Hi @CHETAN_99

Mostly the orderbook variable seems to be None.

send complete code for checking.

Do send the code as well for checking.

It seems TA-lib had some issues while installation,

Do reinstall again for talib

use these files these are updated.

Also do make sure that python 3.8.0 is being used

Hi @Kanha_Meher

Need more info on this.

Do send the complete code and the codebase code that has been used,

use below code

atm, option_chain = tsl.get_option_chain(Underlying="NIFTY", exchange="INDEX", expiry=0, num_strikes=30)

pcr_value = option_chain['PE OI'].sum() / option_chain['CE OI'].sum()

and use this codebase file : https://drive.google.com/file/d/1h8J6VOLrHMAaF1NGP4_vJj2wtkNxfPDw/view?usp=sharing

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as ta

import xlwings as xw

import winsound

import requests

import os

from playsound import playsound

------------------------------ DHAN API LOGIN SETUP ------------------------------

client_code = “”

token_id = “”

tsl = Tradehull(client_code, token_id)

watchlist = [“HDFCBANK”, “ICICIBANK”]

single_order = {‘name’:None, ‘date’:None , ‘entry_time’: None, ‘entry_price’: None, ‘buy_sell’: None, ‘qty’: None, ‘sl’: None, ‘exit_time’: None, ‘exit_price’: None, ‘pnl’: None, ‘remark’: None, ‘traded’:None}

orderbook = {}

wb = xw.Book(‘Live Trade Data.xlsx’)

live_Trading = wb.sheets[‘Live_Trading’]

completed_orders_sheet = wb.sheets[‘completed_orders’]

reentry = “yes” #“yes/no”

completed_orders =

Calculate current loss

my_loss = 0

max_loss = -150

Maximum allowed open positions

max_open_positions = 2

#---------------------------- TELEGRAM ALERT FUNCTION ------------------------------

bot_token = “”

receiver_chat_id = “”

#---------------------------- FUNCTION TO GET LIVE DATA ------------------------------

live_Trading.range(“A2:Z100”).value = None

completed_orders_sheet.range(“A2:Z100”).value = None

for name in watchlist:

orderbook[name] = single_order.copy()

------------------------------ SOUND FUNCTION ------------------------------

def play_sound():

winsound.Beep(9500, 500)

#------------------------------- QTY FUNCTION ------------------------------

def calculate_trade_quantity(balance, risk_per_trade, stock_price):

risk_amount = balance * risk_per_trade

quantity = risk_amount // stock_price

return max(5, int(quantity))

------------------------------ MAIN ALGO ------------------------------

while True:

live_pnl = tsl.get_live_pnl()

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 30):

print(f"Wait for market to start Chetan", current_time)

time.sleep(1)

continue

if current_time > datetime.time(14, 45):

order_details = tsl.cancel_all_orders()

print(f"Market over Closing all trades !! Bye Bye See you Tomorrow Chetan", current_time)

break

if my_loss <= int(max_loss) and tsl.cancel_all_orders == "yes" and tsl.kill_switch == 'ON':

print("Max loss reached! Cancelling all orders and stopping trading.")

tsl.cancel_all_orders()

break

print("\n started while Loop \n")

all_ltp = tsl.get_ltp_data(names = watchlist)

for name in watchlist:

orderbook_df = pd.DataFrame(orderbook).T

live_Trading.range('A1').value = orderbook_df

completed_orders_df = pd.DataFrame(completed_orders)

completed_orders_sheet.range('A1').value = completed_orders_df

current_time = datetime.datetime.now()

print(f"Scanning {name} {current_time}")

try:

chart_1 = tsl.get_historical_data (tradingsymbol = name.upper(),exchange = 'NSE',timeframe='5')

chart_1['upperband'], chart_1['middleband'], chart_1['lowerband'] = talib.BBANDS(chart_1['close'], timeperiod=20, nbdevup=1.5, nbdevdn=1.5, matype=0)

# Define index for the latest candle

index = len(chart_1) - 1 # Last index in the DataFrame

# Reference the latest two candles (previous and current)

alert_candle = chart_1.iloc[index - 1] # Second last candle (previous candle)

letest_candle = chart_1.iloc[index] # Last candle (current candle)

