Exciting news for ITC shareholders! The demerger of ITC’s hospitality business (ITC Hotels), is all set to take effect next year!. This is a significant milestone for ITC as it unlocks value for shareholders by creating a focused entity for its hospitality business. Here’s everything you need to know about this development

1. What Will Shareholders Get?

For every 10 shares of ITC Limited you hold, you will receive 1 share of ITC Hotels. These shares will be credited directly to your demat account.

2. How to Qualify for the Demerger benefit?

To qualify for the demerger benefits, you need to hold ITC as on Record Date which is January 6, 2025.

3. When Will You Get ITC Hotels Shares?

The shares of ITC Hotels will be credited to eligible shareholders within 30-45 days after the Record Date. You’ll receive an email from CDSL when the shares are credited.

4. When Will ITC Hotels Start Trading?

ITC Hotels will be listed as a separate company on the stock exchanges after the demerger process and regulatory approvals.

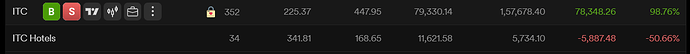

5. Impact on ITC Share Price*

Starting January 6, 2025, ITC’s share price will trade ex-demerger, meaning it will reflect the separation of ITC Hotels.

6. What will be the Impact on Futures and Options (F&O) Positions of ITC?

All existing ITC F&O contracts with expiry dates of January 30, 2025, February 27, 2025, and March 27, 2025, will expire early on January 03, 2025. These contracts will be physically settled based on ITC’s weighted average price on the early expiry day. Fresh F&O contracts for ITC will be introduced on January 6, 2025.