Hi @Zee2Zahid @Subhajitpanja

Server deployment is added in todo-videos list

Use below code

import pandas_ta as ta

indi = ta.supertrend(df['high'], df['low'], df['close'], 7, 3)

df = pd.concat([df, indi], axis=1, join='inner')

print(df)

# 'Column1 = this will give full supertrend line values' trend

# 'Column2 = this will show if st is red or green' direction

# 'Column3 = show values only for green nan for red' long

# 'Column4 = show values only for red nan for green' short

Hi @Zee2Zahid

This is because we can call ltp data only once in 1 second, so we need to use sleep

check below code

for distance_from_atm in range(1,20):

time.sleep(1)

otm_ce_name, otm_pe_name, ce_OTM_strike, pe_OTM_strike = tsl.OTM_Strike_Selection('NIFTY','14-11-2024',3)

ce_ltp = tsl.get_ltp_data(names = otm_ce_name)

time.sleep(1)

pe_ltp = tsl.get_ltp_data(names = otm_pe_name)

print(distance_from_atm, otm_ce_name, ce_ltp)

print(distance_from_atm, otm_pe_name, pe_ltp)

print()

or

for distance_from_atm in range(1,20):

time.sleep(1)

otm_ce_name, otm_pe_name, ce_OTM_strike, pe_OTM_strike = tsl.OTM_Strike_Selection('NIFTY','14-11-2024',3)

ltp_data = tsl.get_ltp_data(names = [otm_ce_name, otm_pe_name])

ce_ltp = ltp_data[otm_ce_name]

pe_ltp = ltp_data[otm_pe_name]

print(distance_from_atm, otm_ce_name, ce_ltp)

print(distance_from_atm, otm_pe_name, pe_ltp)

print()

Hi @Vijen_Singh

This error is due to version mismatch

See below video, for codebase upgrade

@rahulcse56

what is the error you are getting

Hi @CapTn_Mohit

This is okey, I have left my test account api keys, in code.

- If no order is being placed, maybe one of the condition from ema_slope_downtrend , touch_ema_downtrend , no_repeat_order , max_order_limit is False for the entire duration.

so need to check it manually,

see below code

import pdb

from Dhan_Tradehull import Tradehull

import pandas as pd

import talib

import time

# Trading API client setup

client_code = ""

token_id = ""

tsl = Tradehull(client_code, token_id)

# Intraday strategy parameters

available_balance = tsl.get_balance()

leveraged_margin = available_balance * 5 # 5x leverage

max_trades = 1

per_trade_margin = leveraged_margin / max_trades # Amount for each trade

# Watchlist

watchlist = ['NBCC', 'RVNL', 'IFCI', 'HUDCO', 'MAZDOCK', 'INOXWIND', 'ZEEL', 'BSE', 'MMTC', 'ITI', 'BEML', 'SUZLON', 'HINDCOPPER', 'RELIANCE']

traded_watchlist = []

# Function to calculate 69 EMA and check for trend (uptrend/downtrend)

def check_trend_and_touch_ema(chart):

# Calculate 69 EMA for the chart

chart['69ema'] = talib.EMA(chart['close'], timeperiod=69)

# Get the last 4 EMA values for slope detection

ema_values = chart['69ema'].iloc[-4:].values # Last 4 EMA values

ema_slope_uptrend = all(ema_values[i] < ema_values[i+1] for i in range(3)) # Uptrend condition

ema_slope_downtrend = all(ema_values[i] > ema_values[i+1] for i in range(3)) # Downtrend condition

# Get the most recent candle (breakout candle)

bc = chart.iloc[-2] # Breakout candle

# Check if any part of the candle touches the 69 EMA (either body or wick)

touch_ema_uptrend = (bc['high'] >= bc['69ema'] >= bc['low']) or (bc['close'] >= bc['69ema'] >= bc['open'])

touch_ema_downtrend = (bc['high'] >= bc['69ema'] >= bc['low']) or (bc['close'] <= bc['69ema'] <= bc['open'])

return ema_slope_uptrend, ema_slope_downtrend, touch_ema_uptrend, touch_ema_downtrend, bc

# Main loop for the strategy

while True:

for stock_name in watchlist:

print(f"Processing {stock_name}…")

