Hi Traders

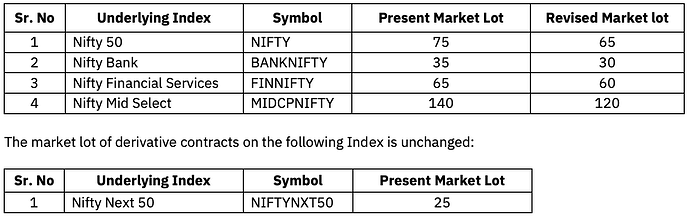

NSE has announced a revision in the market lot sizes for index derivative contracts, effective from 30th December 2025. All the new contracts of January 2026 & beyond already have the new lot size.

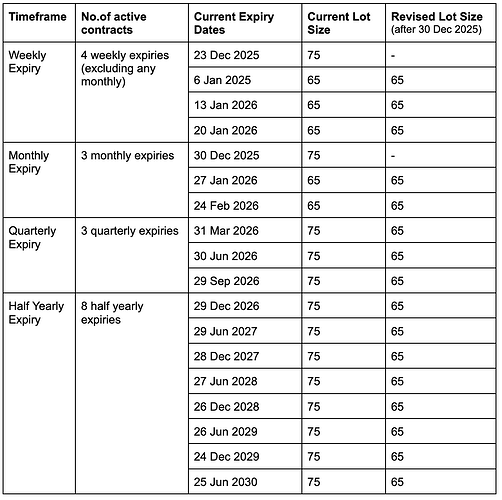

This change affects specifically quarterly and half-yearly contracts, as their lot sizes will be updated to the new lot size. They were launched with the older lot size & now, after 30th Dec 2025, their lot size will be updated. Weekly and monthly contracts will continue with the existing lot sizes until the monthly expiry of 30th December 2025, after which all contracts across expiries (6th Jan & beyond) already have the revised market lots.

Here is the table for Nifty 50 derivatives contract & its expiry cycle -

Because of these changes, all quarterly and half-yearly contracts (Mar’26 & beyond) will stop being tradable after 30th December 2025, with the old lot sizes. Traders who continue to hold positions in these contracts after 30th December 2025 with older lot size, may face issues with managing their open position, as such contracts cannot be exited/managed once the revised lot sizes take effect.

For example, you have 1 lot of open positions in 31st Mar 2026 Nifty Options contract. The current lot size is 75. The updated lot size in the same contract will be 65 after 30th December 2025. When you try to close this position post-30th Dec, you will only be able to exit 65 qty. The balance 10 qty will remain open till expiry.

To ensure an orderly transition and avoid any risk to positions, Dhan RMS will initiate multiple safeguards & send cautions. Make sure to follow the below points :

- Users with open positions in quarterly & half-yearly index derivatives contracts to close their open position by 29th December 2025.

- Dhan RMS will not allow to create any fresh position in the quarterly & half-yearly contracts on & after 22nd December 2025 till the lot size revision is applied.

- If these positions are not squared off voluntarily, the RMS team may force-square off them before the effective date. The force-square off may happen anytime after 29th December, 2025, but this is not guaranteed. Make sure you manage your positions effectively.

These steps are being taken strictly in accordance with the exchange guidelines and are aimed at protecting traders from any unintended consequences during the transition. We request all clients holding quarterly or half-yearly index contracts to review their positions in advance and take timely action. For any assistance or clarification, our team is always available to help.