@Tradehull_Imran,

Sir

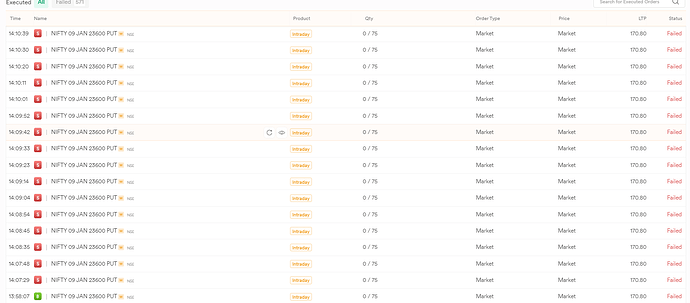

Now code is working as expected, logged in and logout as per time mentioned it has Placed the order but against one buy order there are multiple sell orders. is this ok.

Hi @Tradehull_Imran sir,

Can you please share the dhan codebase for reference which was available on notion.so?

simple yet powerfull,

OPTION SELLING

USE VWAP INDICATOR,

TIME FRAME - 5MIN

INSTRUMENT - ATM STRADDLE STRIKE COMBINED PRICE

AS AND WHEN ITS COMES DOWN VWAP SELL THE STRADDLE

RR WILL BE 1:2

its working fine now… it seems there was problem with ITC symbol yesterday.

When we fetching the OHLC chart data for each instrument in a separate API call , we are hitting the Data API rate limits. As Dhan support to fetch OHLC data of 1000 instruments in a single API, refer this link Market Quote - DhanHQ Ver 2.0 / API Document . please update the get_historic_data() to fetch chart data for the list of trading symbols instead of 1 instrument in a one API call. And consider the same for LTP fetch function. With this I think we can avoid the rate limit issues to some extend. Looking forward for your inputs and support…

Hello @Tradehull_Imran , everyone

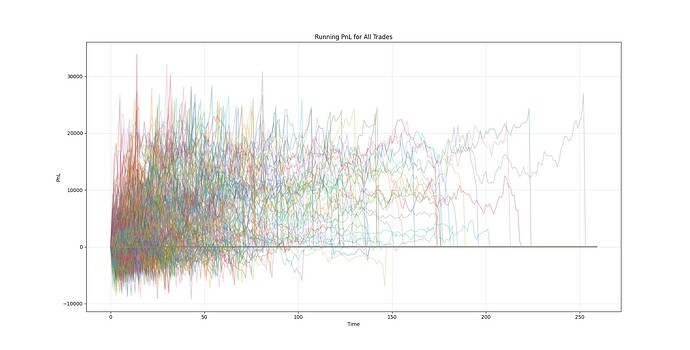

Equity backtesting —

Mothercandle strategy with Volume BO

Time Frame 15 min

Indicators - Volume, RSI >60

Screener that scans Mothercandle structure after 3rd completed candle.

Watchlist to have stocks 3-5 based on screener results

Rule :

Strategy to begin at 10 am

the first candle of the day = Mothercandle that should be about 1-3 % in size

the subsequent 2nd and 3rd should be child candle

the candle that gives BO or BD should have 2x volume > Mothercandle and RSI>60

SL - Low of Mothecandle about 2%

TSL - 1%

Risk Reward 1:2

Suggestion welcome

Thanks

Yeah. Have deleted the existing token and created a new one & its working.

However, Its better to find out why it didn’t work for the previous token to avoid same issue in future

Getting Exception for instrument name BANKNIFTY-JAN2025-49900-CE as Check the Tradingsymbol got exception in pnl as 'BANKNIFTY-Jan2025-49900-CE'

kindly check

Folks anyone from Bangalore here?

We are coming to your city - exclusively for an Algo Trading Workshop!

Date: 11th January, Saturday

Time: 10 AM onwards

Here’s the link for registration link:

We look forward to seeing you soon!

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as ta

import xlwings as xw

import winsound

client_code = “1102790337”

token_id = “eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzM2ODYwMTMxLCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTEwMjc5MDMzNyJ9.Leop6waGeVfmBOtczNEcjRWmC8pUGWQf54YPINGDi_PZjk1IvW-DDdaYXsgM_s8McOT44q4MjEQxGXU0lduK0A”

tsl = Tradehull(client_code,token_id)

watchlist = [‘BEL’, ‘BOSCHLTD’, ‘COLPAL’, ‘HCLTECH’, ‘HDFCBANK’, ‘HAVELLS’, ‘HAL’, ‘ITC’, ‘IRCTC’, ‘INFY’, ‘LTIM’, ‘MARICO’, ‘MARUTI’, ‘NESTLEIND’, ‘PIDILITIND’, ‘TCS’, ‘TECHM’, ‘WIPRO’]

single_order = {‘name’:None, ‘date’:None , ‘entry_time’: None, ‘entry_price’: None, ‘buy_sell’: None, ‘qty’: None, ‘sl’: None, ‘exit_time’: None, ‘exit_price’: None, ‘pnl’: None, ‘remark’: None, ‘traded’:None}

