Dear Traders,

At Dhan, every product and feature we built is designed to bring more structure and purpose to how traders approach markets. The purpose is to give traders a better trading experience. As we build Dhan for Super Traders, our focus remains on making trading more thoughtful and less impulsive.

Having a Trade Plan is Important!

One thing we hear from traders again and again is that planning a trade with discipline is challenging. Many traders have a strategy in mind, but when it comes to position sizing, they get stuck, as there aren’t any solutions that work for them.

Most traders don’t have a clear plan for how much quantity to trade. They may often enter lots & quantities randomly, or average down their positions without proper calculations. Because of this, they either end up losing more than expected or booking profits much lower than what they could have earned with better planning.

It’s important for traders to stay with their principal amount as long as possible, which keeps them in the markets for a long time. Simply not deciding on the right trade sizing may get them to lose the principal quickly.

To size a trade correctly, traders need to be clear about three important things: how much capital they have and want to allocate for a single trade, how much risk they are ready to take, and what reward they are expecting. Even if some traders know these points, there is no easy tool that puts all this together before placing a trade. Most traders either calculate manually or go by gut feeling, which often results in inconsistent trades, bad risk-reward planning, or taking more exposure than they should.

That is exactly the gap we wanted to solve. We have built something that now makes trade planning seamless and integrated.

Introducing Trade Plan for Position Sizing on Dhan Charts !

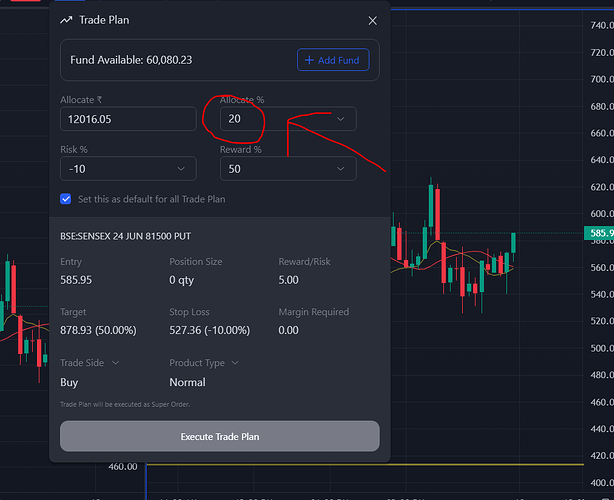

This feature is a simple way to plan your trade before you place it. All you need to do is, enter the percentage of your capital you want to allocate for the trade. Then, set the amount of risk you are willing to take and define the reward or profit return you are aiming for. Just input three important factors :

- % of capital allocated from funds available in the trading account

- Risk in terms of percentage for the trade. Max what your appetite allows you to lose.

- Reward in terms of percentage. The realistic, favourable return you see in this trade

With these three inputs, the Trade Plan will instantly calculate the quantity you should place in this trade, the stop loss price & the target price. You can even save your Trade Plan as a default and reuse it when needed. And when you are ready, execute this plan as Super Order.

Let’s take an example. Say you want to trade NIFTY JUNE Futures. You decide to allocate 20% of your capital. You have INR 10,00,000 as a balance in your trading account. You expect a 6% reward and can handle 2% of risk on this trade. This is a 3:1 reward-to-risk ratio.

The Trade Plan will calculate the lot size, entry, stop loss, and target all based on your inputs and market price. It takes away the guesswork and brings structure to every trade you plan.

Whether you are day trading, swing trading, or building positional trades, this feature is built to bring discipline to your trading journey. With this, we aim to support informed and timely trading decisions. simplifies trade planning with pre-defined inputs for capital, risk, and reward.

Plan First. Then, Trade a Trade Plan!

Thank you

Naman