SIR CAN I PLACE A PRICE ALART IN DHAN USING PYTHON CODE @Tradehull_Imran

@Tradehull_Imran

Hi Imran,

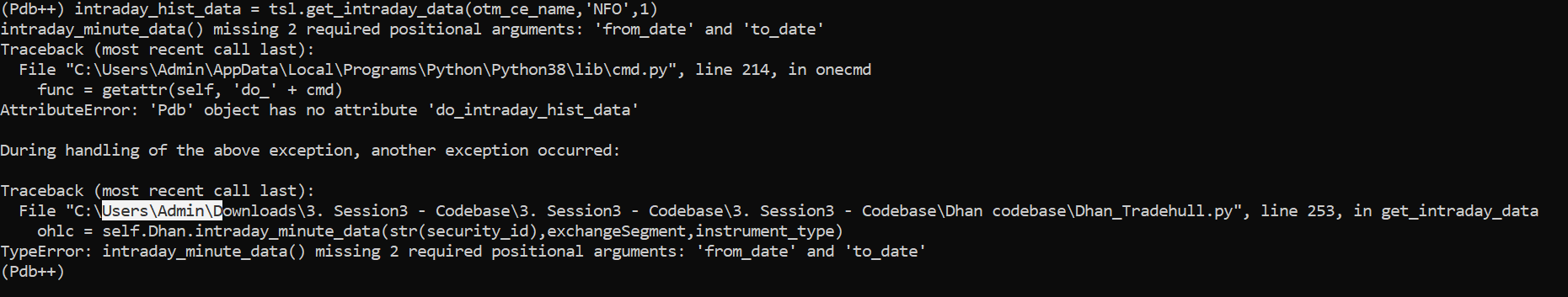

I am on 3 episode of Algo Trading course and tried to fetch previous_hist_data and intraday_hist_data but i am getting the error in attached print screenshot. could you please guide me why i am unable to fetch the data.

sir talib is not installing

if this statement is used in terminal pip install talib

out put is given below

(.venv) PS C:\Users\Intel\PycharmProjects\dhanhq> pip install talib

ERROR: Could not find a version that satisfies the requirement talib (from versions: none)

ERROR: No matching distribution found for talib

(.venv) PS C:\Users\Intel\PycharmProjects\dhanhq>

please share your whatsapp no sir

I think its a version issue,

do use this upgraded codebase file : Dhan_Tradehull_V2.py - Google Drive

Note : The library will update when necessary, but the link to the codebase file remains same

Hi @s_nandi

Yes Price or Condition based alerts can be made using dhanhq,

we do use telegram api / gmail api to create alerts

Hi @Avi_Shetty

Some upgrades were made in dhan-tradehull codebase, regarding historical data

Apply this solution: Learn Algo Trading with Python | Codes | Youtube Series - #952 by Tradehull_Imran

See this session for installation process : https://www.youtube.com/watch?v=YAyIoDJYorA&list=PLnuHyqUCoJsPA4l9KRLrNpWLIfZ9ucLxx&index=8

Talib is installed after we run install_libraries.bat

and install_libraries uses TA_Lib-0.4.24-cp38-cp38-win_amd64.whl to install Talib

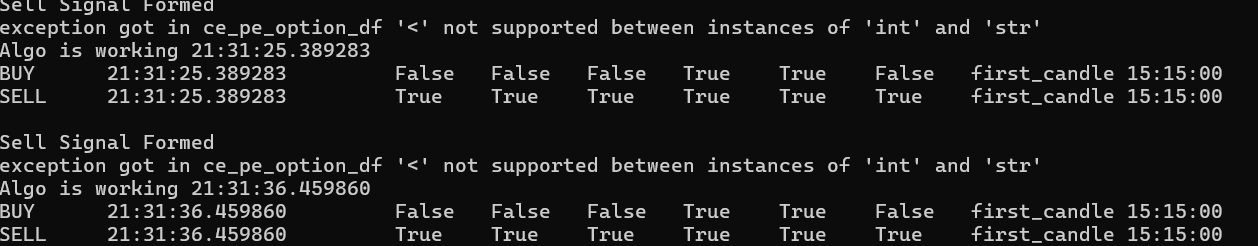

sir, giving below error

Sell Signal Formed

exception got in ce_pe_option_df ‘<’ not supported between instances of ‘int’ and ‘str’

Algo is working 21:31:36.459860

Thanks Sir, Also update get_intraday_data for data fetching for specific date period like between from date and to date, although i have modified it for me, but it will be helpful & useful for all if same can be updated in Dhan_Tradehull_V2 from your side

def get_intraday_datanew(self, tradingsymbol, exchange, timeframe, from_date=None, to_date=None, debug="NO"):

try:

tradingsymbol = tradingsymbol.upper()

exchange = exchange.upper()

instrument_df = self.instrument_df.copy()