# BUY ENTRY CONDITION

bc1 = alert_candle['close'] < alert_candle['lowerband']

bc6 = orderbook[name]['traded'] is None

# SELL ENTRY CONDITION

sc1 = alert_candle['close'] > alert_candle['upperband']

sc6 = orderbook[name]['traded'] is None

except Exception as e:

print(e)

continue

if bc1 and bc2 and bc3 and bc4 and bc5 and bc6:

print("buy ", name, "\t")

margin_available = tsl.get_balance()

margin_required = alert_candle['close']/5.0 # LEVRAGE AMOUNT

if margin_available < margin_required:

print(f"Less margin, not taking order : margin_available is {margin_available} and margin_required is {margin_required} for {name}")

continue

# Calculating the quantity to trade

stock_price = alert_candle['close'] # Use the close price of the alert candle as the stock price

risk_per_trade = 0.06 # Risk 6%

trade_quantity = calculate_trade_quantity(balance=margin_available, risk_per_trade=risk_per_trade, stock_price=stock_price)

orderbook[name]['name'] = name

orderbook[name]['date'] = str(current_time.date())

orderbook[name]['entry_time'] = str(current_time.time())[:8]

orderbook[name]['buy_sell'] = "BUY"

orderbook[name]['qty'] = trade_quantity

try:

entry_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

orderbook[name]['entry_orderid'] = entry_orderid

orderbook[name]['entry_price'] = tsl.get_executed_price(orderid=orderbook[name]['entry_orderid'])

# Stop-loss and target calculations

stop_loss_amount = alert_candle['high'] - alert_candle['low']

stop_loss_price = orderbook[name]['entry_price'] - stop_loss_amount

target_profit_price = orderbook[name]['entry_price'] + (4 * stop_loss_amount)

orderbook[name]['sl'] = round(stop_loss_price, 2)

orderbook[name]['tg'] = round(target_profit_price, 2)

sl_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=orderbook[name]['sl'], order_type='STOPMARKET', transaction_type ='SELL', trade_type='MIS')

orderbook[name]['sl_orderid'] = sl_orderid

orderbook[name]['traded'] = "yes"

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"Entry_done {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

max_open_positions = +1

except Exception as e:

print(e)

if orderbook[name]['traded'] == "yes":

bought = orderbook[name]['buy_sell'] == "BUY"

if bought:

try:

ltp = all_ltp[name]

sl_hit = tsl.get_order_status(orderid=orderbook[name]['sl_orderid']) == "TRADED"

tg_hit = ltp > orderbook[name]['tg']

except Exception as e:

print(e)

if sl_hit:

try:

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=orderbook[name]['sl_orderid'])

orderbook[name]['pnl'] = round((orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty'],1)

orderbook[name]['remark'] = "Bought_SL_hit"

# TELEGRAM MASSAGE

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"SL_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

except Exception as e:

print(e)

if tg_hit:

try:

tsl.cancel_order(OrderID=orderbook[name]['sl_orderid'])

time.sleep(2)

square_off_buy_order = tsl.order_placement(tradingsymbol=orderbook[name]['name'] ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='SELL', trade_type='MIS')

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=square_off_buy_order)

orderbook[name]['pnl'] = (orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty']

orderbook[name]['remark'] = "Bought_TG_hit"

# TELEGRAM MASSAGE

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"TG_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

winsound.Beep(1500, 10000)

except Exception as e:

print(e)[quote="Tradehull_Imran, post:2150, topic:32718, full:true"]

Hi @CHETAN_99

Mostly the orderbook variable seems to be None.

send complete code for checking.

[/quote]

@Tradehull_Imran Sir

Please include the following in the algo:

If the first trade hits the target, no more trades for the day.

If the first trade hits the stop-loss, allow up to 2 more trade opportunities.

Thank you for your guidance! ![]()

Hi @CHETAN_99

Did this error happened after the SL / Tg was hit.

