Hello Traders

SEBI, in continuation of its endeavour to enhance trading convenience & strengthen risk monitoring in derivatives segment has released a detailed circular introducing several important changes to how the equity derivatives market (F&O) will measure risk & calculate Open Interest. With this circular, SEBI has three objectives to achieve :

- Better monitoring and disclosure of risks in F&O

- Reduce unnecessary F&O ban periods in single stocks

- Detect and prevent concentration / manipulation in index options

To do this, SEBI has adopted a new method to calculate Open Interest. It will not change anything for you as a trader, the OI you consume is going to be the same as always. The new OI calculation is for the risk monitoring & position limits by brokers, exchanges & clearing corporations.

What is FutEq Open Interest?

Open Interest (OI) will now be measured using Delta-adjusted exposure across futures and options. This is called Future Equivalent Open Interest (FutEq OI). It is the net delta exposure converted into futures-equivalent lots for every client and then aggregated to the market level. Yes, the delta here is the same delta you see in the Option Chain. But its value will be calculated & provided by clearing corporations to its members & associates. Futures have delta of +1 or -1, for long & short respectively. But for options delta may vary anything between -1 to +1.

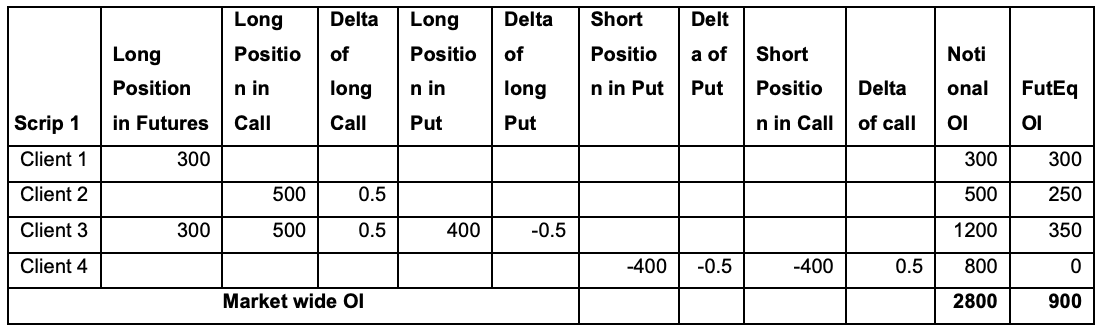

Now for calculating Fut Eq Open Interest, multiply the delta with the notional open interest at each contract level. Here is the simple example :

Affecting Positions Limits

Market Wide Position Limits (MWPL) is currently 20% of free-float shares of a stock. The newer approach to calculate MWPL is lower of 15% of free-float shares & 65x the Avg Daily Delivery Value (ADDV), with a minimum floor of 15% of free float. This will be calculated every 3 months based on last 3 months delivery volume averages. MWPL becomes more aligned with real trading volumes in the cash market. This will reduce the artificially triggered ban periods.

Earlier, the F&O stock was triggered for ban when Open Interest > 95% of MWPL. Now the same limit is applied but instead of Notional Open Interest, the CC will consider FutEq OI. So the stock will be in F&O ban if

FutEq Open Interest > 95% of MWPL

But there is good news here. The ban is not completely an outright ban that you will not be able to place any trade. Like how earlier, you could have always reduced your positions, you can do the same now as well. Position reduction is allowed, but reduction now is measured based on delta & not just contract count.

How will this work at Dhan?

At Dhan, if you have an open position in banned scrip, you can reduce the position, only if the reduction doesn’t increase the delta. If you have multiple positions open, make sure the square off doesn’t lead to delta increment. If it happens, the orders will successfully go through but the exchange/CC may apply a penalty. Also Dhan RMS reserves its right to square off such positions. Here is the detailed example :

| Open Position | Permissible | Not Permissible |

|---|---|---|

| 1 Long Future | 1 Short Future (squareoff) | Short Call or Long Put |

| 1 Long Call | 1 Short Call of same strike (squareoff) | Short Future, Long Put, Short call of different strike |

| 1 Short Put | 1 Long Put of same strike (squareoff) | Short Future, Short call, long put of different strike |

| 1 Long Future & 1 Short Call | Exit both the legs | Exiting only one leg |

| 1 Long Call & 1 Long Put | Exit both the legs | Exiting only one leg |

| 1 Long Call & 1 Short Call of different strike | Exit both the legs | Exiting only one leg |

Also, passive delta increment by market driven price changes are not considered a violation. If these limits are violated, exchange/CC will impose a penalty in breach of the position limits norms.

With these reforms, SEBI is reshaping how the F&O ecosystem measures and manages risk, without altering how traders actually view or use Open Interest in their day-to-day decisions. The shift to FutEq OI simply gives exchanges, brokers, and clearing corporations a more accurate lens to monitor exposure, manage concentration, and prevent unnecessary ban periods. For traders, the experience remains uninterrupted: you continue trading as usual, with clearer rules on how positions can be reduced during a ban and a framework that aligns limits more closely with real market activity. Overall, this circular strengthens market integrity while keeping trader convenience at the centre.

Naman