orderbook = {}

wb = xw.Book(‘Live Trade Data.xlsx’)

live_Trading = wb.sheets[‘Live_Trading’]

completed_orders_sheet = wb.sheets[‘completed_orders’]

reentry = “yes” #“yes/no”

completed_orders =

bot_token = “8059847390:AAECSnQK-yOaGJ-clJchb1cx8CDhx2VQq-M”

receiver_chat_id = “1918451082”

live_Trading.range(“A2:Z100”).value = None

completed_orders_sheet.range(“A2:Z100”).value = None

for name in watchlist:

orderbook[name] = single_order.copy()

while True:

print("starting while Loop \n\n")

current_time = datetime.datetime.now().time()

if current_time < datetime.time(13, 55):

print(f"Wait for market to start", current_time)

time.sleep(1)

continue

if current_time > datetime.time(15, 15):

order_details = tsl.cancel_all_orders()

print(f"Market over Closing all trades !! Bye Bye See you Tomorrow", current_time)

pdb.set_trace()

break

all_ltp = tsl.get_ltp_data(names = watchlist)

for name in watchlist:

orderbook_df = pd.DataFrame(orderbook).T

live_Trading.range('A1').value = orderbook_df

completed_orders_df = pd.DataFrame(completed_orders)

completed_orders_sheet.range('A1').value = completed_orders_df

current_time = datetime.datetime.now()

print(f"Scanning {name} {current_time}")

try:

chart = tsl.get_historical_data(tradingsymbol = name,exchange = 'NSE',timeframe="5")

chart['rsi'] = talib.RSI(chart['close'], timeperiod=14)

cc = chart.iloc[-2]

# buy entry conditions

bc1 = cc['rsi'] > 45

bc2 = orderbook[name]['traded'] is None

except Exception as e:

print(e)

continue

if bc1 and bc2:

print("buy ", name, "\t")

margin_avialable = tsl.get_balance()

margin_required = cc['close']/4.5

if margin_avialable < margin_required:

print(f"Less margin, not taking order : margin_avialable is {margin_avialable} and margin_required is {margin_required} for {name}")

continue

orderbook[name]['name'] = name

orderbook[name]['date'] = str(current_time.date())

orderbook[name]['entry_time'] = str(current_time.time())[:8]

orderbook[name]['buy_sell'] = "BUY"

orderbook[name]['qty'] = 1

try:

entry_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

orderbook[name]['entry_orderid'] = entry_orderid

orderbook[name]['entry_price'] = tsl.get_executed_price(orderid=orderbook[name]['entry_orderid'])

orderbook[name]['tg'] = round(orderbook[name]['entry_price']*1.002, 1) # 1.01

orderbook[name]['sl'] = round(orderbook[name]['entry_price']*0.998, 1) # 99

sl_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=orderbook[name]['sl'], order_type='STOPMARKET', transaction_type ='SELL', trade_type='MIS')

orderbook[name]['sl_orderid'] = sl_orderid

orderbook[name]['traded'] = "yes"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"Entry_done {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

except Exception as e:

print(e)

pdb.set_trace(header= "error in entry order")

if orderbook[name]['traded'] == "yes":

bought = orderbook[name]['buy_sell'] == "BUY"

if bought:

try:

ltp = all_ltp[name]

sl_hit = tsl.get_order_status(orderid=orderbook[name]['sl_orderid']) == "TRADED"

tg_hit = ltp > orderbook[name]['tg']

except Exception as e:

print(e)

pdb.set_trace(header = "error in sl order cheking")

if sl_hit:

try:

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=orderbook[name]['sl_orderid'])

orderbook[name]['pnl'] = round((orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty'],1)

orderbook[name]['remark'] = "Bought_SL_hit"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"SL_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

except Exception as e:

print(e)

pdb.set_trace(header = "error in sl_hit")

if tg_hit:

try:

tsl.cancel_order(OrderID=orderbook[name]['sl_orderid'])

time.sleep(2)

square_off_buy_order = tsl.order_placement(tradingsymbol=orderbook[name]['name'] ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='SELL', trade_type='MIS')

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=square_off_buy_order)

orderbook[name]['pnl'] = (orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty']

orderbook[name]['remark'] = "Bought_TG_hit"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"TG_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

winsound.Beep(1500, 10000)

except Exception as e:

print(e)

pdb.set_trace(header = "error in tg_hit")

Hi, @Tradehull_Imran sir, I have tried my level best to make a alog with the help of API Trades Meetup&Workshop files, Please check it from your end , Sir, because Squareoff Order is not placing when tg_hit = ltp > orderbook[name]['tg']

Got it sir

Thank you!!!

YEP ![]()

Yes I also have the same opinion of getting OHLC data of 1000 instruments in a single API, we expect from Tradehull team to suggest a solution. As far as LTP is concerned, if you are using LTP in a loop where you are also fetching OHCL then instead of LTP you can use close of current candle as LTP “LTP=chart[‘close’].iloc[-1]” along with a considerable value of time interval in time.sleep(t). I think it will minimize API issue.

