[Errno 2] No such file or directory

You have suggested a good method.

yes it can be done, we can use any common database/pickle/HDF5 and send our data frame to it.

both algo strategy can read from the same source.

Hi @Subhajitpanja

Yes it seems rate limits can create issues, specially if you are working with commodity.

I will take this point in next video on how to manage rate limits.

Hi @rahulcse56

Added the same. ![]()

Hi @Aijaz_Ahmad

Yes Backtesting it possible, however historical data seems to be a challenge as of now.

@Hardik @RahulDeshpande

Please add in roadmap.

Hi @info_mail

Do check this link : Learn Algo Trading with Python | Codes | Youtube Series - #952 by Tradehull_Imran

It seems a network issue. PIP was not able to connect to download libraries required

Check if you are not behind a firewall or proxy.

If its a office laptop then it may have those restrictions.

2 candle Theory code files : 2. 2 Candle Theory Algo.zip - Google Drive

Do post your question if you are having any confusion.

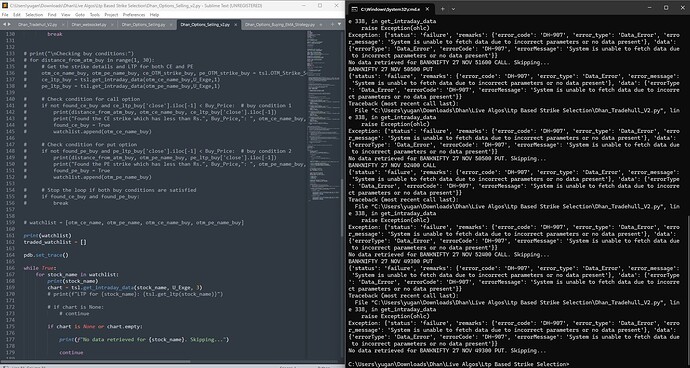

use below pseudocode,

It will move SL to Entry price after options has moved up by 20%

we needed to make changes in trade_info also,

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as pta

import pandas_ta as ta

import warnings

warnings.filterwarnings("ignore")

# ---------------for dhan login ----------------

client_code = "client_code"

token_id = "token_id"

tsl = Tradehull(client_code,token_id)

traded = "no"

trade_info = {"options_name":None, "qty":None, "sl":None, "CE_PE":None, "entry_price":None , "Trailed":None}

while True:

current_time = datetime.datetime.now()

index_chart = tsl.get_historical_data(tradingsymbol='NIFTY NOV FUT', exchange='NFO', timeframe="1")

time.sleep(3)

index_ltp = tsl.get_ltp_data(names = ['NIFTY NOV FUT'])['NIFTY NOV FUT']

if (index_chart == None):

time.sleep(60)

continue

# rsi ------------------------ apply indicators

index_chart['rsi'] = talib.RSI(index_chart['close'], timeperiod=14)

# vwap

index_chart.set_index(pd.DatetimeIndex(index_chart['timestamp']), inplace=True)

index_chart['vwap'] = pta.vwap(index_chart['high'] , index_chart['low'], index_chart['close'] , index_chart['volume'])

# Supertrend

indi = ta.supertrend(index_chart['high'], index_chart['low'], index_chart['close'], 10, 2)

index_chart = pd.concat([index_chart, indi], axis=1, join='inner')

# vwma

index_chart['pv'] = index_chart['close'] * index_chart['volume']

index_chart['vwma'] = index_chart['pv'].rolling(20).mean() / index_chart['volume'].rolling(20).mean()

# volume

volume = 50000

first_candle = index_chart.iloc[-3]

second_candle = index_chart.iloc[-2]

running_candle = index_chart.iloc[-1]

# ---------------------------- BUY ENTRY CONDITIONS ----------------------------

bc1 = first_candle['close'] > first_candle['vwap'] # First Candle close is above VWAP

bc2 = first_candle['close'] > first_candle['SUPERT_10_2.0'] # First Candle close is above Supertrend

bc3 = first_candle['close'] > first_candle['vwma'] # First Candle close is above VWMA

bc4 = first_candle['rsi'] < 80 # First candle RSI < 80

bc5 = second_candle['volume'] > 50000 # Second candle Volume should be greater than 50,000 for Nifty and above 125,000 for Bank Nifty

bc6 = traded == "no"

bc7 = index_ltp > first_candle['low']

print(f"BUY \t {current_time} \t {bc1} \t {bc2} \t {bc3} \t {bc4} \t {bc5} \t {bc7} \t first_candle {str(first_candle['timestamp'].time())}")

# ---------------------------- SELL ENTRY CONDITIONS ----------------------------

sc1 = first_candle['close'] < first_candle['vwap'] # First Candle close is below VWAP

sc2 = first_candle['close'] < first_candle['SUPERT_10_2.0'] # First Candle close is below Supertrend

sc3 = first_candle['close'] < first_candle['vwma'] # First Candle close is below VWMA

sc4 = first_candle['rsi'] > 20 # First candle RSI < 80

sc5 = second_candle['volume'] > 50000 # Second candle Volume should be greater than 50,000 for Nifty and above 125,000 for Bank Nifty

sc6 = traded == "no"

sc7 = index_ltp < first_candle['high']

print(f"SELL \t {current_time} \t {sc1} \t {sc2} \t {sc3} \t {sc4} \t {sc5} \t {sc7} \t first_candle {str(first_candle['timestamp'].time())} \n")

if bc1 and bc2 and bc3 and bc4 and bc5 and bc6 and bc7:

print("Sell Signal Formed")