# Map available timeframes

available_frames = {

2: '2T', # 2 minutes

3: '3T', # 3 minutes

5: '5T', # 5 minutes

10: '10T', # 10 minutes

15: '15T', # 15 minutes

30: '30T', # 30 minutes

60: '60T' # 60 minutes

}

# Handle default date range (last 5 days)

if from_date is None:

from_date = (datetime.datetime.now() - datetime.timedelta(days=5)).strftime('%Y-%m-%d')

if to_date is None:

to_date = datetime.datetime.now().strftime('%Y-%m-%d')

# Exchange mappings

script_exchange = {

"NSE": self.Dhan.NSE,

"NFO": self.Dhan.FNO,

"BFO": "BSE_FNO",

"CUR": self.Dhan.CUR,

"BSE": self.Dhan.BSE,

"MCX": self.Dhan.MCX,

"INDEX": self.Dhan.INDEX

}

instrument_exchange = {

'NSE': "NSE",

'BSE': "BSE",

'NFO': 'NSE',

'BFO': 'BSE',

'MCX': 'MCX',

'CUR': 'NSE'

}

index_exchange = {

"NIFTY": 'NSE',

"BANKNIFTY": "NSE",

"FINNIFTY": "NSE",

"MIDCPNIFTY": "NSE",

"BANKEX": "BSE",

"SENSEX": "BSE"

}

# Handle index exceptions

if tradingsymbol in index_exchange:

exchange = index_exchange[tradingsymbol]

# Fetch security ID and instrument type

if tradingsymbol in self.commodity_step_dict.keys():

security_check = instrument_df[(instrument_df['SEM_EXM_EXCH_ID'] == 'MCX') &

(instrument_df['SM_SYMBOL_NAME'] == tradingsymbol.upper()) &

(instrument_df['SEM_INSTRUMENT_NAME'] == 'FUTCOM')]

if security_check.empty:

raise Exception("Check the Tradingsymbol")

security_id = security_check.sort_values(by='SEM_EXPIRY_DATE').iloc[0]['SEM_SMST_SECURITY_ID']

else:

security_check = instrument_df[

((instrument_df['SEM_TRADING_SYMBOL'] == tradingsymbol) |

(instrument_df['SEM_CUSTOM_SYMBOL'] == tradingsymbol)) &

(instrument_df['SEM_EXM_EXCH_ID'] == instrument_exchange[exchange])

]

if security_check.empty:

raise Exception("Check the Tradingsymbol")

security_id = security_check.iloc[-1]['SEM_SMST_SECURITY_ID']

instrument_type = security_check.iloc[-1]['SEM_INSTRUMENT_NAME']

exchange_segment = script_exchange[exchange]

# Fetch OHLC data from Dhan API

ohlc = self.Dhan.intraday_minute_data(

str(security_id), exchange_segment, instrument_type, from_date, to_date, int(1)

)

if debug.upper() == "YES":

print(ohlc)

if ohlc['status'] != 'failure':

df = pd.DataFrame(ohlc['data'])

if not df.empty:

df['timestamp'] = df['timestamp'].apply(lambda x: self.convert_to_date_time(x))

df = df.dropna(subset=['open', 'high', 'low', 'close'])

# Filter for valid trading days

df['timestamp'] = pd.to_datetime(df['timestamp'])

df = df[(df['timestamp'].dt.date >= datetime.datetime.strptime(from_date, "%Y-%m-%d").date()) &

(df['timestamp'].dt.date <= datetime.datetime.strptime(to_date, "%Y-%m-%d").date())]

# Resample to desired timeframe

if timeframe == 1:

return df

df = self.resample_timeframe(df, available_frames[timeframe])

return df

else:

return df

else:

raise Exception(ohlc)

except Exception as e:

print(e)

self.logger.exception(f"Exception in Getting OHLC data as {e}")

traceback.print_exc()

Hi, tradehall@imran,

in session 8,

$$$$$$$ cc_5 = chart_5.iloc[-1] # pandas completed candle $$$$$$$

we used ilock[-2] for last completed candle in session 6

but ilock[-1] used for last completed candle in session 8 ---- I request u pls explain it . why are u use iloc[-1] ?