# Fetch intraday data for the stock (1-minute candles)

chart = tsl.get_intraday_data(stock_name, 'NSE', 15) # Fetch 1-minute candles

if chart is None or chart.empty:

print(f"No data retrieved for {stock_name}. Skipping...")

continue

# Check trend and EMA touch conditions

try:

ema_slope_uptrend, ema_slope_downtrend, touch_ema_uptrend, touch_ema_downtrend, bc = check_trend_and_touch_ema(chart)

print(f"{stock_name} - 69 EMA values: {chart['69ema'].iloc[-4:]}")

print(f"Uptrend: {ema_slope_uptrend}, Downtrend: {ema_slope_downtrend}")

print(f"Touch EMA Uptrend: {touch_ema_uptrend}, Touch EMA Downtrend: {touch_ema_downtrend}")

except Exception as e:

print(f"Error processing {stock_name}: {e}")

continue

# Ensure there is enough data for trend analysis

if len(chart) < 4:

print(f"Not enough data for {stock_name}. Skipping...")

continue

# Check for trade conditions

no_repeat_order = stock_name not in traded_watchlist

max_order_limit = len(traded_watchlist) < max_trades # Ensure we don't exceed max trades

# Calculate quantity to trade based on the available margin

qty = int(per_trade_margin / bc['close']) # Quantity based on the price of the stock

# Assuming you already have the correct logic in place for determining uptrend/downtrend

# and the other conditions for placing orders.

# Example when placing a sell order (if conditions for downtrend and touch EMA are met)

current_time = datetime.datetime.now()

print(current_time, ema_slope_downtrend , touch_ema_downtrend , no_repeat_order , max_order_limit)

if ema_slope_downtrend and touch_ema_downtrend and no_repeat_order and max_order_limit:

print(f"Placing sell order for {stock_name} - Quantity: {qty}")

trigger_price = 0 # For a market order, trigger price might not be needed

tsl.order_placement(stock_name, 'NSE', qty, 1, 0, 'MARKET', 'BUY', 'MIS')

traded_watchlist.append(stock_name)

time.sleep(10) # Sleep to prevent hitting API rate limits

# Example when placing a buy order (if conditions for uptrend and touch EMA are met)

if ema_slope_uptrend and touch_ema_uptrend and no_repeat_order and max_order_limit:

print(f"Placing buy order for {stock_name} - Quantity: {qty}")

trigger_price = 0 # For a market order, trigger price might not be needed

tsl.order_placement(stock_name, 'NSE', qty, 1, 0, 'MARKET', 'SELL', 'MIS')

traded_watchlist.append(stock_name)

time.sleep(10) # Sleep to prevent hitting API rate limits

time.sleep(10) # Sleep between each watchlist check

-

Dhanhq 1.3.2 gives data for today only, so maybe it did not had enough data to process for signals

use Dhan_Tradehull_V2 to solve it

see : Learn Algo Trading with Python | Codes | Youtube Series - #631 by Tradehull_Imran -

SL orders are covered in Session8 , multitimeframe algo

sl_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, sl_price, 'STOPMARKET', 'SELL', 'MIS')

@Tradehull_Imran mene upgrade kr liya hai

ijjus-MacBook-Air:8. Session8- 2nd Live Algo vijju$ /usr/local/bin/python3.10 “/Users/vijju/Desktop/Stock Algo/Dhan Algo/8. Session8- 2nd Live Algo/2nd live Algo/Multi timeframe Algo.py”

Mibian requires scipy to work properly

-----Logged into Dhan-----

This BOT Is Picking New File From Dhan

Got the instrument file

step Value DF is not generated due to Error from NSE India site: Missing optional dependency ‘xlrd’. Install xlrd >= 2.0.1 for xls Excel support Use pip or conda to install xlrd.

Collecting step values from program memory.