@Tradehull_Imran how to place bracket orders?, entry, stop loss and target together?

is this right?

tsl.order_placement(

tradingsymbol = stock_name,

exchange = “NSE”,

quantity = qty,

price = entry_price

trigger_price = entry_price,

order_type = “LIMIT”,

transaction_type = “BUY”,

trade_type = “MIS”,

validity =‘DAY’,

bo_profit_value = target,

bo_stop_loss_Value = stop_loss

)

@Tradehull_Imran Sir

me too getting the error

Exception for instrument name NIFTY-JAN2025-23750-CE as Check the Tradingsymbol

got exception in pnl as ‘NIFTY-Jan2025-23750-CE’

Algo is working 11:47:06.280986

BUY 11:47:06.280986 True True True False True True False first_candle 11:35:00

SELL 11:47:06.280986 False False False True False True True first_candle 11:35:00

Exception for instrument name NIFTY-JAN2025-23750-CE as Check the Tradingsymbol

got exception in pnl as ‘NIFTY-Jan2025-23750-CE’

Algo is working 11:47:17.886375

@Tradehull_Imran

Since we already have a two-candle strategy in place and it’s proven to be effective, why not start backtesting with the same? Instead of reinventing the wheel, we can focus our energy on optimizing and fine-tuning the existing strategy to achieve even better results.

Let’s leverage what’s already working and build upon it for greater efficiency and success.

@RahulDeshpande Ji

Thank you so much for considering us Bangaloreans and organizing a workshop here—it means a lot! I’ve already registered and am now eagerly waiting for approval.

Looking forward to the opportunity to learn and engage during the workshop.

Very Good Morning Sir.

Info is from ‘Backtrader’ : Hello Algotrading!

A classic Simple Moving Average Crossover strategy, can be easily implemented and in different ways. The results and the chart are the same for the three snippets presented below.

- Buy/Sell Code Snippet

- Target Orders Code Snippet

- Signals Code Snippet

Buy/Signal Code: `from datetime import datetime

import backtrader as bt

Create a subclass of Strategy to define the indicators and logic

class SmaCross(bt.Strategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def __init__(self):

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

self.crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

def next(self):

if not self.position: # not in the market

if self.crossover > 0: # if fast crosses slow to the upside

self.buy() # enter long

elif self.crossover < 0: # in the market & cross to the downside

self.close() # close long position

cerebro = bt.Cerebro() # create a “Cerebro” engine instance

Create a data feed

data = bt.feeds.YahooFinanceData(dataname=‘MSFT’,

fromdate=datetime(2011, 1, 1),

todate=datetime(2012, 12, 31))

cerebro.adddata(data) # Add the data feed

cerebro.addstrategy(SmaCross) # Add the trading strategy

cerebro.run() # run it all

cerebro.plot() # and plot it with a single command`

Target Orders Code: `from datetime import datetime

import backtrader as bt

Create a subclass of Strategy to define the indicators and logic

class SmaCross(bt.Strategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def __init__(self):

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

self.crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

def next(self):

if not self.position: # not in the market

if self.crossover > 0: # if fast crosses slow to the upside

self.order_target_size(target=1) # enter long

elif self.crossover < 0: # in the market & cross to the downside

self.order_target_size(target=0) # close long position

cerebro = bt.Cerebro() # create a “Cerebro” engine instance

Create a data feed

data = bt.feeds.YahooFinanceData(dataname=‘MSFT’,

fromdate=datetime(2011, 1, 1),

todate=datetime(2012, 12, 31))

cerebro.adddata(data) # Add the data feed

cerebro.addstrategy(SmaCross) # Add the trading strategy

cerebro.run() # run it all

cerebro.plot() # and plot it with a single command`

Signals Code: `from datetime import datetime

import backtrader as bt

Create a subclass of SignaStrategy to define the indicators and signals

class SmaCross(bt.SignalStrategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def __init__(self):

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

self.signal_add(bt.SIGNAL_LONG, crossover) # use it as LONG signal

cerebro = bt.Cerebro() # create a “Cerebro” engine instance

Create a data feed

data = bt.feeds.YahooFinanceData(dataname=‘MSFT’,

fromdate=datetime(2011, 1, 1),

todate=datetime(2012, 12, 31))

cerebro.adddata(data) # Add the data feed

cerebro.addstrategy(SmaCross) # Add the trading strategy

cerebro.run() # run it all

cerebro.plot() # and plot it with a single command`

I don’t Know how far is it useful??

I have a simple strategy,

INDEX OPTION SELLING (Short Iron condor)

Rules

- find and buy 0.1 delta deep OTM (hedge)

- Find ATM strikes and calculate the price difference in CE & PE prices.

- if the price difference is more than 10%, wait

- if the price difference is less than 10%, sell ATM CE & ATM PE

- keep watch on both legs prices; if any of the two’s LTP gets double of other leg’s LTP, exit both legs

- re-entry (start again from point 2)

The only problem is with the strategy that if there is a sudden spike in the market, 1 leg price gets multiplied and other legs price doesn’t get reduced in the same ratio.

any suugestions are welcome