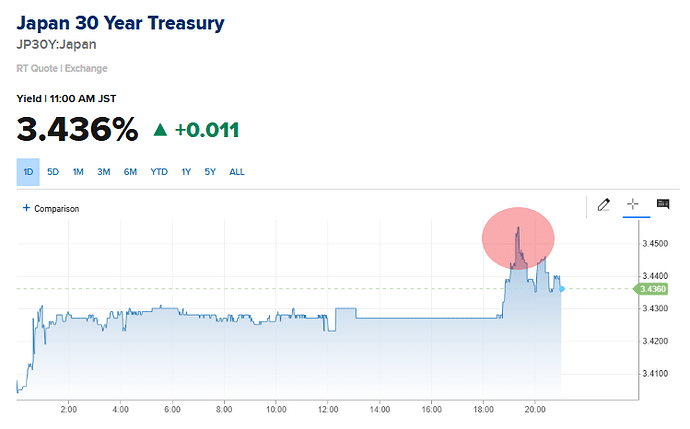

If you look at the charts above, one thing is clear:

Japanese government bond (JGB) yields are exploding to levels not seen in decades.

-

30-year yield: Highest since data existed (3.43%)

-

20-year yield: Highest since 1999

-

10-year yield: Highest since 2007

After more than 20 years of ultra-easy monetary policy, Japan is finally confronting a reality it avoided for decades — inflation, rising rates, and the cost of borrowing catching up with them.

And that puts the Bank of Japan (BoJ) in an impossible situation.

Why Japan Is in Such a Tough Spot

1. Japan has the highest debt-to-GDP ratio in the world — ~230%.

When debt is this high, even small increases in yields make interest payments explode.

2. Inflation is finally “sticky.”

Japan has had inflation above the BoJ’s 2% target for 43 straight months — unheard of in their history.

3. Yield Curve Control (YCC) ended in March 2024.

For years, Japan artificially capped yields by buying unlimited bonds.

Ending YCC meant allowing bond yields to move freely — and they have surged.

4. Markets now expect a December rate hike

The BoJ is signaling that the near-zero interest rate era is ending.

Put together:

High inflation + high debt + rising yields = a policymaker’s nightmare.

Japan must now choose between:

Option A: Keep raising rates → Yields spike even more, debt costs explode, economy slows.

Option B: Return to QE/YCC → Yen collapses, imported inflation worsens.

There is no painless option left.

What’s In It for Japan? Why Even Allow Yields to Rise?

Despite the risks, Japan has strategic incentives to normalize policy:

1. Restore currency credibility

A chronically weak yen distorts trade, crushes purchasing power, and inflates import bills.

2. Re-anchor inflation expectations

Japan wants stable inflation, not runaway inflation caused by a falling yen.

3. Reduce reliance on emergency monetary tools

YCC and negative rates distorted financial markets. Ending them helps long-term stability.

4. Attract domestic savings back into JGBs

Japanese households hold massive cash in bank accounts.

Higher yields encourage savings to stay within Japan rather than chasing foreign assets.

5. Prepare for future fiscal reform

If Japan ever wants a more sustainable fiscal position, normal rates are a necessary step.

Japan is effectively saying:

“Short-term pain, long-term stability.”

Global Repercussions: Why Everyone Is Worried

Japan is not just another country. It is:

The world’s largest foreign investor.

The world’s largest foreign investor.

Money from Japan funds global equities, US Treasuries, EM bonds, corporate credit, and carry trades.

When JGB yields rise, the incentive to invest abroad falls.

Even small repatriation flows can create global volatility.

Potential spillovers:

-

Higher US Treasury yields

-

EM currency weakness

-

Equity outflows globally

-

Tightening financial conditions

-

Stress in leveraged trades

This isn’t about Japan alone — it’s about a key pillar of global liquidity shifting.

So what happens to the Yen carry trade? But firstly, what is a yen carry trade?

Investors borrow yen at ultra-low interest rates, convert them to USD or EM currencies, and invest in higher-yielding assets.

For decades, this was one of the easiest trades in global macro.

Why it’s now under threat:

-

Rising Japanese yields increase the cost of borrowing yen.

-

Narrowing US–Japan rate differential reduces carry returns.

-

A strengthening yen creates FX losses for investors.

As funding costs rise, leveraged positions become unprofitable, leading to:

Carry trade unwinding = selling of global risk assets + buying yen to repay loans

This is exactly what caused the August 2024 12.4% crash in the Nikkei — its worst day since 1987.

Will it be as bad this time?

Experts say no, for three reasons:

-

Pension funds, insurers, and NISA retail flows are structural buyers of foreign assets

-

Japanese investors are still net buyers of overseas bonds in 2025

-

Lower US hedging costs post-Fed cuts make foreign bonds attractive

So while we may see episodic volatility, a full-blown systemic unwind is less likely — unless yen surges violently.

What This Means for India & Emerging Markets

Even without a massive carry unwind, rising JGB yields create pressure:

1. FII Outflows Risk

If Japanese institutions shift even a small allocation back home, EM equities may see selling.

2. INR Weakness

Carry unwind → yen buying → global currency pressure → INR softens.

3. Higher Indian Bond Yields

Global yields move in sympathy.

Banks, NBFCs, real estate, infra may feel the heat.

4. Short-term volatility in high-beta sectors

Smallcaps, midcaps, financials could react sharply.

5. Long-term positive: India’s inclusion in global bond indices

This brings predictable inflows to offset global turbulence.

Japan is entering a new era after decades of ultra-loose policy.

Bond yields are spiking because the BoJ is choosing currency credibility and inflation control over financial market calm.

The yen carry trade is no longer a one-way bet, and that means:

-

More volatility globally

-

More sensitivity to BoJ actions

-

Emerging markets, including India, must watch yen, JGB yields, and FII flows closely

Whether Japan continues tightening or U-turns back to QE/YCC will set the tone for global markets in 2025.