Also do use this code .. for managing orderbook error

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as ta

import xlwings as xw

import winsound

import requests

import os

from playsound import playsound

# ------------------------------ DHAN API LOGIN SETUP ------------------------------

client_code = "1102790337"

token_id = "eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzM3NTIzMDg4LCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTEwMjc5MDMzNyJ9.UWD34xX9VHFQ9ULmjhiufvqp-jzrDXFpKKOLVj0ix6wDVxOUZDmScAiQc-TBN_-TDT7wZl5AjLsFMFiuwrVciQ"

tsl = Tradehull(client_code, token_id)

watchlist = ["IDEA", "ONGC"]

single_order = {

'name': None,

'date': None,

'entry_time': None,

'entry_price': None,

'buy_sell': None,

'qty': None,

'sl': None,

'exit_time': None,

'exit_price': None,

'pnl': None,

'remark': None,

'traded': None

}

orderbook = {}

wb = xw.Book('Live Trade Data.xlsx')

live_Trading = wb.sheets['Live_Trading']

completed_orders_sheet = wb.sheets['completed_orders']

reentry = "yes" # "yes/no"

completed_orders = []

# Calculate current loss

my_loss = 0

max_loss = -150

# Maximum allowed open positions

max_open_positions = 2

# ---------------------------- TELEGRAM ALERT FUNCTION ------------------------------

bot_token = ""

receiver_chat_id = ""

# ---------------------------- FUNCTION TO GET LIVE DATA ------------------------------

live_Trading.range("A2:Z100").value = None

completed_orders_sheet.range("A2:Z100").value = None

for name in watchlist:

orderbook[name] = single_order.copy()

# ------------------------------ SOUND FUNCTION ------------------------------

def play_sound():

winsound.Beep(9500, 500)

# ------------------------------- QTY FUNCTION ------------------------------

def calculate_trade_quantity(balance, risk_per_trade, stock_price):

risk_amount = balance * risk_per_trade

quantity = risk_amount // stock_price

return max(5, int(quantity))

# ------------------------------ MAIN ALGO ------------------------------

while True:

live_pnl = tsl.get_live_pnl()

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 30):

print(f"Wait for market to start Chetan", current_time)

time.sleep(1)

continue

if current_time > datetime.time(14, 45):

order_details = tsl.cancel_all_orders()

print(f"Market over Closing all trades !! Bye Bye See you Tomorrow Chetan", current_time)

break

if my_loss <= int(max_loss) and tsl.cancel_all_orders == "yes" and tsl.kill_switch == 'ON':

print("Max loss reached! Cancelling all orders and stopping trading.")

tsl.cancel_all_orders()

break

print("\n started while Loop \n")

all_ltp = tsl.get_ltp_data(names=watchlist)

for name in watchlist:

orderbook_df = pd.DataFrame(orderbook).T

live_Trading.range('A1').value = orderbook_df

completed_orders_df = pd.DataFrame(completed_orders)

completed_orders_sheet.range('A1').value = completed_orders_df

current_time = datetime.datetime.now()

print(f"Scanning {name} {current_time}")

try:

chart_1 = tsl.get_historical_data(

tradingsymbol=name.upper(),

exchange='NSE',

timeframe='5'

)

chart_1['upperband'], chart_1['middleband'], chart_1['lowerband'] = talib.BBANDS(chart_1['close'], timeperiod=20, nbdevup=1.5, nbdevdn=1.5, matype=0)

# Define index for the latest candle

index = len(chart_1) - 1 # Last index in the DataFrame

# Reference the latest two candles (previous and current)

alert_candle = chart_1.iloc[index - 1] # Second last candle (previous candle)

letest_candle = chart_1.iloc[index] # Last candle (current candle)

