The Indian IT sector, a vital pillar of the economy, faces significant challenges from proposed U.S. policies aimed at curbing outsourcing to India, which could impact the Nifty50 index. As of September 2025, reports suggest the U.S. administration is exploring measures to limit outsourcing, including potential tariffs on software exports and stricter H1B visa regulations to prioritize American jobs. These policies could disrupt the business models of major Indian IT firms like TCS and Infosys, which rely heavily on U.S. clients for revenue. Such restrictions may increase operational costs for global firms and reduce demand for Indian IT services, potentially leading to job losses and slower growth in a sector critical to India’s economic narrative.

The IT sector’s substantial weight in the Nifty50 index amplifies its influence on the broader market. According to NSE data from August 29, 2025, Information Technology accounts for approximately 10.51% of the Nifty50’s weightage, with key players like TCS, Infosys, HCL Tech, and Wipro holding significant shares. This notable presence means that any prolonged weakness in IT could hinder the index’s overall performance, especially as financial services (36.82%) alone may not offset sector-specific declines. With IT stocks already under pressure, their impact on the Nifty50 could constrain market gains unless other sectors step up to fill the gap.

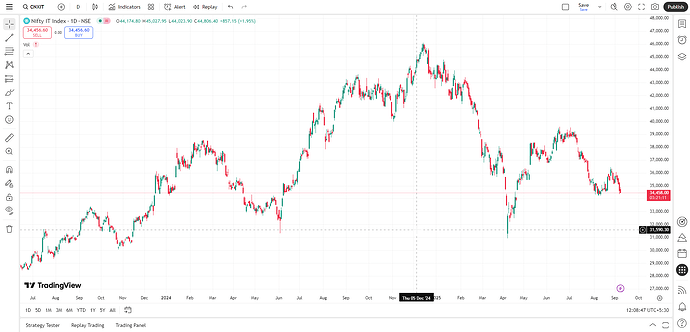

Adding to the concerns, many IT stocks have already seen sharp declines from their 52-week highs, reflecting investor unease amid global policy shifts and economic challenges. For example, Tech Mahindra trades about 18.24% below its 52-week high of ₹1,807.40, closing near ₹1,477 as of September 5, 2025, while other majors like TCS and Infosys have also faced pullbacks. The Nifty IT index has been hit by disappointing Q1 revenues and fears of reduced outsourcing demand, further eroding confidence. With these headwinds, the IT sector risks acting as a drag on the Nifty50, potentially limiting its upward trajectory unless positive developments, such as new contracts or relaxed U.S. policies, emerge to restore momentum.

Disclaimer: This article was generated with the assistance of artificial intelligence to provide insights based on available data and trends. While every effort has been made to ensure accuracy, readers are encouraged to verify information independently and consult financial experts before making investment decisions.