Hi @Tradehull_Imran , Sir.

Upon your teaching and your guidance, I have Completed my Algo, I am getting small errors while exiting the Trade, sir.

Please go through the Algo , and help me , Sir..

My Algo is

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as pta

import pandas_ta as ta

import warnings

warnings.filterwarnings("ignore")

#-----------------------------------------------------------------------------------

client_code = "11"

token_id = "11"

tsl = Tradehull(client_code,token_id)

#----------------------------------------------------------------------------------

available_balance = tsl.get_balance()

leveraged_margin = available_balance*5

max_trades = 20

per_trade_margin = (leveraged_margin/max_trades)

max_loss = available_balance * -0.09 # max loss of 9%

#-----------------------------------------------------------------------------------------

watchlist = ['GOLDPETAL DEC FUT', 'CRUDEOILM DEC FUT', 'SILVERMIC FEB FUT']

traded_wathclist = []

#-----------------------------------------------------------------------------------------------------

while True:

live_pnl = tsl.get_live_pnl()

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 18):

print("Wait for market to start", current_time)

time.sleep(1)

continue

if (current_time > datetime.time(23, 15)) or (live_pnl < max_loss):

# I_want_to_trade_no_more = tsl.kill_switch('ON')

order_details = tsl.cancel_all_orders()

print("Market is over, Bye see you tomorrow", current_time)

break

for stock_name in watchlist:

time.sleep(2)

print(f"Scanning {stock_name}")

# Conditions that are on 1 minute timeframe -------------------------------------------

chart_1 = tsl.get_historical_data(tradingsymbol=stock_name, exchange='MCX', timeframe="1")

pervious_candle = chart_1.iloc[-2]

no_repeat_order = stock_name not in traded_wathclist

# rsi ------------------------ apply indicators--------------------------------------

# Buy when rsi crosses above 55 and sell when rsi crosses below 45

# Ensure chart_1 has sufficient rows

if len(chart_1) <= 15:

print(f"Not enough data for {stock_name}. Skipping.")

continue

# Calculate RSI and drop NaN values

chart_1['rsi'] = talib.RSI(chart_1['close'], timeperiod=14)

chart_1['prev_rsi'] = chart_1['rsi'].shift(1)

chart_1.dropna(subset=['rsi', 'prev_rsi'], inplace=True)

# Add crossover columns

chart_1['uptrend_cross'] = (chart_1['prev_rsi'] <= 55) & (chart_1['rsi'] > 55)

chart_1['downtrend_cross'] = (chart_1['prev_rsi'] >= 45) & (chart_1['rsi'] < 45)

# Ensure the columns exist in the completed candle

cc_1 = chart_1.iloc[-2] # Second-to-last row

if 'uptrend_cross' not in cc_1 or 'downtrend_cross' not in cc_1:

print(f"Missing crossover columns for {stock_name}. Skipping.")

continue

# Access crossover values

uptrend_1 = cc_1['uptrend_cross']

downtrend_1 = cc_1['downtrend_cross']

print(f"Uptrend: {uptrend_1}, Downtrend: {downtrend_1}")

# Supertrend for Exit from open position -------------------------- apply indicators-----------------------------------

indi = ta.supertrend(chart_1['high'], chart_1['low'], chart_1['close'], 10, 1)

chart_1 = pd.concat([chart_1, indi], axis=1, join='inner')

cc_1 = chart_1.iloc[-2] #pandas completed candle of 1 min timeframe

exit_sell = cc_1['close'] > cc_1['SUPERT_10_1.0']

exit_buy = cc_1['close'] < cc_1['SUPERT_10_1.0']

# BUY conditions ------------------------------------------------------------------------------

breakout_b1 = ((pervious_candle['close'] - pervious_candle['open']) / pervious_candle['open']) * 100 # percentage change

breakout_b2 = pervious_candle['volume'] > 0.2 * chart_1['volume'].mean()

if uptrend_1 and breakout_b2 and (0.01 <= breakout_b1 <= 0.4) and no_repeat_order:

print(stock_name, "is in uptrend, Buy this script")

lot_size = tsl.get_lot_size(stock_name)

# Place buy order-------------------------------------------------------------------------

entry_orderid = tsl.order_placement(stock_name, 'MCX', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

traded_wathclist.append(stock_name)