MOTHERSON

dhanhq.intraday_minute_data() takes 4 positional arguments but 7 were given

Traceback (most recent call last):

File “/Users/vijju/Desktop/Stock Algo/Dhan Algo/8. Session8- 2nd Live Algo/2nd live Algo/Dhan_Tradehull_V2.py”, line 257, in get_historical_data

ohlc = self.Dhan.intraday_minute_data(str(security_id),exchange_segment,instrument_type,self.start_date,self.end_date,int(interval))

TypeError: dhanhq.intraday_minute_data() takes 4 positional arguments but 7 were given

Traceback (most recent call last):

File “/Users/vijju/Desktop/Stock Algo/Dhan Algo/8. Session8- 2nd Live Algo/2nd live Algo/Multi timeframe Algo.py”, line 58, in

chart_1[‘rsi’] = talib.RSI(chart_1[‘close’], timeperiod=14) #pandas

TypeError: ‘NoneType’ object is not subscriptable

vijjus-MacBook-Air:8. Session8- 2nd Live Algo vijju$ pip3 show dhanhq

Name: dhanhq

Version: 2.0.1

Summary: The official Python client for communicating with the DhanHQ API

Home-page: https://dhanhq.co/

Author: Dhan

Author-email: dhan-oss@dhan.co

License: MIT LICENSE

Location: /Users/vijju/Library/Python/3.9/lib/python/site-packages

Requires: pandas, pyOpenSSL, requests, websockets

Required-by:

vijjus-MacBook-Air:8. Session8- 2nd Live Algo vijju$

mera version 2.0.1 aa rha hai fir bhi error aa rhi hai

Hi @rahulcse56

2 min timeframe is not supported as of now, below are the supported timeframes

Timeframe:

1 - 1 minute

5 - 5 minutes

15 - 15 minutes

25 - 25 minutes

60 - 60 minutes

DAY - DAY

However you could resample 1 min data to get 2 min candles

https://pandas.pydata.org/docs/reference/api/pandas.Series.resample.html

Hi @Vijen_Singh

try below code, and run again

pip install dhanhq==2.0.0

if it still not works after that

-

Send me code in formatted way : see : Learn Algo Trading with Python | Codes | Youtube Series - #368 by Tradehull_Imran

-

Also resend me pip show dhanhq

-

and the error in formatted way

dhanhq has been updated to 2.0.1, maybe thats creating some issue

Great Sir, Its working now, God bless you…Thank You

Hi @Vijen_Singh

I got your formatted code and error on : Youtube session 8

I tried the same code on my end,

The issue is in client_code or token_id, check if token is not expired and is correct.

Also do let me know, if it works after that

Hi @Tradehull_Imran

Sir ,on entering my credentials in the file , I’m unable to fetch available balance.

@Tradehull_Imran still not working

below my pip3 show danhq

vijjus-MacBook-Air:1. Api Upgrade vijju$ pip3 show dhanhq

Name: dhanhq

Version: 2.0.0

Summary: The official Python client for communicating with the DhanHQ API

Home-page: https://dhanhq.co/

Author: Dhan

Author-email: dhan-oss@dhan.co

License: MIT LICENSE

Location: /Users/vijju/Library/Python/3.9/lib/python/site-packages

Requires: pandas, pyOpenSSL, requests, websockets

Required-by:

vijjus-MacBook-Air:1. Api Upgrade vijju$

I am getting error

vijjus-MacBook-Air:8. Session8- 2nd Live Algo vijju$ /usr/local/bin/python3.10 "/Users/vijju/Desktop/Stock Algo/Dhan Algo/8. Session8- 2nd Live Algo/2nd live Algo/Multi timeframe Algo.py"

Mibian requires scipy to work properly

-----Logged into Dhan-----

This BOT Is Picking New File From Dhan

Got the instrument file

step Value DF is not generated due to Error from NSE India site: Missing optional dependency 'xlrd'. Install xlrd >= 2.0.1 for xls Excel support Use pip or conda to install xlrd.

Collecting step values from program memory.

