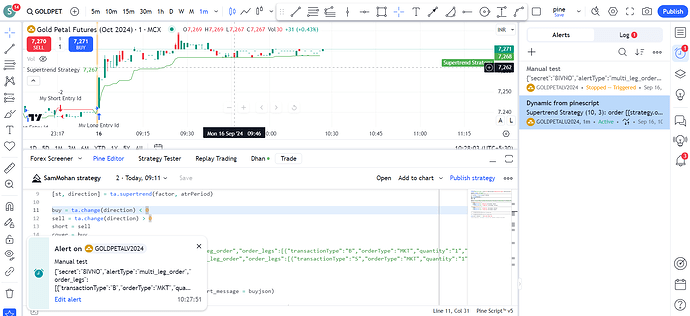

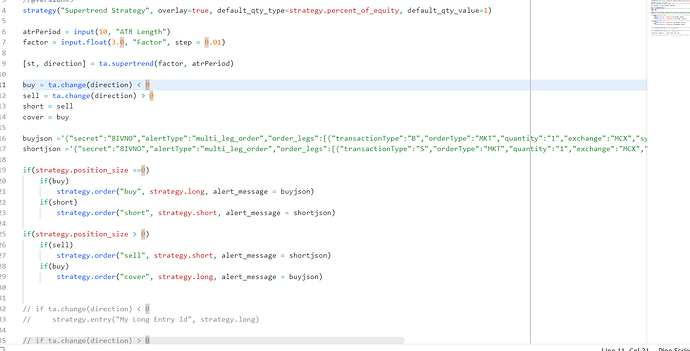

//@version=5

strategy("Supertrend Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

var bool tradeCompleted = false

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[st, direction] = ta.supertrend(factor, atrPeriod)

buy = ta.change(direction) < 0

sell = ta.change(direction) > 0

short = sell

cover = buy

buyjson ='{"secret":"8IVNO","alertType":"multi_leg_order","order_legs":[{"transactionType":"B","orderType":"MKT","quantity":"1","exchange":"MCX","symbol":"GOLDPETAL1!","instrument":"FUT","productType":"M","sort_order":"1","price":"0"}]}'

shortjson ='{"secret":"8IVNO","alertType":"multi_leg_order","order_legs":[{"transactionType":"S","orderType":"MKT","quantity":"1","exchange":"MCX","symbol":"GOLDPETAL1!","instrument":"FUT","productType":"M","sort_order":"1","price":"0"}]}'

if (not tradeCompleted)

if (strategy.position_size == 0)

if (buy)

strategy.order("buy", strategy.long, alert_message = buyjson)

if (short)

strategy.order("short", strategy.short, alert_message = shortjson)

if (strategy.position_size > 0)

if (sell)

strategy.order("sell", strategy.short, alert_message = shortjson)

tradeCompleted := true

if (buy)

strategy.order("cover", strategy.long, alert_message = buyjson)

tradeCompleted := true

plot(st, color = direction == -1 ? color.green : color.red)

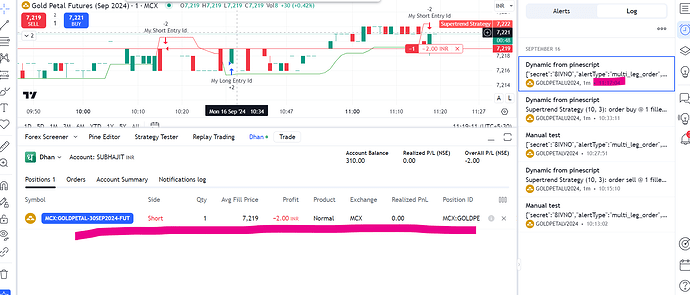

@t7support

Sir I have modified the code for one time execution

var bool tradeCompleted = false

entering the trade when

if (not tradeCompleted)

just before exit making it true

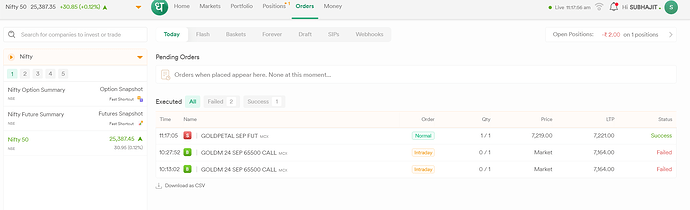

I will check on live trading day

Is it Okey Sir ?