Hi Folks,

Our Algo Trading Series, hosted by @Tradehull_Imran, has been incredibly well-received, benefiting 5,000+ traders so far with in-depth, practical insights.

Due to popular demand, we’re back with the second edition of the Algo Trading Series, designed to help our Algo Trading community systematically master advanced algorithmic trading concepts.

Video Series:

Episode 1: Introduction to Advance Algo Trading

Topics covered:

![]() Introduction to Advanced Algo Trading – The series builds upon the basics covered in the previous playlist, focusing on creating fully functional live trading algorithms.

Introduction to Advanced Algo Trading – The series builds upon the basics covered in the previous playlist, focusing on creating fully functional live trading algorithms.

![]() Pandas Library for Data Handling – The session covers how to use Pandas to process market data efficiently, including sorting, filtering, and calculating indicators like moving averages.

Pandas Library for Data Handling – The session covers how to use Pandas to process market data efficiently, including sorting, filtering, and calculating indicators like moving averages.

![]() Technical Indicators & Customization – Explains how to apply and customize technical indicators such as SMA, Bollinger Bands, MACD, RSI, and Supertrend using Python’s TA-Lib.

Technical Indicators & Customization – Explains how to apply and customize technical indicators such as SMA, Bollinger Bands, MACD, RSI, and Supertrend using Python’s TA-Lib.

![]() Candlestick Pattern Recognition – Demonstrates how to detect common patterns like Doji, Marubozu, and Engulfing patterns programmatically using Python.

Candlestick Pattern Recognition – Demonstrates how to detect common patterns like Doji, Marubozu, and Engulfing patterns programmatically using Python.

![]() Foundation for Building Scanners & Strategies – Sets the stage for the next sessions by discussing how to create personalized scanners and automate strategy execution using algorithmic trading concepts.

Foundation for Building Scanners & Strategies – Sets the stage for the next sessions by discussing how to create personalized scanners and automate strategy execution using algorithmic trading concepts.

Codes: Session 1: Introduction to Advance Algo Trading

Episode 2: How To Create A Scanner & Scanning Option Chain

Topics covered:

Summary: Advanced Algo Trading Series | Episode 2

![]() Introduction to Scanners in Algo Trading

Introduction to Scanners in Algo Trading

- Understanding the difference between a scanner and an algo

- Scanners help identify trade opportunities; algos handle order execution

![]() Creating Different Types of Scanners

Creating Different Types of Scanners

- Basic Scanners: Normal scanner and option chain scanner

- Indicator-Based Scanners: Using RSI, Supertrend, and candlestick patterns

- Price Action-Based Scanners: Implementing bullish and bearish engulfing patterns

