Hello Trader ![]()

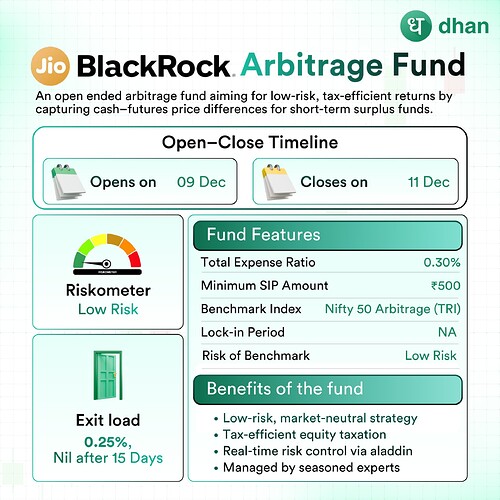

Arbitrage Funds are quietly becoming one of the fastest-growing low-risk categories in India - and now JioBlackRock has filed for its own Arbitrage Fund NFO.

Given their track record of low-cost, high-scale products, this filing has already caught attention across traders and long-term investors.

Before full details come out, here’s the simplest way to understand what arbitrage really is - and why people look at it differently.

What Is an Arbitrage Fund? (Explained in 10 Seconds)

Arbitrage means earning from price differences, not predictions.

![]() Think like a mango trader

Think like a mango trader

- Ratnagiri price: ₹100/kg

- Mumbai price: ₹102/kg

Buy at ₹100 → Sell at ₹102 → ₹2 profit

Profit is locked in upfront, without worrying about whether prices go up or down.

In the stock market, Arbitrage Funds do the same: Buy in cash market ↔ Sell in futures market → Capture the spread.

This is why arbitrage is considered:

![]() Stable

Stable

![]() Market-neutral

Market-neutral

![]() Low risk

Low risk

![]() Ideal during volatile periods

Ideal during volatile periods

How Traders & Long-Term Investors Look at Arbitrage Funds

How Traders & Long-Term Investors Look at Arbitrage Funds

Traders (Idle Cash Strategy)

- Park money between trades

- Use T+1 liquidity

- Earn steady returns without taking directional risk

- Benefit from equity taxation

- Avoid idle cash lying unproductive in trading account

For traders, arbitrage means: “If I’m not deploying capital today, it should still earn something safely.”

Long-Term Investors (Stability Strategy)

- Use arbitrage during uncertain markets

- Park temporary surplus before redeployment

- Prefer low risk + predictable returns

- Use as a bridge between investments

Arbitrage Fund Insights & Last 6-Month Trends

Arbitrage Fund Insights & Last 6-Month Trends

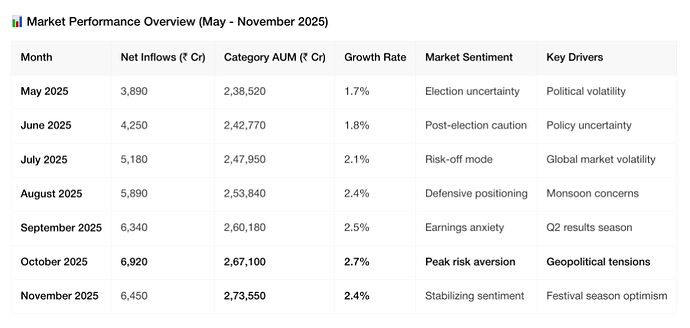

The category has grown sharply due to election volatility, global uncertainty, monsoon impact, earnings season swings, and geopolitical tensions.

Here’s the Quick snapshot:

*Source : askfuzz.ai

What the Data Tells Us

What the Data Tells Us

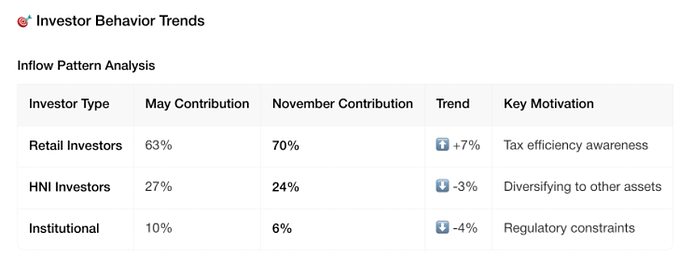

- Non-stop inflows for 6 straight months - extremely rare

- Retail participation up from 63% → 70% - mass awareness

- Category AUM up ₹35,000 Cr - massive demand spike

- October was the turning point - highest inflows, highest risk-off mood

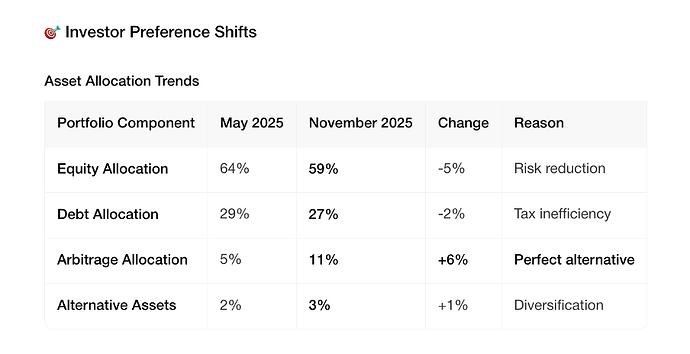

- Investors want stability with equity taxation. Arbitrage fits that slot perfectly.

Why JioBlackRock Entering Arbitrage Matters

Right now, everyone’s looking for something steady. Spreads are good, volatility is high, and arbitrage fits that mood perfectly. JioBlackRock entering the category just adds more confidence on top.

More details will be out once the NFO document is released. Stay tuned - this could be a solid option for many. ![]()