We are a registered Depository Participant (DP) with CDSL and when you complete the onboarding process, a demat account is opened in your name to hold securities electronically. Any buying or selling transactions that take place on stock exchanges are settled and recorded in your demat account by way of a credit or debit entry.

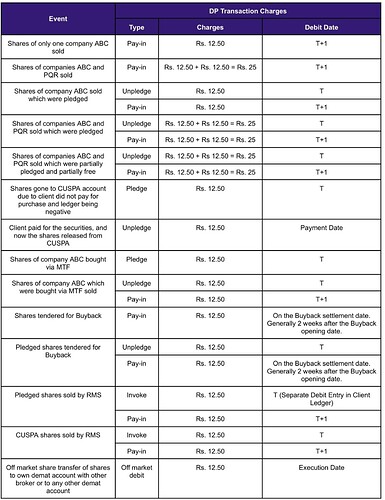

As your DP/Broker, we perform various transactions as per your instructions and these transactions are chargeable as per tariff sheet. Some common types of transactions include the Pay-out and Pay-in of securities when you buy and sell, pledge, unpledge, invoke, dematerialization, rematerialization, and off-market transfer of securities.

These charges are applicable on each transaction, regardless of the quantity involved. Trade-related charges such as brokerage, STT (Securities Transaction Tax), and stamp duty are clearly stated in the contract notes we issue to you. However, DP charges are separately calculated on a daily basis in our back-office system and deducted from your trading ledger. A detailed breakdown of these charges is sent to your registered email address on a monthly basis, with the subject line “CDSL Demat Transaction & Holding Statement.”

The broad framework of DP charges can be summarised as follows:

- DP Charges are deducted on the execution date, which is when shares are actually transferred out of demat account.

- Charges for Pledge, Unpledge, Invoke and Pay-in etc are applied at a per Scrip / per ISIN for each transaction irrespective of quantity.

- When securities are sold, we do early pay-in of the shares to the depository in real-time. This ensures you get the 80% benefit of the sale proceeds right away. To achieve this, pay-in needs to be done in batches at regular intervals during the market hours. Since DP charges are applicable per transaction, it is levied each time early pay-in is done, meaning if you sell a scrip multiple times a day in small quantities, charges are levied each time.

- If there are multiple pledge transactions then, un-pledge transactions will also be multiple corresponding to respective pledge transactions and thus, charges will be levied on each individual pledge and un-pledge transaction.

- If un-pledge is for a part of the pledged quantity then, un-pledge charges will be applied on part un-pledge quantity and for remaining balance quantity, the un-pledge charges will be applied on same lines until the pledge is closed.

To provide further clarification, please refer to the table below:

Important Notes:

- Since we do real time time early Pay-in, the shares which you order for sale are immediately sent to the NCL. Hence, in the above cases, if you sell in multiple tranches, for each tranche charges would be levied.

- Freeholding shares are those shares in your demat account for which are either not pledged or locked-in for any reason.

- Invoke is done when shares are sold by our risk management team (RMS)

- CUSPA, refers to a client’s unpaid securities account. The shares are transferred to CUSPA when the amount for purchase of shares is not paid by T+1 day 12 pm.

- The current rate of GST is 18% on depository services.

- We may also unpledge shares which will be removed from the Approved List for which applicable charges will be levied.

– Shrimohan J.

Product Operations @ Dhan