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying ='NIFTY',Expiry ='28-11-2024')

lot_size = tsl.get_lot_size(ce_name)*1

entry_orderid = tsl.order_placement(ce_name,'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

traded = "yes"

trade_info['options_name'] = ce_name

trade_info['qty'] = lot_size

trade_info['sl'] = first_candle['low']

trade_info['CE_PE'] = "CE"

time.sleep(1)

trade_info['entry_price'] = tsl.get_executed_price(orderid=trade_info['entry_orderid'])

if sc1 and sc2 and sc3 and sc4 and sc5 and sc6 and sc7:

print("Sell Signal Formed")

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying ='NIFTY',Expiry ='28-11-2024')

lot_size = tsl.get_lot_size(pe_name)*1

entry_orderid = tsl.order_placement(pe_name,'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

traded = "yes"

trade_info['options_name'] = pe_name

trade_info['qty'] = lot_size

trade_info['sl'] = first_candle['high']

trade_info['CE_PE'] = "PE"

# ---------------------------- check for exit SL/TG

if traded == "yes":

long_position = trade_info['CE_PE'] == "CE"

short_position = trade_info['CE_PE'] == "PE"

if long_position:

price_has_moved_20_pct = ltp > (trade_info['entry_price'])*1.2

position_has_not_been_trailed = trade_info['Trailed'] is None

if price_has_moved_20_pct and position_has_not_been_trailed:

trade_info['sl'] = trade_info['entry_price']

trade_info['Trailed'] = "yes_I_have_trailed"

sl_hit = index_ltp < trade_info['sl']

tg_hit = index_ltp < running_candle['SUPERT_10_2.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

pdb.set_trace()

if short_position:

sl_hit = index_ltp > trade_info['sl']

tg_hit = index_ltp > running_candle['SUPERT_10_2.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

pdb.set_trace()

# trade_info = {

# 'CE_PE': 'PE',

# 'options_name': 'NIFTY 21 NOV 23350 PUT',

# 'qty': 25,

# 'sl': 23357.95

# }

Hi @Naga_Rajesh_K

Sure will take it up on Monday.

Hi @thakurmhn

Link : Learn Algo Trading with Python | Codes | Youtube Series - #1041 by Tradehull_Imran

Do send complete error screenshot.

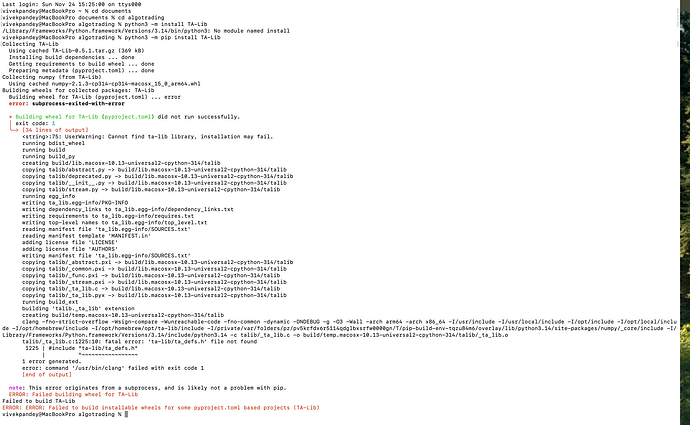

Hi, @Tradehull_Imran ,

Good Day!

I wanted to check if you have setup available for macOS?

do check this link : TA-Lib

and this one : How do I install TA-lib in python 3 in Mac OS High Sierra? - Stack Overflow

Thanks Imran.

I have tried again to execute that Library and it worked.

Hi @Tradehull_Imran,

Can you please share the backtest code in the meantime.

Hi @Tradehull_Imran,

When I am running the algo on weekend/holidays or after market hours, chart = tsl.get_intraday_data(stock_name, U_Exge, 3) function is throwing error so is there any possibility to get this data from the last traded day’s pricing data with this function.

How to Solve error

if (index_chart == None):

time.sleep(60)

continue

C:\Algo Practice\Session 8>py “2 candle theory Algo - Both Side Pseudocode V2.py”

File “2 candle theory Algo - Both Side Pseudocode V2.py”, line 37

if (index_chart == None):

^

SyntaxError: invalid syntax

Hi

@Tradehull_Imran

I applied the code

Trade is execute but sl error

C:\Algo Practice\Session 8>py “RSI Option V2.py”

Codebase Version 2.1

-----Logged into Dhan-----

reading existing file all_instrument 2024-11-25.csv

Got the instrument file

available_balance 275667.47

BUY 09:55:23.121570 True False False cc_1 09:45:00

SELL 09:55:23.121570 True True True cc_1 09:45:00

NIFTY NOV FUT Buy PUT

Traceback (most recent call last):

File “RSI Option V2.py”, line 146, in

price_has_moved_20_pct = ltp > (trade_info[‘entry_price’])*1.2

NameError: name ‘ltp’ is not defined

Please do correction