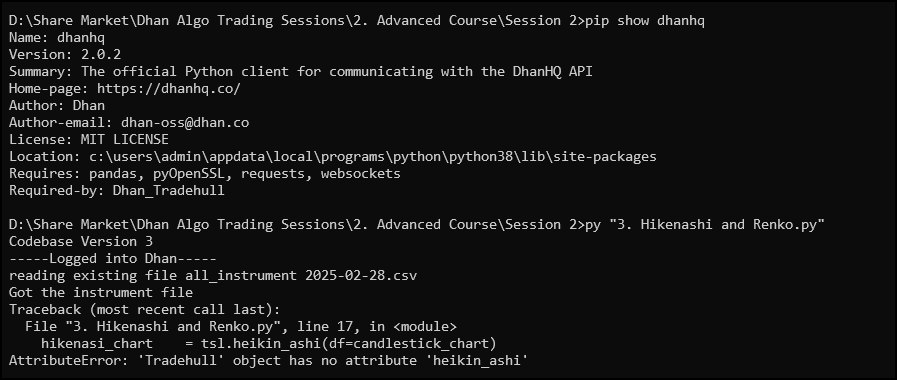

![]() Building Heikin Ashi & Renko Charts

Building Heikin Ashi & Renko Charts

- How to convert candlestick data into Heikin Ashi and Renko charts

- Applying indicators like Supertrend on these charts

![]() Debugging & Testing Scanners

Debugging & Testing Scanners

- Importance of backtesting scanners before live deployment

- Using print statements and debugging techniques to fix scanner issues

- Handling errors when stock symbols change or data isn’t available

![]() Option Chain Scanning

Option Chain Scanning

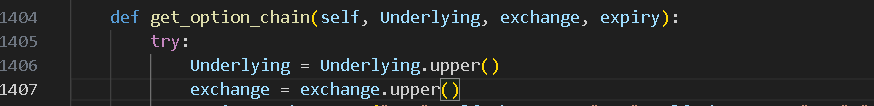

- Understanding the importance of API access to real-time option chain data

- Fetching option chain data for index and stock options

- Extracting ATM (At-the-Money) strike prices

![]() Selecting Strikes Based on Data Metrics

Selecting Strikes Based on Data Metrics

- LTP-Based Selection: Finding strikes with LTP below a certain value

- Volume & Open Interest-Based Selection: Identifying strikes with the highest volume or OI

- Change in Open Interest: Spotting potential trend shifts

- Put-Call Ratio (PCR) Calculation: Using volume and OI to gauge market sentiment

![]() Strategic Approach to Algo Trading

Strategic Approach to Algo Trading

- Learning fundamental concepts before combining them into an advanced algo

- Step-by-step approach to integrating scanners, indicators, and execution strategies

![]() Watch the Full Video Here:

Watch the Full Video Here:

Session 2 codes: https://drive.google.com/file/d/11b85183lLTOOQl0DBUU78Qciw0kia_4b/view?usp=sharing

This session provides an in-depth, hands-on approach to creating scanners and working with option chain data—ideal for traders looking to automate their strategies! ![]()

Episode 3: Advanced Algo Trading Series

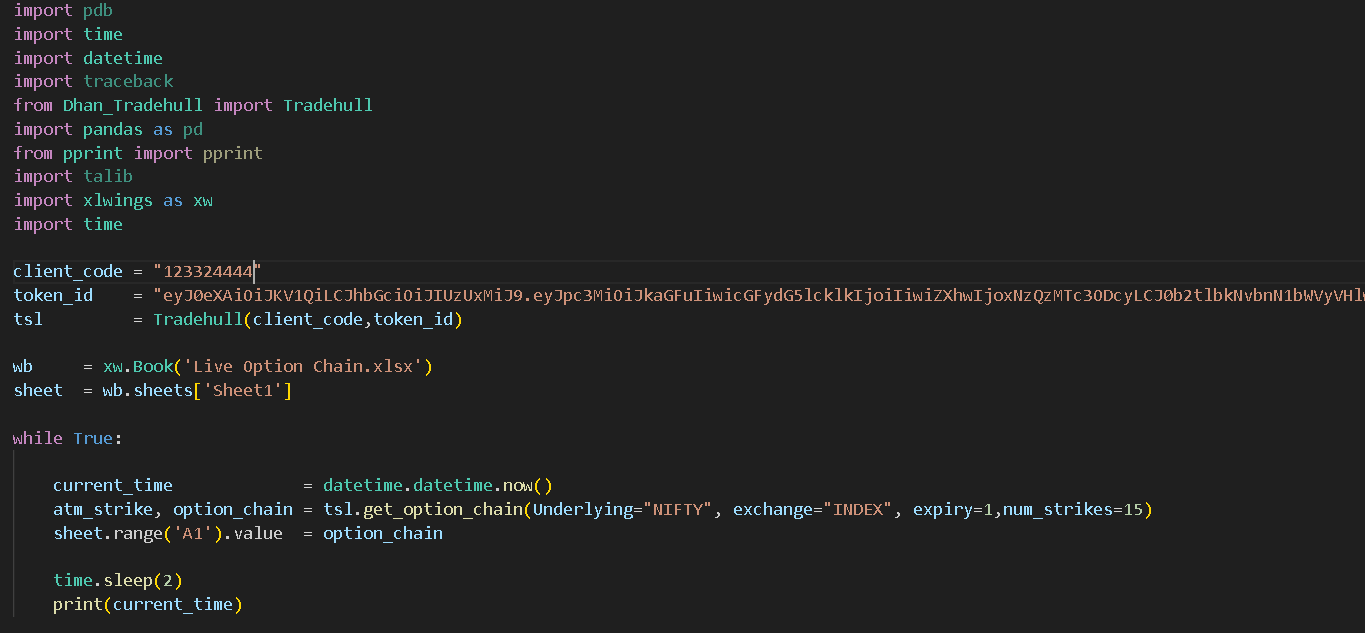

![]() Connecting Algo with Excel – Learn how to integrate Excel to view and control your algo’s decision-making process.