# BUY ENTRY CONDITION

bc1 = alert_candle['close'] < alert_candle['lowerband']

bc6 = orderbook[name]['traded'] is None

# SELL ENTRY CONDITION

sc1 = alert_candle['close'] > alert_candle['upperband']

sc6 = orderbook[name]['traded'] is None

except Exception as e:

print(e)

continue

if bc1 and bc6:

print("buy ", name, "\t")

margin_available = tsl.get_balance()

margin_required = alert_candle['close'] / 5.0 # LEVERAGE AMOUNT

if margin_available < margin_required:

print(f"Less margin, not taking order: margin_available is {margin_available} and margin_required is {margin_required} for {name}")

continue

# Calculating the quantity to trade

stock_price = alert_candle['close'] # Use the close price of the alert candle as the stock price

risk_per_trade = 0.06 # Risk 6%

trade_quantity = calculate_trade_quantity(

balance=margin_available, risk_per_trade=risk_per_trade, stock_price=stock_price

)

orderbook[name]['name'] = name

orderbook[name]['date'] = str(current_time.date())

orderbook[name]['entry_time'] = str(current_time.time())[:8]

orderbook[name]['buy_sell'] = "BUY"

orderbook[name]['qty'] = trade_quantity

try:

entry_orderid = tsl.order_placement(

tradingsymbol=name,

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=0,

order_type='MARKET',

transaction_type='BUY',

trade_type='MIS'

)

orderbook[name]['entry_orderid'] = entry_orderid

orderbook[name]['entry_price'] = tsl.get_executed_price(orderid=orderbook[name]['entry_orderid'])

# Stop-loss and target calculations

stop_loss_amount = alert_candle['high'] - alert_candle['low']

stop_loss_price = orderbook[name]['entry_price'] - stop_loss_amount

target_profit_price = orderbook[name]['entry_price'] + (4 * stop_loss_amount)

orderbook[name]['sl'] = round(stop_loss_price, 2)

orderbook[name]['tg'] = round(target_profit_price, 2)

sl_orderid = tsl.order_placement(

tradingsymbol=name,

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=orderbook[name]['sl'],

order_type='STOPMARKET',

transaction_type='SELL',

trade_type='MIS'

)

orderbook[name]['sl_orderid'] = sl_orderid

orderbook[name]['traded'] = "yes"

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"Entry_done {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

max_open_positions += 1

except Exception as e:

print(e)

if orderbook[name]['traded'] == "yes":

bought = orderbook[name]['buy_sell'] == "BUY"

if bought:

try:

ltp = all_ltp[name]

sl_hit = tsl.get_order_status(orderid=orderbook[name]['sl_orderid']) == "TRADED"

tg_hit = ltp > orderbook[name]['tg']

except Exception as e:

print(e)

if sl_hit:

try:

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=orderbook[name]['sl_orderid'])

orderbook[name]['pnl'] = round((orderbook[name]['exit_price'] - orderbook[name]['entry_price']) * orderbook[name]['qty'], 1)

orderbook[name]['remark'] = "Bought_SL_hit"

# TELEGRAM MESSAGE

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"SL_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = single_order.copy()

except Exception as e:

print(e)

if tg_hit:

try:

tsl.cancel_order(OrderID=orderbook[name]['sl_orderid'])

time.sleep(2)

square_off_buy_order = tsl.order_placement(

tradingsymbol=orderbook[name]['name'],

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=0,

order_type='MARKET',

transaction_type='SELL',

trade_type='MIS'

)

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=square_off_buy_order)

orderbook[name]['pnl'] = (orderbook[name]['exit_price'] - orderbook[name]['entry_price']) * orderbook[name]['qty']

orderbook[name]['remark'] = "Bought_TG_hit"

# TELEGRAM MESSAGE

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"TG_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = single_order.copy()

winsound.Beep(1500, 10000)

except Exception as e:

print(e)

thanks sir

OMG,

Hi, @Subhajitpanja , What a Robust Trading Plan, I think it will be very difficult to code for Higher highs and Lower Lows, or Trendline. @Tradehull_Imran, Need your Suggestions, Sir.

@Tradehull_Imran , Superb sir, I think, I cannot contribute at this moment because it don’t have perfect strategy with at least 50% win ratio.. Basically I am a Level based trader ( Support and Resistance ), Currently I am trying Range Break out,

Nifty 50 Stocks with 0.75 % , up or down in 1st 5 min. candle of the day

Range :- 9.45 to 10.15 ( Mark Highs and Lows )

Time Frame is 5 mins.

