The back-and-forth between the old and new tax regimes has been the talk of the town for a while. And for years, just a few investments would make the old regime feel like an obvious choice.

But recent changes in the tax slabs and rebates has given a clear edge to the new regime. The government’s direction is clear, make things simpler and push everyone towards the new regime.

What the numbers say

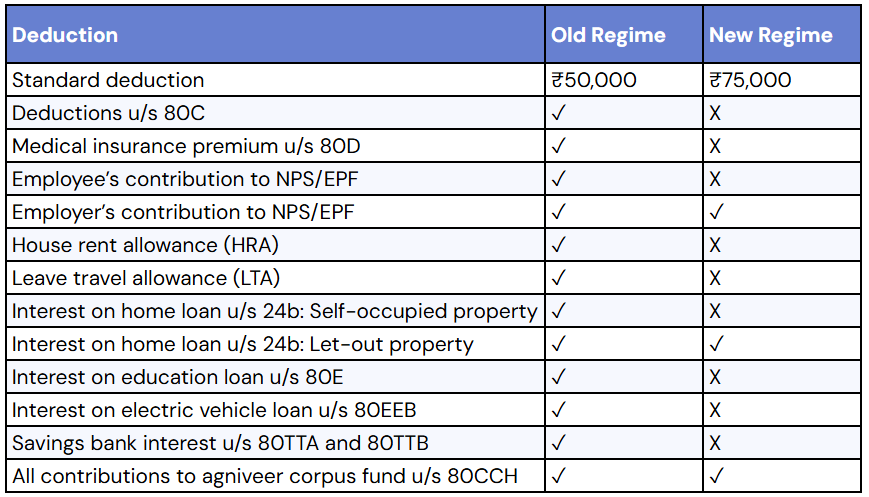

Under the old regime, the rebate only covered income up to ₹5 lakh. In the new regime, that rebate extends to ₹12 lakh. With a higher standard deduction of ₹75,000, a salaried individual can now earn up to ₹12.75 lakh tax-free.

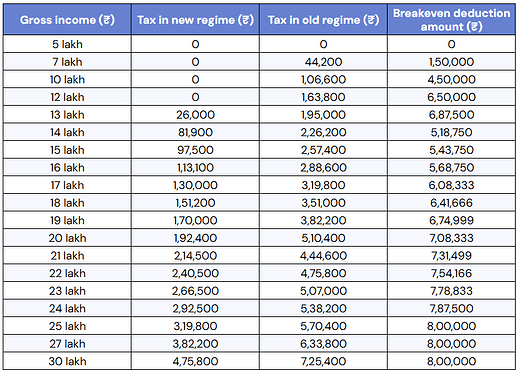

On the other hand, the deductions needed to make the old regime work are quite steep. Here’s a table showing how much you need in deductions at different income levels for the old regime to even come close to matching the new regime.

How to use this table?

- If your total deductions > break-even → the old regime wins.

- If your total deductions < break-even → the new regime is better.

A few things to keep in mind:

- The breakeven figures exclude the ₹50,000 standard deduction under the old regime.

- For tax calculation under both regimes, we’ve already accounted for the standard deduction: ₹75,000 in new, ₹50,000 in old.

- If you don’t have salary income (and therefore no standard deduction), your numbers will change.

What should you choose?

For most people, the old regime isn’t a practical choice anymore. Let’s say you’re earning ₹12 lakh, you’d need ₹6.5 lakh in deductions just to stay on par with the new regime. That’s a big ask.

The old regime might still work for those with substantial HRA, or education loan interest. But realistically, this applies to a small group, probably less than 10% of taxpayers.

Even with the new regime, some deductions are still available. For example, contributions to NPS by your employer or interest on rental property loans. If you’ve got these, they can still give you some relief.

And then starting this year, the government is also asking for detailed information while claiming deductions under old regime.

So, unless your deductions are well above the breakeven point, sticking with the new regime would be a smart choice.