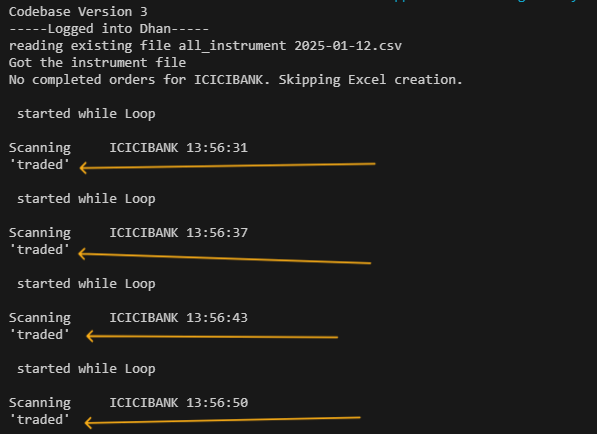

HII @Tradehull_Imran Sir Please Help me to solve this problem Why ‘traded’ is showing hear is the problem image and code also

import time

import datetime

from Dhan_Tradehull import Tradehull

import talib

import winsound

import openpyxl

from openpyxl.styles import Font, Alignment

# ------------------------------ DHAN API LOGIN SETUP ------------------------------

client_code = ""

token_id = ""

tsl = Tradehull(client_code, token_id)

watchlist = ['ICICIBANK']

single_order = {'name': None,'date': None,'entry_time': None,'entry_price': None,'buy_sell': None,'qty': None,'sl': None,'exit_time': None,'exit_price': None,'pnl': None,'remark': None,'traded': None}

orderbook = {}

reentry = "yes" # "yes/no"

completed_orders = []

# Calculate current loss

my_loss = 0

max_loss = -150

# Maximum allowed open positions

max_open_positions = 2

# ---------------------------- TELEGRAM ALERT FUNCTION ------------------------------

bot_token = ""

receiver_chat_id = ""

# ---------------------------- FUNCTION TO GET LIVE DATA ------------------------------

for name in watchlist:

orderbook[name] = single_order.copy()

# ------------------------------ SOUND FUNCTION ------------------------------

def play_sound():

winsound.Beep(9500, 500)

#----------------------------------- EXCEL DATA --------------------------------------

def create_and_write_to_excel(file_name, sheet_name, data):

"""

Creates an Excel file and writes data to it.

Args:

file_name (str): The name of the Excel file (e.g., 'output.xlsx').

sheet_name (str): The name of the sheet in the Excel file.

data (list of dict): List of dictionaries where keys are column headers and values are row data.

"""

# Check if the data is empty

if not data:

print(f"No data to write for sheet '{sheet_name}'. Skipping Excel file creation.")

return

# Create a new workbook

wb = openpyxl.Workbook()

sheet = wb.active

sheet.title = sheet_name

# Add headers

headers = list(data[0].keys())

for col_num, header in enumerate(headers, 1):

cell = sheet.cell(row=1, column=col_num, value=header)

cell.font = Font(bold=True)

cell.alignment = Alignment(horizontal='center', vertical='center')

# Add rows

for row_num, row_data in enumerate(data, start=2):

for col_num, header in enumerate(headers, start=1):

sheet.cell(row=row_num, column=col_num, value=row_data[header])

# Adjust column widths

for col_num, header in enumerate(headers, start=1):

column_width = max(len(header), 15) # Minimum column width

sheet.column_dimensions[openpyxl.utils.get_column_letter(col_num)].width = column_width

# Save the file

wb.save(file_name)

print(f"Excel file '{file_name}' created and data written successfully.")

# Initialize orderbook for each stock in the watchlist

for name in watchlist:

orderbook[name] = {

'single_order': single_order.copy(),

'completed_orders': [] # Initialize as an empty list

}

# Process completed orders for each stock

for name in orderbook:

completed_orders = orderbook[name]['completed_orders']

if completed_orders: # Only process non-empty lists

create_and_write_to_excel(file_name='trade_log.xlsx', sheet_name='TradeLog', data=completed_orders)

else:

print(f"No completed orders for {name}. Skipping Excel creation.")