Buy :- when currently candle is above the high and volume should be 2 times of the average volume.

Sell :- when currently candle is Below the low and volume should be 2 times of the average volume.

TP/SL :- 0.5 %

@Tradehull_Imran Hi sir it’s been a great learning from you, thankyou so much for the beautiful content on youtube.

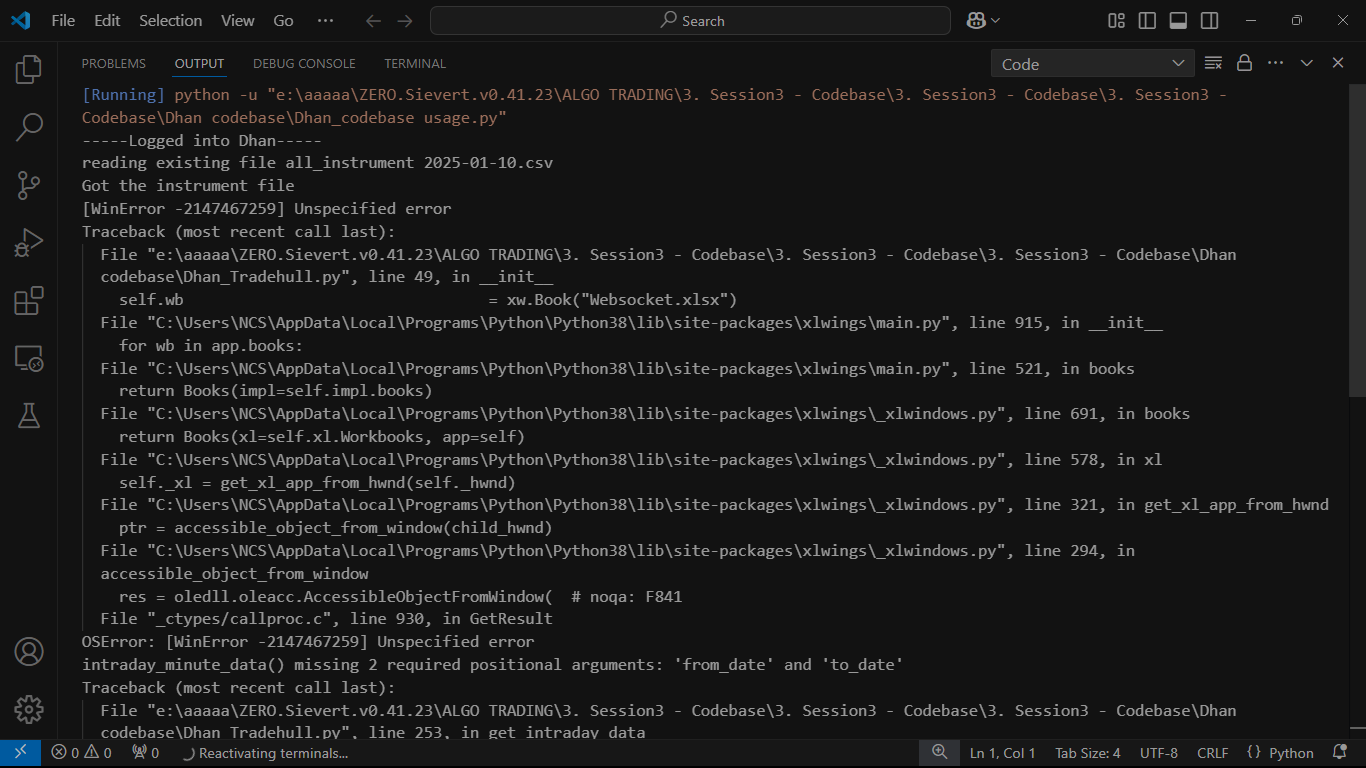

sir actually i was trying to implement your learning and also subscribed to data api of dhan but sir after running “codebaseusage.py” file- I’m getting this error.

