Why the Coming Weeks are Critical for Markets

The next few weeks are action-packed for markets, with key events and corporate earnings set to shape investor sentiment. Here’s why they matter:

-

19th Jan: HDFC Bank & Hindustan Lever Results

As bellwethers of the banking and FMCG sectors, their quarterly results will provide insights into consumer demand, rural recovery, and financial sector resilience. -

25th Jan: ICICI Bank Q3 Results

After Kotak Mahindra Bank’s stellar rally post-results, all eyes will be on ICICI Bank to gauge growth in profitability and asset quality trends. -

31st Jan: US Fed Interest Rate Decision

The Fed’s stance on interest rates will influence global liquidity and foreign flows into Indian markets, impacting equity and fixed-income assets. -

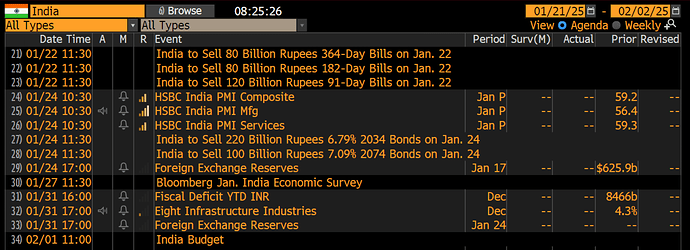

1st Feb: Union Budget 2025

A pivotal event for the markets! Key reforms, tax policies, and sectoral incentives could drive market momentum. (Stay tuned for live updates from us! )

) -

6th Feb: RBI Monetary Policy Meeting

The RBI’s commentary on inflation, growth, and liquidity will set the tone for fixed-income markets and banking stocks. -

10th Feb: Tata Steel Q3 Results

As a leading indicator of the metals and infrastructure sectors, Tata Steel’s performance will highlight trends in global demand and pricing dynamics.

These events collectively hold the power to influence market sentiment, sectoral performance, and investment flows. Which of these do you think will have the biggest impact on your portfolio?

Let us know your thoughts! ![]()