Hi All

At Dhan, we have built a lot of features and tools for options trading. From simple open interest charts to the strategy builder on our Options Trader Web platform, we aim to provide a full palette for options trading. In fact, our team is proud to say that we were one of the first brokers to offer a fully-fledged advanced options chain with Greeks on our platform.

This post is about Option Greeks data and its calculations on Dhan. Option Greeks are a set of metrics that measure the sensitivity of an option’s price (premium) to changes in its underlying price, volatility, time to expiration, and a few other variables. These are valuable tools for options traders. By understanding how they work, traders can make more informed decisions about their trades and manage their risk more effectively.

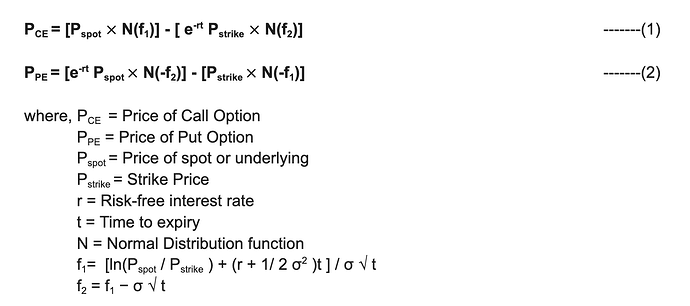

We have used the Black-Scholes Model (BSM) to estimate the option premium value. It is important to remember that the BSM is a theoretical mathematical equation that helps to determine the price of an option contract based on variables such as spot price, strike price, time to expiration, volatility, and risk-free interest rate. This model gives the estimated value assuming that all other factors are constant.

Below is the formula to determine Option Price :

At Dhan, we show four Options Greeks. Below is a detailed formula for each greek. For simplicity, the equations are written for the call options only. To calculate greek for put options, replace PCE by PPE in all the formulas.

Delta (Δ) : Delta is the sensitivity of an option price (premium) to changes in the spot price (underlying). Hence, delta shows how much an option’s price will change for every ₹1 change in the underlying price. Mathematically, it is the derivative of the Call or Put premium with respect to the underlying price.

![]()

Theta(θ) : Theta is the rate of decline of an option price (premium) with respect to time. Theta is always negative, which means that the value of an option will decrease as time passes. This is because options lose value as they get closer to expiration. This is also known as time decay.

![]()

Generally, the time unit for theta is calculated in years, but it can be converted to days by dividing by 252. This is because there are approximately 252 trading days in a year.

Gamma(Γ) : Gamma is the rate of change of delta with respect to change in underlying price. Hence it is a double differentiation of option premium with underlying price.

![]()

Vega(ν) : Vega is the rate of change of the option price (premium) with respect to the volatility of the underlying asset. We keep volatility as Implied Volatility (IV). This shows how much the premium will increase or decrease for every 1% change in Volatility.

![]()

One important point to note and understand is that like all models, this model is a theoretical model and the real option price (premium) may not exactly resemble it. As you can see, to calculate the Option Greeks value, we have used the theoretical formula to determine option premium {equations (1) and (2)}. So on certain days, particularly on and around expiry day, a few of the values may appear abnormally high or low because the real option price will not be in sync with the theoretical option price. The real option price is based on actual demand & supply. For example, the theta value may appear more than the option premium itself because the real option price has decreased too much relative to the theoretical price. And by now we know the theoretical value depends on many variables & assumptions.

Next, you may also find differences in the Greek values on different platforms. This may happen for many reasons:

- The underlying models for calculating price and Greeks may differ.

- The input variables, such as risk-free interest rate and volatility, may differ.

- The technology stack and platform may differ, with difference id library & functions or other such differences that respective platforms use for reference or models.

We understand that Option Greeks are very valuable tools for Options Traders, but it is also important that as traders you know the underlying models that are being used on platforms to showcase this data. Hope this helps in understanding the background calculation of greeks as an additional perspective in your trading journey.

Disclaimer: The AI image is generated for representation purposes only. It doesnt intend to resemblance anyone in particular: living or dead.

Happy Trading!

Naman Sharma

Product