Connecting Algo with Excel – Learn how to integrate Excel to view and control your algo’s decision-making process.

![]() Automating Trade Execution – Execute buy/sell orders directly from Excel by inputting values.

Automating Trade Execution – Execute buy/sell orders directly from Excel by inputting values.

![]() Reading & Writing Data in Excel – Learn how to fetch live market data into Excel and track indicators like LTP, RSI, and entry conditions in real-time.

Reading & Writing Data in Excel – Learn how to fetch live market data into Excel and track indicators like LTP, RSI, and entry conditions in real-time.

![]() Managing Trades with API – How to execute, modify, and track orders dynamically.

Managing Trades with API – How to execute, modify, and track orders dynamically.

![]() Rate Limits & Optimization – Techniques to make your algo more efficient and avoid API rate limitations.

Rate Limits & Optimization – Techniques to make your algo more efficient and avoid API rate limitations.

![]() Creating a Mini RoboCop – Build a simplified trading bot that automates order placement & risk management via Excel.

Creating a Mini RoboCop – Build a simplified trading bot that automates order placement & risk management via Excel.

![]() Upcoming in Part 2 – Automating option chain updates and sending alerts via Telegram for key trade updates.

Upcoming in Part 2 – Automating option chain updates and sending alerts via Telegram for key trade updates.

This episode is a must-watch for traders looking to bridge the gap between algo trading and Excel automation. ![]()

Watch the video ![]()

Stay tuned for the next episodes! From here on, we will upload two weekly videos for everyone to learn and implement!

Episode 3 codes: https://drive.google.com/file/d/1fd-JW_H9erCQ10MaxZfKM7piLaXaz6fV/view?usp=sharing

Episode 4: Framework of Live Algo

In Episode 4, we dive into building a structured framework for live algo trading, ensuring precision, scalability, and efficiency.

Key Highlights:

Key Highlights:

![]() Blueprint for Live Algo – A structured approach to executing strategies seamlessly.

Blueprint for Live Algo – A structured approach to executing strategies seamlessly.

![]() Managing Multiple Positions – Track & automate entries, exits, SL, and P&L dynamically.

Managing Multiple Positions – Track & automate entries, exits, SL, and P&L dynamically.

![]() Trade Execution & Monitoring – Build an order book system for real-time tracking.

Trade Execution & Monitoring – Build an order book system for real-time tracking.

![]() Re-Entry & Risk Management – Avoid duplicate trades, implement trailing SL & pyramiding.

Re-Entry & Risk Management – Avoid duplicate trades, implement trailing SL & pyramiding.

![]() Testing & Debugging – Simulate trades before going live for smooth execution.

Testing & Debugging – Simulate trades before going live for smooth execution.

![]() Why Watch? Learn how to automate & scale your trading system with a powerful framework!

Why Watch? Learn how to automate & scale your trading system with a powerful framework!

![]() Watch now for real-time coding & implementation!

Watch now for real-time coding & implementation! ![]()

![]()

Code files for Episode 4: https://drive.google.com/file/d/1_xRdUlFBRD6N8QwMADMOLFvL9P4v1Rww/view?usp=sharing

Episode 5: Testing Your Algo

Code files: https://drive.google.com/file/d/1TYK764BWTKEbf-d69wkjJiC0aI0SjHfY/view?usp=sharing

Episode 6 is now live!

Watch it here:

Here are the codes:

Epsiode 7 is now live:

Here are the codes:

https://drive.google.com/file/d/1ynB_IwDHlw5G4Ai50dOvXT3ErhHNnD2f/view?usp=sharing

Episode 8:

Here are the codes:

Episode 9 :

Here are the codes:

Episode 10 :

Here are the codes:

Episode 11 ![]()

Here are the codes:

As usual, @Tradehull_Imran will be there to help you with any doubts!