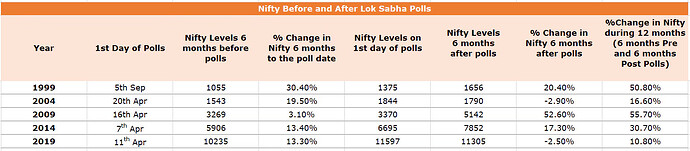

I was checking the performance of the markets pre and post election over the last few years. Here is the historical performance from 1999.

Source: Mint.

Traders - how do you participate in the markets during election? Is this your first time trading during election phase? @t7support @iamshrimohan @traderdax @Trader_Rdx @TraderJay @trader7626 @TraderATH @optionsbuffet @commodityvasanth @nnJhavarePatil @PiyushChaudhry @KirubakaranRajendran @EggMasonValue @Laibakhan @BY7898

Investors - Do you stay invested? Invest more money or wait for the results to make investments? @Investing_Sutra @TavagaAdvisory @Investor @krishag @Lokesh360 @GopalGupta @babubv @dhanuser1 @RASHIMAKHIJA @Jainil2003

2 Likes

Just keep running my automated systems as usual. No change in that. Have traded during previous election phases as well.

Besides there is no point in gambling on events with significant % of risk capital available. But I have tried for OTM lotteries on both sides with small capital. Got lucky once…

1 Like

I dont think any major change would be seen immediately after the results. The market is already gaining in the anticipation of bjp winning sentiments. And by the time results are declared, it will already be on a significant high, it might shoot up till 23000 temporarily if bjp comes to power and then fall again in short span of time.

The problem is everybody’s saying market crash will happen but the market wont crash until everybody thinks like that. Once the crash sentiments go away, market may crash after that. Its totally unpredictable.

I just hope market remains stable thats what’s best for the economy. Unnecessary rise or fall based on the sentiments and not on the actual underlying value is too dangerous.

1 Like

As an investor, I am just gonna invest in systematic manner as usual.

Churning of portfolio would be done only 1 month after the results.

See, Markets are at the verge of breakout both Nifty and the broader markets. Especially Nifty is not going to breakout in a narrow line however it has tested the ATH manier times now. So 23000 in Nifty and 50K in BNF is for sure without any intervention of election factors.

Now what is next after that will be decided by the election results. BJP taking crown is allready been factored in the Markets to an extend. But if it wins with majority to form a stable government then markets can take even more up move provided the corporate results are good enough to hold the Markets.

If everybody predicts that a certain party is winning 400+ seats in the election, isn’t that factored in? Then why the rally? Beyond certain corporate groups, not much has happened in the broader markets in the last 8 years or so. This time around, the broader markets are rallying more than the mainstream corporate groups.

The markets are rallying because it knows something that most people don’t plus the valuations are still comfortable. In a bull market everybody distrusts the valuations and in a bear market everybody trusts the price.

Nifty can go to any highs and it does not matter, because Nifty Dollar Index isn’t in sync with Nifty. Our PPP goes down and Nifty goes up, then what is there to be so joyous about? We are still at the same point. Our true performance is measured by the Nifty Dollar Index. You could see Nifty at 40,000 and USDINR at ₹150, and then again we are at the same point as of today.

@krishag @vijendran.sukumar @shraddha

Nifty50 vs Nifty50 Dollar Index for the last 10 years

4 Likes