Dear Mutual Fund Investors,

Very often, we find our investors wanting to cash out their Mutual Fund investments for various reasons, such as financial emergencies or to reallocate their funds.

A general expectation is that they should receive funds from their redemptions almost immediately. However, the redemption process involves various parties and generally takes 2-3 days.

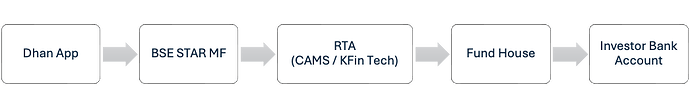

Let’s understand how it works :

1. Placing a Redemption Request:

Investors initiate the process by placing a redemption request through their Dhan App.

2. Processing the Request:

Once the request is made, it goes to BSE STAR MF and then to RTAs (Registrar and Transfer Agents) for validation. After validation, the Fund House processes it, debits the units from the investor’s holdings, and sends the request for fund settlement.

3. Settlement Cycle:

The settlement cycle is the period it takes for the Fund House to convert the units into cash and transfer the proceeds to the investor’s account. This cycle varies by fund category & the cut-off timings.

- Liquid Funds: T+1 days

- Debt Funds: T+2 days

- Equity Funds: T+2 days

- International Funds: T+5 or more days

Here, T represents the date when the order was approved by the AMCs.

4. Credit to Investor’s Account:

After the settlement period, the funds are credited to the investor’s bank (linked to Folio(s) / AMC Statement) as per the settlement cycle.

Understanding these timelines can help you plan your financial needs better.

Happy Investing,

Saurav Parui