The code below is for Back testing (Paper Trade), working for me , coded for option trading in focus, you can modify it as per your requirement. Waiting for suggestions and remarks. Thank you.

import pdb

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

import talib

import time

import datetime

client_code = "put your client_code"

token_id = "put your toekn_id"

tsl = Tradehull(client_code,token_id)

traded_watchlist = []

tradelist = []

############## Simulation Input #############

lot_size = 15

lots_number = 100 #How many lots you want to trade for

watchlist = {'Script':'BANKNIFTY 30 JAN 51200 PUT','Selected_date': '2025-01-03', 'exchange': 'NFO'}

#############################################

print("\nSimulation started for selected_date.....", datetime.datetime.now().strftime("%H:%M:%S"))

try:

data_1min = tsl.get_historical_data(watchlist['Script'], watchlist['exchange'], '1')

data_1min = pd.DataFrame(data_1min)

data_1min['timestamp'] = pd.to_datetime(data_1min['timestamp'])

data_1min.set_index('timestamp', inplace=True)

selected_date = pd.Timestamp(watchlist['Selected_date'])

# Filter data for simulation

data_1min_filtered = data_1min[data_1min.index.date < selected_date.date()] # Data till

final_data_1min = data_1min[data_1min.index.date == selected_date.date()] # Data for

def filter_market_hours(data):

market_open = datetime.time(9, 15)

market_close = datetime.time(15, 30)

return data.between_time(market_open, market_close)

def update_5min_data(data_1min_filtered):

resampled = data_1min_filtered.resample('5T').agg({

'open': 'first',

'high': 'max',

'low': 'min',

'close': 'last',

'volume': 'sum'

})

resampled = resampled.dropna(how='any')

return filter_market_hours(resampled)

def update_15min_data(data_1min_filtered):

resampled = data_1min_filtered.resample('15T').agg({

'open': 'first',

'high': 'max',

'low': 'min',

'close': 'last',

'volume': 'sum'

})

resampled = resampled.dropna(how='any')

return filter_market_hours(resampled)

data_5min_filtered = update_5min_data(data_1min_filtered)

data_15min_filtered = update_15min_data(data_1min_filtered)

for index, row in final_data_1min.iterrows():

row_df = pd.DataFrame([row], index=[index])

data_1min_filtered = pd.concat([data_1min_filtered, row_df]).sort_index()

data_5min_filtered = update_5min_data(data_1min_filtered)

data_15min_filtered = update_15min_data(data_1min_filtered)

tradingsymbol = watchlist['Script']

chart_1 = data_1min_filtered

chart_5 = data_5min_filtered

chart_15 = data_15min_filtered #use it if u need

chart_1['rsi'] = talib.RSI(chart_1['close'], timeperiod=14)

chart_5['rsi'] = talib.RSI(chart_5['close'], timeperiod=14)

max_order_limit = len(traded_watchlist)

if (max_order_limit < 1):

bc_5 = (chart_5['rsi'].iloc[-2]) < chart_5['rsi'].iloc[-1]

ltp = chart_1['close'].iloc[-1]

# Buy conditions

if (bc_5):

if (chart_1['rsi'].iloc[-1] > 60):

buy_time = chart_1.index[-1].strftime("%H:%M:%S")

buy_price = ltp

sl_price = chart_1['low'].iloc[-2]

traded_watchlist.append({"Script":tradingsymbol, "Buy": buy_price, "Buy_Time": buy_time, "SL_price": sl_price})

#Selling

max_order_limit = len(traded_watchlist)

if (max_order_limit > 0):

for wstock_name in traded_watchlist:

tradingsymbol = wstock_name["Script"]

sl_price = wstock_name["SL_price"]

buy_price = wstock_name["Buy"]

buy_time = wstock_name["Buy_Time"]

wltp = chart_1['close'].iloc[-1]

sell_time = chart_1.index[-1].strftime("%H:%M:%S")

#Sell conditions

if ((sl_price > wltp) or (chart_5['low'].iloc[-2] > wltp)): #Modify the selling condition as per your requirment

sell_price = wltp

quantity = lot_size * lots_number

Trade_point = round((sell_price - buy_price),2)

Trade_TO = sell_price + buy_price

Trade_PNL = round((Trade_point*quantity - (40 + Trade_TO*quantity*0.0011)),2) #Broker and other charges included roughly

tradelist.append({"SN": len(tradelist) + 1, "Script":tradingsymbol, "Buy": buy_price, "Buy_Time": buy_time, "SL_price": sl_price, "Sell": sell_price, "Sell_Time": sell_time, "Trade_point":Trade_point, "Trade_PNL":Trade_PNL})

traded_watchlist[:] = [item for item in traded_watchlist if item['Script'] != tradingsymbol]

except KeyboardInterrupt:

print("\nProcess interrupted by user (Ctrl+C).")

