NSE has received approval from SEBI to introduce a new Derivative Contract linked to the Nifty Next 50 Index. Starting April 24, 2024, Futures and Options contracts on the Nifty Next 50 Index will be open for trading in the Future & Options segment.

Here are the details:

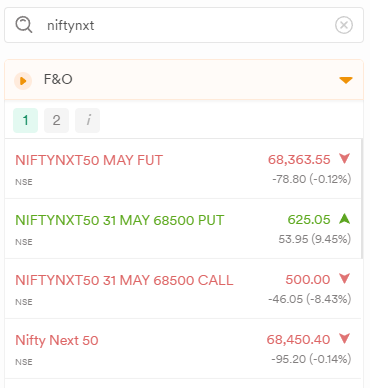

Symbol: NIFTYNXT50

Lot Size: 10 | Freeze Quantity: 600

Expiry: Last Friday of the Expiry Month

Strike Scheme for Options: Available at intervals of 100 with strikes 40 - 1 - 40 and 500 with strikes 20 - 1 -20

More details can be found here and here.

As per NSE in FY24, Nifty Next 50 index exhibited a 71% correlation with Beta of 0.95 in relation to the Nifty 50 Index.

Traders, do share your view and strategies which you can use to trade in this contract.

4 Likes

Only Monthly options ? That doesn’t make sense - every new Index should come with Weeklies.

Hardly anyone will trade monthlies on this index

1 Like

No bandwidth now. Friday busy with SENSEX option selling  Also I guess some time will be taken for liquidity to come into the new contract.

Also I guess some time will be taken for liquidity to come into the new contract.

@Lumiaman88 Yea weeklies are new gem! But only constrain is cant add more days to week  Maybe multiple contracts would expire on a given day, lets see!

Maybe multiple contracts would expire on a given day, lets see!

@t7support Yea. But here IMO correlation based scalping/trading using algo could be done. Also when a new index is launched in F&O, there exists a price discovery arbitrage between synthetic futures and actual futures.

Waiting for new indices and waiting for crypto in India:crown:

scalping = high transaction charges and small profits per trade have to counter balance that and loss making trades. A difficult proposition IMO.

1 Like

Good for option buyer because of theta decay expire is so long so there is good for option buyer in sideways market

Update:

In order to encourage active participants in Futures and Options contracts on Nifty Next 50 Index, it has been decided that no transaction charges will be levied on the trades done in Futures and Options contracts on Nifty Next 50 Index (NIFTYNXT50) in Future & Options segment from April 24, 2024 (product launch date) till October 31, 2024 - NSE

1 Like

Trade karaye bina hamey nahi chodega exchange

1 Like

Update:

31st May 2024 is the first monthly expiry of the NIFTY NEXT 50 Index, just one trading day before the Exit Polls results will be announced. India VIX is already at the levels of 24 and ATM straddle at 1125.05.

The Futures and Synthetic Futures difference is of around 10 points. This seems to be a good trading setup for algo traders and arbitrageurs (like me  ), or maybe even scalpers!

), or maybe even scalpers!

What’s your opinion? @t7support @KirubakaranRajendran @PiyushChaudhry @viswaram @Himanshu_Arora

1 Like

Over-trading is detrimental to financial health. But the exchange is enticing me to trade with new contracts and new opportunities

1 Like

I am sitting this out… Would like to watch the space though to see if any arbitrage opportunities develop.

1 Like