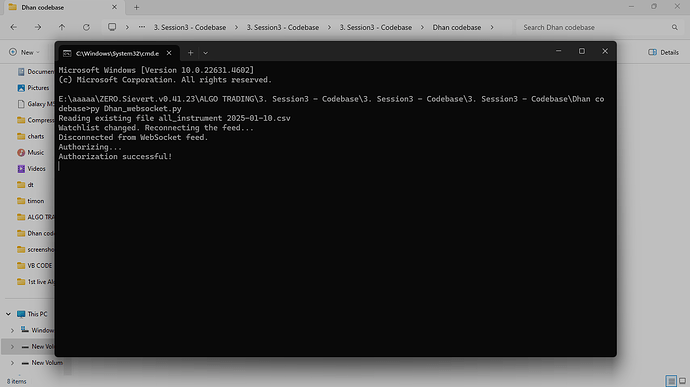

@Tradehull_Imran Hello sir, after running websocket.py on command prompt, I am getting this error. please help to solve this error. ie not getting any data on excel file.

Hi, @Kishore007, I have watched respected @Tradehull_Imran sir video

where sir try to create open source project. I just spellbound on that 2nd point sir suggested us to give some Idea only for now. As well as also mentioned one strategy 4-5 years at least it should work maybe after that it will not work.

I am also programmer to some other language. So I was thinking scene then if I create most basic strategy does not matter how many people will use it still it should be still unique as long run. I need some very raw strategy people can use and mix there own blend. but pillar should be like this only as long as stock market will be there

Suppose on your back test you are taking Daily I am taking 5 mins

you are back testing 5year on some stocks I am testing 1 years on some other stocks.

Sir will give us the ultimate answer

I just asked below things to Microsoft co-pilot

can I create higher high candle breakout with python programing

Absolutely, you can create a program to identify higher high candle breakouts using Python. To help you get started, here’s a general outline of the steps involved:

- Import Libraries: You’ll need libraries like

pandas,numpy, andmatplotlibfor data manipulation and visualization. If you’re dealing with stock data,yfinancecan be useful. - Download or Load Data: You can use APIs like Yahoo Finance to fetch historical stock data, or you can load your own dataset.

- Calculate Highs and Lows: Extract the ‘High’ and ‘Low’ values from your data.

- Identify Higher Highs and Breakouts:

- A “higher high” occurs when the price reaches a new high compared to the previous high.

- A breakout can be identified when the price moves above a certain resistance level.

- Visualization: Plot the data to visualize the breakouts.

Here’s a simple example to get you started:

python

import yfinance as yf

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

# Download historical data for a stock

stock = yf.download('AAPL', start='2022-01-01', end='2023-01-01')

# Calculate rolling high

stock['Rolling_High'] = stock['High'].rolling(window=20).max()

# Identify higher highs

stock['Higher_High'] = stock['High'] > stock['Rolling_High'].shift(1)

# Plotting

plt.figure(figsize=(12, 6))

plt.plot(stock['Close'], label='Close Price')

plt.plot(stock['Rolling_High'], label='Rolling High (20 days)')

plt.scatter(stock.index, stock['Close'][stock['Higher_High']], label='Higher High', color='red', marker='^')

plt.legend()

plt.show()

This script will download historical data for Apple Inc. (AAPL) and identify higher highs in the price. The yfinance library fetches the data, and pandas handles the data manipulation.

Now I am concentrating only study about technical analysis. If I don’t know that very well I can not do proper code. Maybe within next year I also try to be part of Imran sir open source project.

Thank you

Hi @Kishore007

Higher highs and Lower Lows, or Trendline.. these can be done.

pandas makes it easier to work on it

Hi @Kishore007

Added.. +1

Hi @Kanha_Meher

Congrats for algo deployment

use point no 3 from below thread.

https://private-poc.madefortrade.in/t/learn-algo-trading-with-python-codes-youtube-series/32718/177?u=tradehull_imran

WebSocket is a old method we used to get LTP.. now we have upgraded to a easier solution..

apply below solution

https://private-poc.madefortrade.in/t/learn-algo-trading-with-python-codes-youtube-series/32718/952?u=tradehull_imran

thankyou sir, it solved my problem. ![]()