Hello Everyone,

We built ScanX to unwrap markets and showcase the insights from companies, markets, screeners, and much more - from thousands of data points available and help you analyse them and decide what to do next on your investing journey.

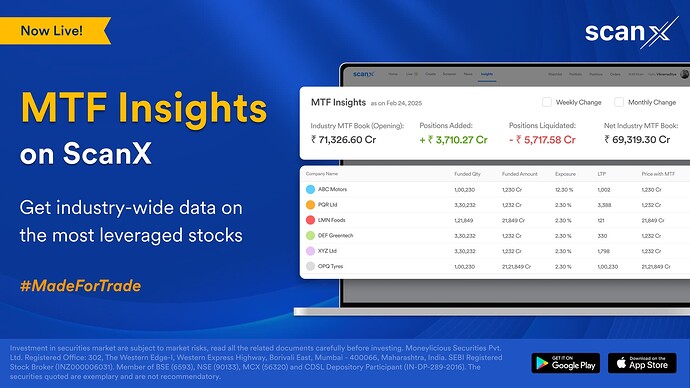

We launched ScanX last year as part of Dhan’s product ecosystem, to help Indian traders and investors find stocks, run analyses and execute, all from a single platform. And we have added a range of new data points and insights since then. Along with this, we are adding data which was never analysed or presented to take actions upon. One such data is MTF Insights.

MTF or Margin Trading Facility is the go-to option for swing traders with high conviction and who know how to ride the stock gains with added leverage. It is offered by almost all brokers now and at Dhan, we offer it at 12.49% interest p.a. with a seamless experience across all our products.

There are 1000+ stocks where you can get up to 4X margin. And the reason for buying stocks with MTF can be multiple, based on your analysis and conviction. But while taking these trades, how about an option to see what the industry is doing?

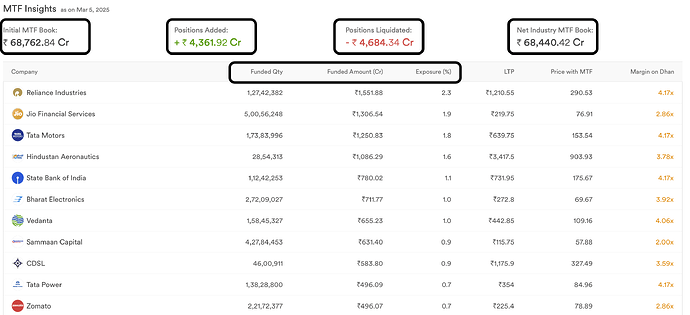

Margin Trading Facility books have grown from ₹28,000 crores in Jan 2023 to ₹85,000 crores during the peak of Sep 2024. In the first two months of 2025, the industry MTF book is down by ₹13,000 crores, reaching a size of ₹70,000 crore by the end of February.

Another fact, only 7 companies have 10% of the entire industry MTF book. Want to dive-in more?

Introducing: MTF Insights on ScanX

Now, you can see which stocks have the highest MTF exposure in the industry and how much leverage you can get against each of them on Dhan, in a single window. Not just this, you can also track if the MTF book sizes are increasing or decreasing for a particular stock.

We have more updates planned to make this even more insightful and a lot more data with insights is coming your way on ScanX. We would love to hear your feedback and thoughts on this and what we should add next.

Thank you

Pranita