should be option to download the quarterly results or annual reports and investor presentationsas well.

- The peer comparison in chart should also have the index that company belongs to. Like reliance industries chart should have option to compare it with nifty 50 chart to gauge performance as compared to index that reliance belongs to.

- Keep tata motors → financial results → growth rate → QoQ → growth rate is on consolidated financial statement. So the heading should be mentioned as Growth Rate (Consolidated)

Missing Ratios:

ROIC, FCF/Sales, Promoter holding change%, Industry PE, datapoints comparable to latest quarter, PE(TTM) comparable to Industry PE, PEG, Price/Sales, operating cash flow to revenue, turnover ratios, quick ratio, interest coverage ratio, debt to net income, retailers holding change %.

I don’t know how to explain this:

Open tata motors page, without scrolling just click on Shareholding tab. The page scrolls correctly to shareholders data, but the tab color that has blue underline remains at Cashflows.

Even tried it from any other tab as well

I don’t know if you understood what I meant.

Other requests made already by other members here:

- Dark mode

- FnO stocks and indices - Add filter may have enabled option for Technical indicators, candlestick patterns and price action options only.

- Option to apply screener to watchlists.

I am not a trader so pardon my terminologies.

Nice suggestion. Noted. Will evaluate its feasibility.

Vow - well done … Keep inventing …once you have a strong tech team sky is the limit for bringing scattered data under Dhan Roof - Dhansutra

This is a much desired feature but sadly it wont be implemented by dhan or any other platform as the custom scripts are proprietary. So only TV can implement this feature and guess what it is coming soon

Hi

Gone through ScanX. Such a wonderful start to new heights.

Wish there is a feature to add multiple companies to watchlist at once. its a paid feature in every scanner/screener providers.

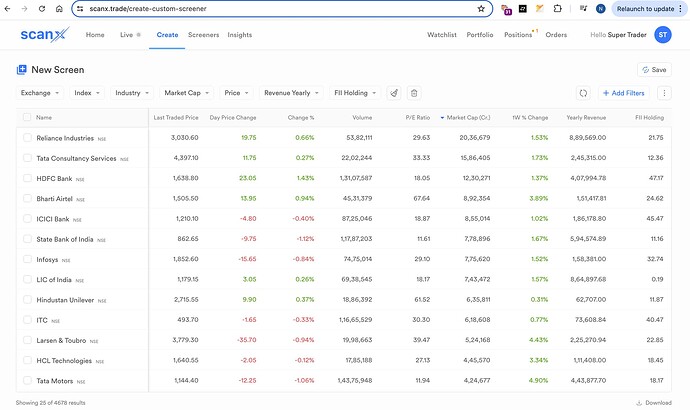

So I couldnt figure out a way to build a simple screener -

Latest close price(15min) crossed above bollingerband(20,2)

Is this kind of scan not intended to be part of this product? What is the use of 35 technical filters then? A common way to use supertrend is to check if it is crossed by latest close. Whereas currently the filter works as just a simple slider to select supertrend values from 0 to max. How will someone know which value of supertrend to select? Am I missing something here?

Also the universe is only Nifty500? Why not entire list of NSE stocks?

This is once again the long running battle between what product managers think is right and what is actually right for the users.

I would suggest you to look at chartink.com for benchmark and not screener.com. The former is generations ahead for scanning. Also look at failure of streak.tech. Chartink provides free scans over entire NSE list without any hiccups whereas streak only does scan on 500 stocks. Streak also started with in built scans what it thought to be useful with very limited ways to build custom screeners outside the template of in-built scans. Later they had to offer their platform for free and still I doubt anyone uses it. Its just one pile of garbage with beautiful UI because its not of much use to the end user.

@Naman, @RahulDeshpande , @shraddha

If we can create watch list from the scan/search results, which will sync up in all dhan platforms, then why it is so difficult to scan only in my portfolio stocks or watch list stocks?

Also note that by default dhan will create “Invested” system watch list.

So please give an option only to scan within our own created watch lists and within our own holdings. https://trendlyne.com/ has this feature already. But I need to sync my holdings/watch list every week, so it is very difficult to track.

