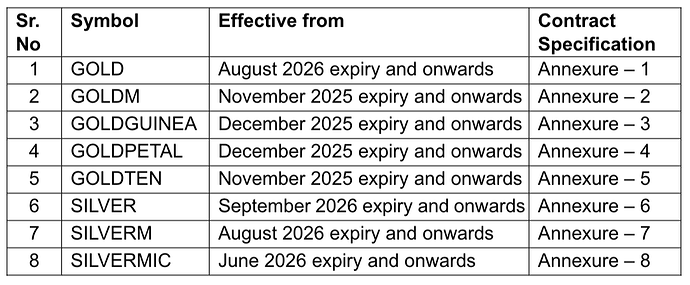

MCX has announced a change in the Staggered Delivery Tender Period for futures contracts under the Precious Metals category (like Gold and Silver).

| Item | Earlier | New (Effective now) |

|---|---|---|

| Staggered Delivery Tender Period | 5 days | 3 days |

This change is in line with the SEBI circular dated May 24, 2024, regarding “Modification in Staggered Delivery Period in Commodity Futures Contracts.”

What is Staggered Delivery Tender Period?

This is the window before expiry when sellers of futures contracts can start expressing intent to deliver the physical commodity — and buyers must be prepared to take delivery.

Shortening this period means:

- Less time exposure to delivery risk

- Lower funding & warehousing uncertainty for participants

- Smoother expiry week with reduced volatility caused by forced square-offs

Impact on Traders / Community Members

For intraday & positional traders:

- No impact on day-to-day trading.

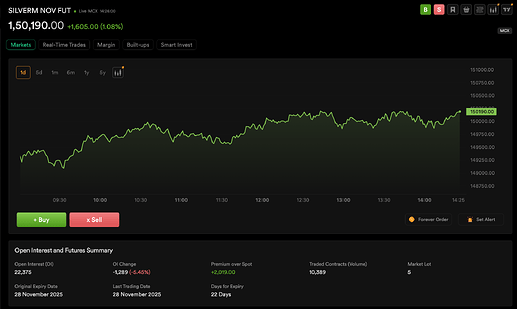

- But near expiry, liquidity may thin out faster because the delivery window begins earlier.

For traders carrying positions into expiry:

- Be aware of the shortened delivery cycle — the exchange can mark your position for delivery sooner.

- Margins can increase sharply during this delivery period.

For hedgers & bullion players:

- Faster physical settlement cycle — good for those looking to take/give delivery.

Delivery & Contract Key Details (from annexures)

For Gold (standard & mini) contracts:

- Last trading day: 5th of the expiry month

- Delivery allowed at:

- Ahmedabad (Primary)

- New Delhi & Mumbai (additional delivery centers)

- Delivery unit: 1 kg for GOLD, 8 grams for GOLD Mini

- Margins during delivery period:

Higher of:- (3% + 5-day VaR) OR

- 25% margin applied during delivery period

Reference:

MCX: Modification in Staggered Delivery Period in Commodity Futures Contracts

SEBI circular SEBI/HO/MRD/MRD-PoD-1/P/CIR/2024/57 dated May 24, 2024.