# ------------------------------- QTY FUNCTION ------------------------------

def calculate_trade_quantity(balance, risk_per_trade, stock_price):

risk_amount = balance * risk_per_trade

quantity = risk_amount // stock_price

return max(5, int(quantity))

# ------------------------------ MAIN ALGO ------------------------------

while True:

live_pnl = tsl.get_live_pnl()

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 30):

print(f"Wait for market to start Chetan", {str(current_time.time())[:8]})

time.sleep(1)

continue

if current_time > datetime.time(14, 45):

order_details = tsl.cancel_all_orders()

print(f"Market over Chetan. Closing all trades! Logging data to Excel. {str(current_time.time())[:8]}")

create_and_write_to_excel("trades.xlsx", "Trade Log", completed_orders)

break

if my_loss <= int(max_loss) and tsl.cancel_all_orders == "yes" and tsl.kill_switch == 'ON':

print("Max loss reached! Cancelling all orders and stopping trading.")

tsl.cancel_all_orders()

break

print("\n started while Loop \n")

all_ltp = tsl.get_ltp_data(names=watchlist)

for name in watchlist:

current_time = datetime.datetime.now()

print(f"Scanning {name} {str(current_time.time())[:8]}")

try:

chart_1 = tsl.get_historical_data(tradingsymbol=name.upper(),exchange='NSE',timeframe='5')

chart_1['upperband'], chart_1['middleband'], chart_1['lowerband'] = talib.BBANDS(chart_1['close'], timeperiod=20, nbdevup=1.5, nbdevdn=1.5, matype=0)

# Define index for the latest candle

index = len(chart_1) - 1 # Last index in the DataFrame

# Reference the latest two candles (previous and current)

alert_candle = chart_1.iloc[index - 1] # Second last candle (previous candle)

letest_candle = chart_1.iloc[index] # Last candle (current candle)

# BUY ENTRY CONDITION

bc1 = alert_candle['close'] < alert_candle['lowerband']

bc6 = orderbook[name]['traded'] is None

# SELL ENTRY CONDITION

sc1 = alert_candle['close'] > alert_candle['upperband']

sc6 = orderbook[name]['traded'] is None

except Exception as e:

print(e)

continue

if bc1 and bc6:

print("buy ", name, "\t")

margin_available = tsl.get_balance()

margin_required = alert_candle['close'] / 5.0 # LEVERAGE AMOUNT

if margin_available < margin_required:

print(f"Less margin, not taking order: margin_available is {margin_available} and margin_required is {margin_required} for {name}")

continue

# Calculating the quantity to trade

stock_price = alert_candle['close'] # Use the close price of the alert candle as the stock price

risk_per_trade = 0.04 # Risk 4%

trade_quantity = calculate_trade_quantity(balance=margin_available, risk_per_trade=risk_per_trade, stock_price=stock_price)

orderbook[name]['name'] = name

orderbook[name]['date'] = str(current_time.date())

orderbook[name]['entry_time'] = str(current_time.time())[:8]

orderbook[name]['buy_sell'] = "BUY"

orderbook[name]['qty'] = trade_quantity

try:

entry_orderid = tsl.order_placement(

tradingsymbol=name,

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=0,

order_type='MARKET',

transaction_type='BUY',

trade_type='MIS'

)

orderbook[name]['entry_orderid'] = entry_orderid

orderbook[name]['entry_price'] = tsl.get_executed_price(orderid=orderbook[name]['entry_orderid'])

# Stop-loss and target calculations

stop_loss_amount = alert_candle['high'] - alert_candle['low']

stop_loss_price = orderbook[name]['entry_price'] - stop_loss_amount

target_profit_price = orderbook[name]['entry_price'] + (4 * stop_loss_amount)

orderbook[name]['sl'] = round(stop_loss_price, 2)

orderbook[name]['tg'] = round(target_profit_price, 2)

sl_orderid = tsl.order_placement(

tradingsymbol=name,

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=orderbook[name]['sl'],

order_type='STOPMARKET',

transaction_type='SELL',

trade_type='MIS'

)

orderbook[name]['sl_orderid'] = sl_orderid

orderbook[name]['traded'] = "yes"

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"Entry_done {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

max_open_positions += 1

except Exception as e:

print(e)

if orderbook[name]['traded'] == "yes":

bought = orderbook[name]['buy_sell'] == "BUY"

if bought:

try:

ltp = all_ltp[name]

sl_hit = tsl.get_order_status(orderid=orderbook[name]['sl_orderid']) == "TRADED"

tg_hit = ltp > orderbook[name]['tg']

except Exception as e:

print(e)

if sl_hit:

try:

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=orderbook[name]['sl_orderid'])

orderbook[name]['pnl'] = round((orderbook[name]['exit_price'] - orderbook[name]['entry_price']) * orderbook[name]['qty'], 1)

orderbook[name]['remark'] = "Bought_SL_hit"