except Exception as e:

print("\nAn unexpected error occurred:", e)

finally:

print("\nSimulation ended.....", datetime.datetime.now().strftime("%H:%M:%S"))

print(f"\nFinal Trade Details for {watchlist['Selected_date']}:")

if tradelist:

for trade in tradelist:

trade['Buy_Time'] = trade['Buy_Time'].strftime("%H:%M:%S") if isinstance(trade['Buy_Time'], datetime.time) else trade['Buy_Time']

trade['Sell_Time'] = trade['Sell_Time'].strftime("%H:%M:%S") if isinstance(trade['Sell_Time'], datetime.time) else trade['Sell_Time']

headers = tradelist[0].keys()

column_widths = {header: max(len(str(header)), *(len(str(row[header])) for row in tradelist)) for header in headers}

header_row = " ".join(f"{header:<{column_widths[header]}}" for header in headers)

print(header_row)

for trade in tradelist:

row = " ".join(f"{str(value):<{column_widths[header]}}" for header, value in trade.items())

print(row)

Final_PNL = round(sum(trade['Trade_PNL'] for trade in tradelist), 2)

Final_point = round(sum(trade['Trade_point'] for trade in tradelist), 2)

print(f"\nFinal_point of 1 unit: {Final_point}")

print(f"Final_PNL of 1 lot: Rs.{Final_PNL}/-")

else:

print("No trades to display.")

@Tradehull_Imran - getting below error “ModuleNotFoundError: No module named ‘Dhan_Tradehull_V2’”.

And while installing pip install Dhan_Tradehull_V2, getting below error, any idea sir?

“ERROR: Could not find a version that satisfies the requirement Dhan_Tradehull_V2 (from versions: none)

ERROR: No matching distribution found for Dhan_Tradehull_V2”

@Tradehull_Imran sir Can You Share Strategy Backtesting Code

Hello sir Im Nimesh Guliana

Use API of Angel one

Algo for swing trading

Algo start time 9:15 end time 15:15

Algo for Equity time 1W chart

Strategy SME 50 for buy and SME 100 for sell ( just for try not for real )

Add

SL on last candel

in a day total trade will 4

no ripped trade

And more learn from you Sir

i hope you will make one video on it

index_chart = tsl.get_historical_data(tradingsymbol='NIFTY JAN FUT', exchange='NFO', timeframe="1")

Dear sir,

For retrieving historical data, previously we were getting 5 trading days data as mentioned in ‘DHANHQ API documentation’, but now i getting for only two days. I am using the latest version of Tradehull_V2. Is this error appearing for all of us? Kindly verify.

Hello Sir, I am not able to understand, whether Vote is registered OR not?

How to confirm my Vote Registration, Please.

VBR Prasad

Oh, That’s a great Initiative…

Hello everyone,

I would like to propose a backtest of a scalping strategy that I’ve been studying. This strategy uses a combination of moving averages and the Average Directional Index (ADX) to identify strong trends and potential trade entries.

Scalping Strategy Overview:

Indicators Used:

- Simple Moving Average (SMA) – A basic lagging indicator.

- Exponential Moving Average (EMA) – More responsive to recent price changes.

- Jurik Moving Average (JMA) – A leading indicator that reacts faster than both SMA and EMA.

Why Three Moving Averages?

- SMA is lagging, EMA is more reactive, and JMA leads them all. This combination helps in filtering out noise and identifying trends more accurately.

Trend Identification Logic:

- Buy Signal: If JMA > EMA > SMA, the market is in an uptrend.

- Sell Signal: If JMA < EMA < SMA, the market is in a downtrend.

Additional Confirmation:

- ADX Indicator: We only consider trades when the ADX is above 25, which indicates a strong trend.

Entry Conditions:

For a Buy Trade:

- Trend Check: Ensure JMA > EMA > SMA.

- ADX Confirmation: ADX value must be above 25.

- Entry Point: Enter the trade after a pullback when the price bounces upward.

For a Sell Trade:

- Trend Check: Ensure JMA < EMA < SMA.

- ADX Confirmation: ADX value must be above 25.

- Entry Point: Enter the trade after a retracement when the price drops downward.

Risk Management: Stop-Loss and Take Profit

- Stop-Loss:

- Place your stop-loss at the high of the entry candle for a sell trade or the low of the entry candle for a buy trade.

- Take Profit:

- Aim for a 1:1.5 risk-to-reward ratio initially.

- Book 70% of your profit at this level.

- For the remaining position, aim for a 1:2 risk-to-reward ratio and exit the trade completely at this point.

I believe this strategy could be effective for fast-paced intraday trades, especially in volatile markets. Backtesting this could give us valuable insights into its success rate and areas of improvement.

Looking forward to hearing your thoughts!

Sir Installation done,

certutil -generateSSTFromWU roots.sst

certutil -addstore -f root roots.sst

i tested run working fine sir,

thankyou very much sir