Dear Users,

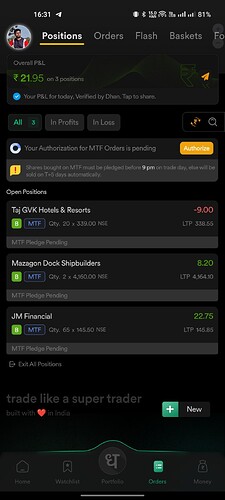

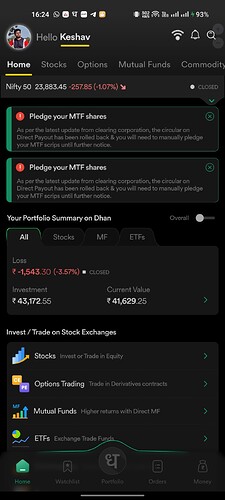

As per latest SEBI Regulations on Direct Payout starting Feb 24th 2025, new exchange regulations will simplify the process for booking MTF (Margin Trading Facility) positions.

You will no longer need to manually pledge your MTF purchases; they will automatically be pledged and reflected in your portfolio as part of your MTF holdings from the next day. Few more things to keep in mind are as follows:

-

Auto-Pledge of MTF Purchases: All MTF shares will be auto-pledged once credited to your demat account by the clearing corporation. No MTF OTP will be required.

-

Pledge Charges: No changes in DP or pledge charges.

-

Handling Delivery Shortages: Both “market” and “internal” shortages will now be settled through the clearing corporation’s auction. If shares aren’t received in the auction, a closeout credit will be added to your ledger. For MTF positions, short-delivered shares will be converted to delivery and adjusted in your Dhan ledger.

-

Pre-Delivery Sell (BTST): For shares received via auction, there may be delays in pay-in processing due to new pledge/unpledge requirements. If pay-in fails, auction debits/penalties may apply.

To explain this with an example :

- You buy 100 SBI shares using MTF on Monday. They appear in your holdings by Tuesday and will auto-pledge when credited to your demat account by 5:00 PM.

- If only 50 shares are credited on Tuesday, the remaining 50 will arrive by 11:00 AM Wednesday as part of the auction payout and be auto-pledged.

- If only 25 of the remaining 50 shares are credited, the other 25 will be closed out, and a credit will reflect in your trading ledger.

- If you sell these 100 shares on Tuesday, Dhan will handle pay-in based on when shares are credited:

- 50 shares credited Tuesday will go for pay-in the same evening.

- Pay-in for auctioned shares will be attempted by 10:30 AM Wednesday. Any shortfall may lead to an auction debit and penalties, handled on a best-effort basis.

Please get in touch with us on help@dhan.co in case of any other doubts.

P.S : As a caution, we advise traders to be mindful while taking BTST trades for Tue Feb 25th, 2025 incase there are any hiccups similar to the last implementation by the clearing corporation.