You can do that on ScanX. Simply, tick mark the checkbox besides the stock name in the screener results table, you will see the basket & watchlist icon on the bottom right corner. Add these stocks in the existing wtachlist or create the new one.

@Naman Can you please limit the scan result to 100 per page. If the results are more than 100 so if we select 1st 100 and add to watchlist, the next 100 stocks we need to manually select one by one as it doesn’t work select all and it will select all the stocks in the scan result and this can not be added in the watchlist due to the 100 limit.

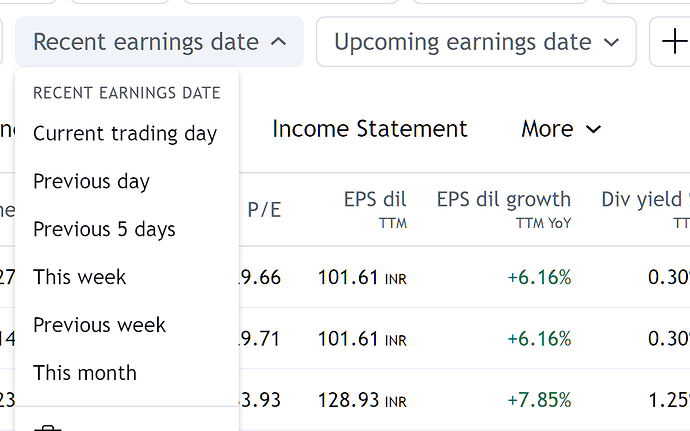

2nd Can you please add filter for recent earnings or the upcoming earnings to exclude. Tradingview scanner has added it and it is very useful.

@nx.vijay I don’t think you should compare ScanX with TradingView, instead it should be done with Streak and the likes.

TradingView is light-years ahead of Dhan or any other Brokerage in fact. Even if a brokerage innovates and invests for 5 years, it will be difficult to match the prowess of TradingView. Those guys hire from Apple, Google, Macquarie and what not.

If compared with Streak or Tickertape, ScanX is a step in the right direction.

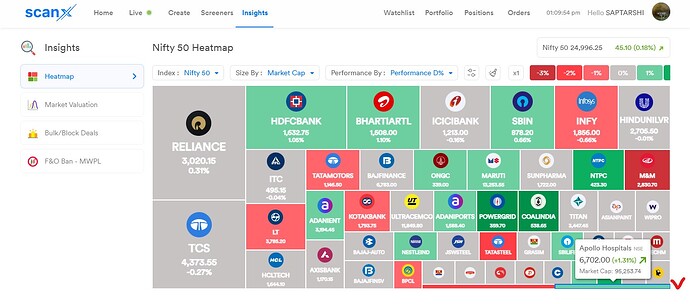

I am currently using Scan X, and it is the best product for the stock market. However, I would like to request that you kindly add a dropdown arrow or scroll option in the heatmap tab.

@Champion_Trader Will checkout Chartink too.

Scan X is an amazing forum . It was worth waiting. Is it possible to have a screener to

(1) identify stocks in which promoter / FII / DII holding is increased or decreased

(2) Who are major share holders & the % of holding for each shares

Hi @dhingrab

Something similar you can do. Here is the link of the screener that I tried building with the conditions you mentioned above.

Hi @dhingrab

If you don’t select any index, it means you have selected all. If you want to have just NSE stocks, select NSE from the exchange filters. When you dont make any selection of filters, there is list of all the stocks. Right now I can see 4678 stocks.

thanks got it now

Thanks it works. Going forward please see if you can provide functionality to edit parameters of BBand or any other indicators. Also, its not like BB can be used only on price. similarly for other indicators, they can be used on other metrics like RSI also. So a way to edit input source will also be nice. Also please implement all the indicators in scanx that are available on tv.dhan.co possibly with editable parameters and with the ability to choose any timeframe

ScanX is good product and I can understand it just launched and Nothing is perfect on its initial days. Need of lots of modification in future.

I want to give some basic suggestions for now that 1)please add NSE FnO in index 2)Can uh start Email alerts for those screener which are rarely gives results like one of the inbuild screener is best quarterly result when stock appears rarely in the screener.