# SELL conditions -----------------------------------------------------------------------------

breakout_s1 = ((pervious_candle['close'] - pervious_candle['open']) / pervious_candle['open']) * 100 # percentage change

breakout_s2 = pervious_candle['volume'] > 0.2 * chart_1['volume'].mean()

if downtrend_1 and breakout_s2 and (-0.4 <= breakout_s1 <= -0.01) and no_repeat_order:

print(stock_name, "is in downtrend, Sell this script")

lot_size = tsl.get_lot_size(stock_name)

# Place sell order-------------------------------------------------------------------------

entry_orderid = tsl.order_placement(stock_name, 'MCX', lot_size, 0, 0, 'MARKET', 'SELL', 'MIS')

traded_wathclist.append(stock_name)

# Exit conditions based on Supertrend indicator----------------------------------------------------

for stock_name in traded_wathclist:

time.sleep(2)

print(f"Checking exit conditions for {stock_name}")

# Fetch updated 1-minute chart

chart_1 = tsl.get_historical_data(tradingsymbol=stock_name, exchange='MCX', timeframe="1")

# Apply Supertrend indicator again

indi = ta.supertrend(chart_1['high'], chart_1['low'], chart_1['close'], 10, 1)

chart_1 = pd.concat([chart_1, indi], axis=1, join='inner')

cc_1 = chart_1.iloc[-2] # Get the completed candle

# Exit conditions

exit_sell = cc_1['close'] > cc_1['SUPERT_10_1.0']

exit_buy = cc_1['close'] < cc_1['SUPERT_10_1.0']

# Check for existing positions to square off

position = tsl.get_position(stock_name) # Get current position details

if position['type'] == 'BUY' and exit_buy:

print(f"Exiting BUY position for {stock_name}")

exit_orderid = tsl.order_placement(stock_name, 'MCX', position['lot_size'], 0, 0, 'MARKET', 'SELL', 'MIS')

traded_wathclist.remove(stock_name)

elif position['type'] == 'SELL' and exit_sell:

print(f"Exiting SELL position for {stock_name}")

exit_orderid = tsl.order_placement(stock_name, 'MCX', position['lot_size'], 0, 0, 'MARKET', 'BUY', 'MIS')

traded_wathclist.remove(stock_name)

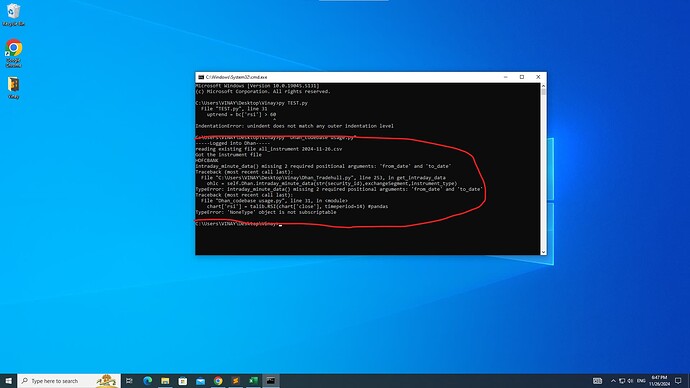

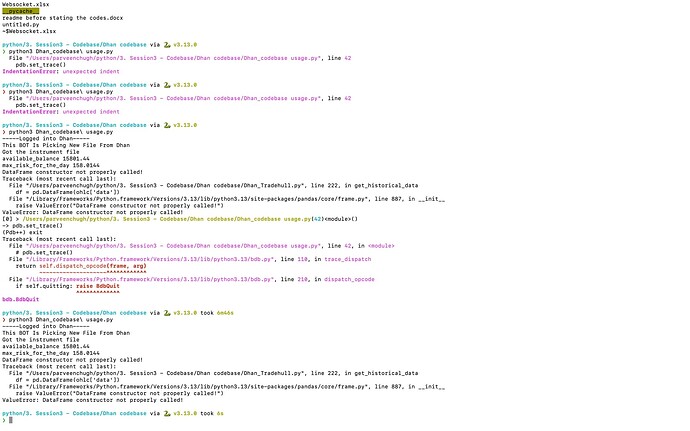

My error message is

GOLDPETAL DEC FUT is in uptrend, Buy this script

Checking exit conditions for GOLDPETAL DEC FUT

Traceback (most recent call last):

File "MCX - Exit.py", line 147, in <module>

position = tsl.get_position(stock_name) # Get current position details

AttributeError: 'Tradehull' object has no attribute 'get_position'