-

Along with well renowned NSE and BSE a new stock exchange is being setup known as “MSE - Metropolitan Stock Exchange”.

-

It has already received funding from brokerage firms like Groww, Zerodha, and etc.

-

Similar to Nifty50 and Sensex this exchange will have its own Index called “SX40” which will be an umbrella of 40 large cap stocks based on free float market capitalisation.

-

Products: ETF, F&O, Index fund and portfolio.

-

Soon this exchange will be available with most stock brokers. Tagging: @Dhan @PravinJ @Naman

-

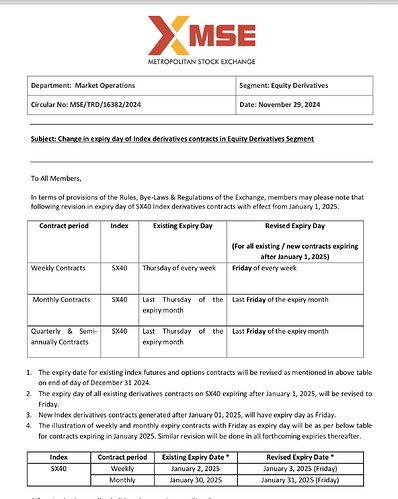

Trading & expiry schedule: Attached below.

Exchanges reduced volumes for brokers in 2024, in 2025 brokers will now run exchanges.

It’s interesting that the two biggest stock brokers, who have a huge number of clients, are now joining the ownership board of the lesser-known Metropolitan Stock Exchange as investors.

Their involvement might really help make the MSE more popular and improve its liquidity, especially if they think about offering trades without brokerage fees or lower fees for orders placed at this exchange for their clients.

Let’s hope they don’t adopt the same flawed method of market capitalization based weightage for the SX40 that other major indices in India use. A different way of calculating weights could help manage the price fluctuations that larger stakes tend to create for their benefit, which often leaves retail traders facing losses in index trading.

This exchange was setup long ago and didn’t gain any traction since then and it could remain so, I believe, because of network effects.

Recent news indicates that SEBI is already discussing this issue. Let’s hope they take steps to protect the interests of retail investors soon.

Is that even a point? Tell me one thing that isn’t rigged in this country. ![]()

@thisisbanerjee I believe that using an index weighting system that can’t easily be influenced by those with a lot of money would really help to protect everyday retail participants in the Derivatives market. I just hope they don’t wait too long to put this into action.

@Brishide The only fair calculation I see is, equal weighted index.

I’m okay with whatever they choose to do, as long as it’s not just 3 or 4 stocks that determine how the whole Secondary Market in India looks. A weighting system that’s hard to manipulate would be great, so retail traders won’t have to shoulder all the losses.