MOTHERSON

dhanhq.intraday_minute_data() takes 4 positional arguments but 7 were given

Traceback (most recent call last):

File "/Users/vijju/Desktop/Stock Algo/Dhan Algo/8. Session8- 2nd Live Algo/2nd live Algo/Dhan_Tradehull_V2.py", line 296, in get_intraday_data

ohlc = self.Dhan.intraday_minute_data(str(security_id),exchange_segment,instrument_type,start_date,end_date,int(1))

TypeError: dhanhq.intraday_minute_data() takes 4 positional arguments but 7 were given

Traceback (most recent call last):

File "/Users/vijju/Desktop/Stock Algo/Dhan Algo/8. Session8- 2nd Live Algo/2nd live Algo/Multi timeframe Algo.py", line 58, in <module>

chart_1['rsi'] = talib.RSI(chart_1['close'], timeperiod=14) #pandas

TypeError: 'NoneType' object is not subscriptable

vijjus-MacBook-Air:8. Session8- 2nd Live Algo vijju$

And my code is

# https://ta-lib.github.io/ta-lib-python/

# https://www.notion.so/TradeHull-Dhan-Codebase-76b32fa814e64aea843e14a148854214#efa40986725341e6bfa9ad6fcfc10a6d

import pdb

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

import talib

import time

import datetime

client_code = "1101529493"

token_id = "eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzMxNzcxMDU4LCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTEwMTUyOTQ5MyJ9.Oo3_dwF1lGkiSenKu-XdpsMZIav5og-BK2CxzuTPyaAZGyUMDJEb_lCaTOLXwydfeeXbwzeKRs3pHXhlosKGGQ"

tsl = Tradehull(client_code,token_id) # tradehull_support_library

available_balance = tsl.get_balance()

leveraged_margin = available_balance*5

max_trades = 3

per_trade_margin = (leveraged_margin/max_trades)

max_loss = (available_balance*1)/100*-1

watchlist = ['MOTHERSON', 'OFSS', 'MANAPPURAM', 'BSOFT', 'CHAMBLFERT', 'DIXON', 'NATIONALUM', 'DLF', 'IDEA', 'ADANIPORTS', 'SAIL', 'HINDCOPPER', 'INDIGO', 'RECLTD', 'PNB', 'HINDALCO', 'RBLBANK', 'GNFC', 'ALKEM', 'CONCOR', 'PFC', 'GODREJPROP', 'MARUTI', 'ADANIENT', 'ONGC', 'CANBK', 'OBEROIRLTY', 'BANDHANBNK', 'SBIN', 'HINDPETRO', 'CANFINHOME', 'TATAMOTORS', 'LALPATHLAB', 'MCX', 'TATACHEM', 'BHARTIARTL', 'INDIAMART', 'LUPIN', 'INDUSTOWER', 'VEDL', 'SHRIRAMFIN', 'POLYCAB', 'WIPRO', 'UBL', 'SRF', 'BHARATFORG', 'GRASIM', 'IEX', 'BATAINDIA', 'AARTIIND', 'TATASTEEL', 'UPL', 'HDFCBANK', 'LTF', 'TVSMOTOR', 'GMRINFRA', 'IOC', 'ABCAPITAL', 'ACC', 'IDFCFIRSTB', 'ABFRL', 'ZYDUSLIFE', 'GLENMARK', 'TATAPOWER', 'PEL', 'IDFC', 'LAURUSLABS', 'BANKBARODA', 'KOTAKBANK', 'CUB', 'GAIL', 'DABUR', 'TECHM', 'CHOLAFIN', 'BEL', 'SYNGENE', 'FEDERALBNK', 'NAVINFLUOR', 'AXISBANK', 'LT', 'ICICIGI', 'EXIDEIND', 'TATACOMM', 'RELIANCE', 'ICICIPRULI', 'IPCALAB', 'AUBANK', 'INDIACEM', 'GRANULES', 'HDFCAMC', 'COFORGE', 'LICHSGFIN', 'BAJAJFINSV', 'INFY', 'BRITANNIA', 'M&MFIN', 'BAJFINANCE', 'PIIND', 'DEEPAKNTR', 'SHREECEM', 'INDUSINDBK', 'DRREDDY', 'TCS', 'BPCL', 'PETRONET', 'NAUKRI', 'JSWSTEEL', 'MUTHOOTFIN', 'CUMMINSIND', 'CROMPTON', 'M&M', 'GODREJCP', 'IGL', 'BAJAJ-AUTO', 'HEROMOTOCO', 'AMBUJACEM', 'BIOCON', 'ULTRACEMCO', 'VOLTAS', 'BALRAMCHIN', 'SUNPHARMA', 'ASIANPAINT', 'COALINDIA', 'SUNTV', 'EICHERMOT', 'ESCORTS', 'HAL', 'ASTRAL', 'NMDC', 'ICICIBANK', 'TORNTPHARM', 'JUBLFOOD', 'METROPOLIS', 'RAMCOCEM', 'INDHOTEL', 'HINDUNILVR', 'TRENT', 'TITAN', 'JKCEMENT', 'ASHOKLEY', 'SBICARD', 'BERGEPAINT', 'JINDALSTEL', 'MFSL', 'BHEL', 'NESTLEIND', 'HDFCLIFE', 'COROMANDEL', 'DIVISLAB', 'ITC', 'TATACONSUM', 'APOLLOTYRE', 'AUROPHARMA', 'HCLTECH', 'LTTS', 'BALKRISIND', 'DALBHARAT', 'APOLLOHOSP', 'ABBOTINDIA', 'ATUL', 'UNITDSPR', 'PVRINOX', 'SIEMENS', 'SBILIFE', 'IRCTC', 'GUJGASLTD', 'BOSCHLTD', 'NTPC', 'POWERGRID', 'MARICO', 'HAVELLS', 'MPHASIS', 'COLPAL', 'CIPLA', 'MGL', 'ABB', 'PIDILITIND', 'MRF', 'LTIM', 'PAGEIND', 'PERSISTENT']

