HI

@Tradehull_Imran

How can we run 2 strategy in a window

-

yes the calculations are okey,

just for a correction point

The data api per day limit is 10000.

7000 is the per day limit for order Api’s. -

In case you have two family account with both data api subscription the method you are suggesting will work. no issues in that.

Hi @Himansshu_Joshi

I am not clear on your error, do share complete error

Also on a high level guess

It seems hat your are sending below command on pdb

& C:/Users/DELL/AppData/Local/Programs/Python/Python38/python.exe "C:/Users/DELL/Downloads/2. 2 Candle Theory Algo/2. 2 candle theory Algo/2. 2 candle theory Algo - Both Side Pseudocode.py"

which will give syntax error

trying to send below command on pdb

print(index_chart)

Thanks for the reply… please share the link of the files… i am not able to find the link.

Yes sir @Tradehull_Imran and thank you to correct me.

Hi @Dhan, @Hardik @RahulDeshpande

As algo developer/user we need strategy which should work as seamless process, maybe in a sever too.

If I am a commodity trader then it’s very difficult go with this daily 10000 data api limit.

And one person required atleast two three strategy which they can use. But with this daily 10000 data api limit, it’s almost…

Hope @Dhan team will look into this matter🙏

Hi @rahulcse56

Session 9 Code files

Session 9 was recorded in first week of Aug, till then Dhanhq used WebSocket method to get ltp

Dhan_Tradehull_V2 was created a lot later on

As of now we don’t need to use WebSocket ,

the Session 9 Code files I have shared are updated to match with Dhan_Tradehull_V2

Hi @Shiv_Kumar

Now we have moved to a easier method

Check this link : Learn Algo Trading with Python | Codes | Youtube Series - #952 by Tradehull_Imran

Thanks a ton

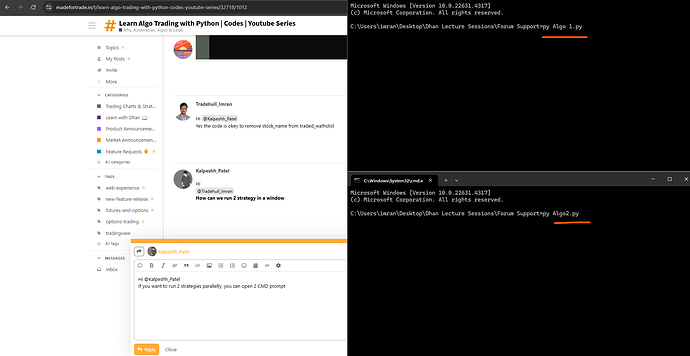

Hi @Kalpeshh_Patel

If you want to run 2 strategies parallelly, you can open 2 CMD prompt

like this one

Also do note

-

If 2 strategies are running parallelly then the API will be used by both of them, which will essentially half the rate limits for each algo

-

Also both the algo will use CPU AND RAM, so we need to monitor in Task Manager that we have enough capacity to run both the strategies paralelly.

Hi

@Tradehull_Imran

there are some common data charts to import

Can we merge those both algo strategy in to one

So Data API usage count can reduce

@Tradehull_Imran sir please ![]() don’t consider as silly question this one.

don’t consider as silly question this one.

suppose we have implemented one algo strategy properly with your guidance

Which will take entry properly but before exit data api limit exceeded. Then ![]()

When you will build tick by tick strategy please do consider to create notification /alert something which will confirm us how many data api usage are left for the day ![]()

Hello @Tradehull_Imran

i want to add few more points, please enable telegram alerts in the algo so that we get notification for any order execution through algo, also let us know how to do cloud deployment of this algo so that we dont need to worry about execute the algo on daily 9:15am.

Thanks in advance

Is it possible or is there a way to backtest the algo for last 6 months period if the algo uses 5 min & daily time frame, asking as dhan provides 5min data for last 3-4 days only.

@Tradehull_Imran excel not getting automatic data from dhan through api

Tag to sir

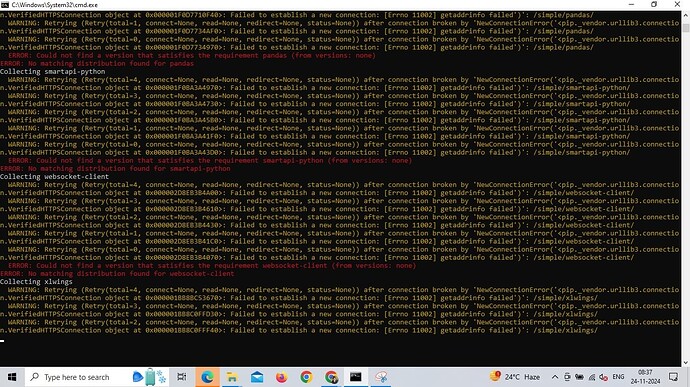

While installing “install Libraries” in personal laptop, I am getting the following error ![]()

ERROR: Could not find a version that satisfies the requirement dhanhq (from versions: none)

ERROR: No matching distribution found for dhanhq

Can You plesase help me to add one more condition for sl and tgt

=>

Cond1 - sl_hit = index_ltp > trade_info[‘sl’]

Cond2 to add----> If LTP traded on (order price + 20%) then sl price update to orderprice

Cond3 - tg_hit = index_ltp < running_candle[‘SUPERT_10_2.0’]

if long_position:

sl_hit = index_ltp < trade_info['sl']

tg_hit = index_ltp < running_candle['SUPERT_10_2.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

I tried for that following codes

Please verify

if traded == “yes”:

long_position = trade_info['CE_PE'] == "CE"

short_position = trade_info['CE_PE'] == "PE"

if long_position:

sl_hit = index_ltp < trade_info['sl']

if chart_15['close'].iloc[-1] > order_price*1.20:

sl_hit = order_price

tg_hit = index_ltp < cc5_2['SUPERT_10_3.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

Sir If you don’t mind can you please solve my issue with BFO.

Well, @Hardik would be the best person to address whether we’re planning to increase the rate limit. However, it’s encouraging to see that users are keen on this feature— we have noted it down.

That said, increasing the rate limit involves a lot of behind-the-scenes work. Our current system architecture would require significant changes to accommodate this, so it’s not a straightforward task.

We appreciate your interest and suggestions—please keep them coming!

Have you already uploaded code for two candle strategy?