# TELEGRAM MESSAGE

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"SL_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = single_order.copy()

except Exception as e:

print(e)

if tg_hit:

try:

tsl.cancel_order(OrderID=orderbook[name]['sl_orderid'])

time.sleep(2)

square_off_buy_order = tsl.order_placement(

tradingsymbol=orderbook[name]['name'],

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=0,

order_type='MARKET',

transaction_type='SELL',

trade_type='MIS'

)

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=square_off_buy_order)

orderbook[name]['pnl'] = (orderbook[name]['exit_price'] - orderbook[name]['entry_price']) * orderbook[name]['qty']

orderbook[name]['remark'] = "Bought_TG_hit"

# TELEGRAM MESSAGE

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"TG_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = single_order.copy()

play_sound()

except Exception as e:

print(e)

# SELL ENTRY LOGIC

elif sc1 and sc6:

print("sell ", name, "\t")

margin_available = tsl.get_balance()

margin_required = alert_candle['close'] / 5.0 # LEVERAGE AMOUNT

if margin_available < margin_required:

print(f"Less margin, not taking order: margin_available is {margin_available} and margin_required is {margin_required} for {name}")

continue

# Calculating the quantity to trade

stock_price = alert_candle['close'] # Use the close price of the alert candle as the stock price

risk_per_trade = 0.04 # Risk 4%

trade_quantity = calculate_trade_quantity(balance=margin_available, risk_per_trade=risk_per_trade, stock_price=stock_price)

orderbook[name]['name'] = name

orderbook[name]['date'] = str(current_time.date())

orderbook[name]['entry_time'] = str(current_time.time())[:8]

orderbook[name]['buy_sell'] = "SELL"

orderbook[name]['qty'] = trade_quantity

try:

entry_orderid = tsl.order_placement(

tradingsymbol=name,

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=0,

order_type='MARKET',

transaction_type='SELL',

trade_type='MIS'

)

orderbook[name]['entry_orderid'] = entry_orderid

orderbook[name]['entry_price'] = tsl.get_executed_price(orderid=orderbook[name]['entry_orderid'])

# Stop-loss and target calculations

stop_loss_amount = alert_candle['high'] - alert_candle['low']

stop_loss_price = orderbook[name]['entry_price'] + stop_loss_amount

target_profit_price = orderbook[name]['entry_price'] - (4 * stop_loss_amount)

orderbook[name]['sl'] = round(stop_loss_price, 2)

orderbook[name]['tg'] = round(target_profit_price, 2)

sl_orderid = tsl.order_placement(

tradingsymbol=name,

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=orderbook[name]['sl'],

order_type='STOPMARKET',

transaction_type='BUY',

trade_type='MIS'

)

orderbook[name]['sl_orderid'] = sl_orderid

orderbook[name]['traded'] = "yes"

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"Entry_done {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

max_open_positions += 1

except Exception as e:

print(e)

# Exit Logic for Sell Positions

if orderbook[name]['traded'] == "yes":

sold = orderbook[name]['buy_sell'] == "SELL"

if sold:

try:

ltp = all_ltp[name]

sl_hit = tsl.get_order_status(orderid=orderbook[name]['sl_orderid']) == "TRADED"

tg_hit = ltp < orderbook[name]['tg']

except Exception as e:

print(e)

if sl_hit:

try:

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=orderbook[name]['sl_orderid'])

orderbook[name]['pnl'] = round((orderbook[name]['entry_price'] - orderbook[name]['exit_price']) * orderbook[name]['qty'], 1)

orderbook[name]['remark'] = "Sold_SL_hit"

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"SL_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = single_order.copy()

except Exception as e:

print(e)

if tg_hit:

try:

tsl.cancel_order(OrderID=orderbook[name]['sl_orderid'])

time.sleep(2)

square_off_sell_order = tsl.order_placement(

tradingsymbol=orderbook[name]['name'],

exchange='NSE',

quantity=orderbook[name]['qty'],

price=0,

trigger_price=0,

order_type='MARKET',

transaction_type='BUY',

trade_type='MIS'

)

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=square_off_sell_order)

orderbook[name]['pnl'] = (orderbook[name]['entry_price'] - orderbook[name]['exit_price']) * orderbook[name]['qty']

orderbook[name]['remark'] = "Sold_TG_hit"

message = "\n".join(f"{key}: {repr(value)}" for key, value in orderbook[name].items())

message = f"TG_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message, receiver_chat_id=receiver_chat_id, bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = single_order.copy()

play_sound()

except Exception as e:

print(e)

Also Please @Tradehull_Imran Sir Do Check The Code Is It Completely Correct Or Not