# watchlist = ['CRUDEOIL']

traded_wathclist = []

while True:

live_pnl = tsl.get_live_pnl()

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 30):

print("wait for market to start", current_time)

continue

if (current_time > datetime.time(15, 15)) or (live_pnl < max_loss):

I_want_to_trade_no_more = tsl.kill_switch('ON')

order_details = tsl.cancel_all_orders()

print("Market is over, Bye Bye see you tomorrow", current_time)

break

for stock_name in watchlist:

time.sleep(0.2)

print(stock_name)

# Conditions that are on 1 minute timeframe

chart_1 = tsl.get_intraday_data(stock_name, 'NSE', 1) # 1 minute chart # this call has been updated to get_historical_data call,

# chart_1 = tsl.get_historical_data(tradingsymbol = stock_name,exchange = 'NSE',timeframe="1")

chart_1['rsi'] = talib.RSI(chart_1['close'], timeperiod=14) #pandas

cc_1 = chart_1.iloc[-2] #pandas completed candle of 1 min timeframe

uptrend = cc_1['rsi'] > 50

# downtrend = cc_1['rsi'] < 49

# Conditions that are on 5 minute timeframe

chart_5 = tsl.get_intraday_data(stock_name, 'NSE', 5) # 5 minute chart

# chart_5 = tsl.get_historical_data(tradingsymbol = stock_name,exchange = 'NSE',timeframe="5") # this call has been updated to get_historical_data call,

chart_5['upperband'], chart_5['middleband'], chart_5['lowerband'] = talib.BBANDS(chart_5['close'], timeperiod=5, nbdevup=2, nbdevdn=2, matype=0)

cc_5 = chart_5.iloc[-1] # pandas

ub_breakout = cc_5['high'] > cc_5['upperband']

# lb_breakout = cc_5['low'] < cc_5['lowerband']

no_repeat_order = stock_name not in traded_wathclist

max_order_limit = len(traded_wathclist) <= max_trades

if uptrend and ub_breakout and no_repeat_order and max_order_limit:

print(stock_name, "is in uptrend, Buy this script")

sl_price = round((cc_1['close']*0.98),1)

qty = int(per_trade_margin/cc_1['close'])

buy_entry_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, 0, 'MARKET', 'BUY', 'MIS')

sl_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, sl_price, 'STOPMARKET', 'SELL', 'MIS')

traded_wathclist.append(stock_name)

# if downtrend and lb_breakout and no_repeat_order and max_order_limit:

# print(stock_name, "is in downtrend, Sell this script")

# sl_price = round((cc_1['close']*1.02),1)

# qty = int(per_trade_margin/cc_1['close'])

# buy_entry_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, 0, 'MARKET', 'SELL', 'MIS')

# sl_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, sl_price, 'STOPMARKET', 'BUY', 'MIS')

# traded_wathclist.append(stock_name)

I tried both ways

chart_1 = tsl.get_intraday_data(stock_name, 'NSE', 1) # 1 minute chart # this call has been updated to get_historical_data call,

And

# chart_1 = tsl.get_historical_data(tradingsymbol = stock_name,exchange = 'NSE',timeframe="1")

both are getting same error

not able to extract 2 min intraday historical data

-----Logged into Dhan-----

reading existing file all_instrument 2024-11-08.csv

Got the instrument file

DataFrame constructor not properly called!

Traceback (most recent call last):

File “C:\Python\Dhan API Python\BUY_SELL ALGO\Dhan_Tradehull_V2.py”, line 259, in get_historical_data

df = pd.DataFrame(ohlc[‘data’])

File “C:\Users\AppData\Local\Programs\Python\Python38\lib\site-packages\pandas\core\frame.py”, line 817, in init

raise ValueError(“DataFrame constructor not properly called!”)

ValueError: DataFrame constructor not properly called!

Sir, I have a few doubts about my Algo strategy.

1, How to know the Stock’s current month’s future in Long Build-up or Short build-up?

2, How to know the Stock’s most traded/liquid Call or Put option? (I think adding Volume + Open Interest from ITM 6 to OTM 6, an option with most Vol+OI is liquid enough to Buy.

Or any other Method to find the most liquid Option?)

3, How to know the option’s Volume and Open Interest?

4, If applying an indicator with 14 periods on Intraday data at 9:15, how can

the indicator calculates accurate data when data starts at 9:15 today.

5, How to get previous day data for stock in 5 minute time frame?

6, code for trailing Stop Loss.

Code for the above would be helpful

Thanks a lot for the people and their hard work behind this Algo trading series!!!

Hi, sir… Thank you for your support…

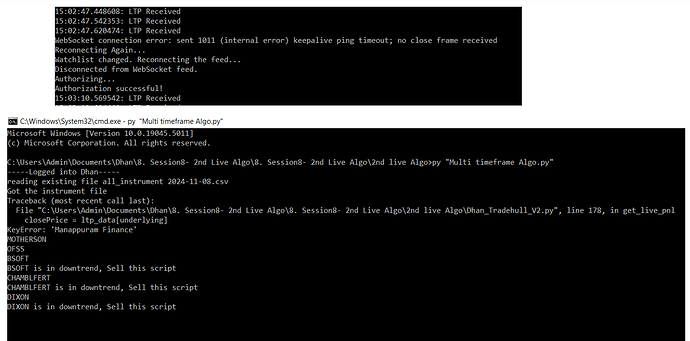

After downloding the websocket_v2 and Multi timeframe Algo, I am getting this Error , but orders got placed in my account…

Any big issue with this errors ?

I have screenshot only.

Please check and reply, sir…

Hi i have done this. I happend to download the certifi certifi-2024.8.30-py3-none-any.whl from one of links mentioned in one of the posts. I then went to that folder and did “pip install certifi” and also “pip install certifi --upgrade”

output is:

C:\Users\rando\Downloads>pip install certifi-2024.8.30-py3-none-any.whl

Defaulting to user installation because normal site-packages is not writeable

Processing c:\users\rando\downloads\certifi-2024.8.30-py3-none-any.whl

certifi is already installed with the same version as the provided wheel. Use --force-reinstall to force an installation of the wheel.

C:\Users\rando\Downloads>pip install certifi --upgrade

Defaulting to user installation because normal site-packages is not writeable

Requirement already satisfied: certifi in c:\users\rando\appdata\local\packages\pythonsoftwarefoundation.python.3.12_qbz5n2kfra8p0\localcache\local-packages\python312\site-packages (2024.8.30)

but it says requirement already satisfied but still i keep getting [SSL: CERTIFICATE_VERIFY_FAILED] certificate verify failed: unable to get local issuer certificate (_ssl.c:1000) error when i try to use the marketfeed Apis. what is the issue plz? does the certifi have to installed in some particular folder? (windows machine btw)

Dear imran sir

Many problems are solved in V2

But still need deep dive session needed in V2

Thanks for the V2

means algo by dhan is not free