Dear Traders,

Dhan is built for Traders, we focus on ensuring we provide you best in class trading features and have continued to ensure we enhance your experience with time to time.

For all market participants, be it investors and trades - diversification is important. Diversification is a fundamental investment strategy that involves spreading your capital across different asset classes such as stocks, bonds, real estate, commodities and more. The goal is to reduce overall risk by ensuring that no single asset class dominates your portfolio. If one asset performs poorly, losses can be offset by gains from other assets, helping to stabilise returns.

This concept is equally applicable for traders, providing a diversified platform for implementing trading strategies across various markets. By trading multiple assets, you can avoid over-dependence on a specific market, sector, timing, or regulation, helping to protect your profit and loss (P&L) from sudden market changes or unexpected events that could negatively impact returns. At Dhan, you can trade and invest across a variety of segments, including equities, mutual funds, options, futures, ETFs, fixed income, and commodities. These segments are available through NSE, BSE, and MCX, all powered by our in-house trading system - DEXT.

Today, we are excited to announce the launch of a new exchange-segment on Dhan, designed to enhance risk management for traders and offer a broader range of asset classes for diversification.

Introducing: Commodity Derivatives by NSE on Dhan

National Stock Exchange (NSE), the world’s largest derivative exchange, started offering commodity derivatives in 2018. In recent times, the commodity segment on NSE has seen a lot of traction & interest from the trading community. Infact, in January 2024, NSE became the second largest commodity derivative exchange in India, surpassing NCDEX.

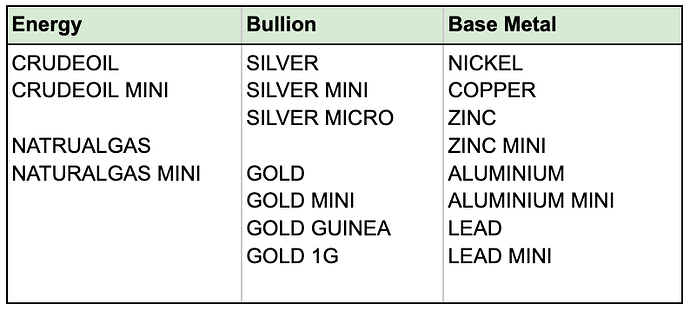

The NSE offers commodity derivatives for the following instruments:

At Dhan, all instruments are live and available for trading, provided they meet the criteria outlined in the Dhan Risk Management Policy. One key requirement is that the contract must have a minimum of 10 lots of Open Interest to be actively traded on the Dhan.

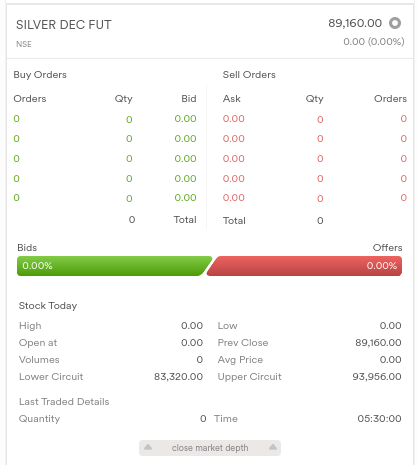

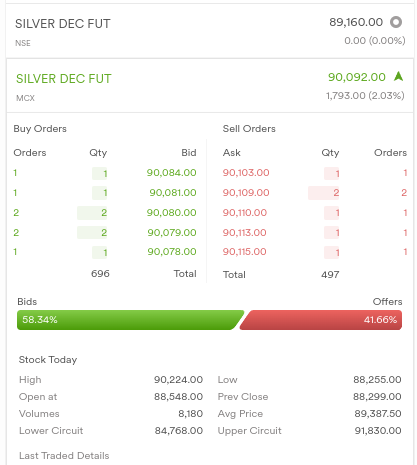

To start trading in Commodity derivatives on NSE, simply enter the instrument’s name in the search across any platform of Dhan - App or Web, Options Trader (ot.dhan.co) or on Charting Console of Dhan (tv.dhan.co). You will see a list of results where commodity instruments would also showcase NSE exchange in front of them. Tap or click on the desired instrument and you are good to go. You will also find similar names across various exchanges in the search result. The exchange is clearly indicated next to each instrument in the subscript. Be sure to check the exchange name carefully before placing a trade. The exchange is visible in the search results, instrument page, order window, position table, and order book.

If you are hardcode Commodity Trader and already on Dhan, you by now know that we provide you many incredible features:

- Single Margin for all Exchanges & Segments from the first day!

- Instant Pledging and Un-pledging experience for Margin Benefit

- Margin Benefits are available across all segments & exchanges

- Trading from Charts

- Option Chain and also Advanced Option Chain

- All Order Types - Market, Limit and Trigger

- For Large Traders - Iceberg Orders

- For Scalpers - Scalper Mode on Charts

- and more

Now with NSE & MCX on Dhan, you have an option of two exchanges to trade Commodities. This will help you to manage your position in adverse cases better. Explore the new NSE Commodity segment today and share your feedback.

Happy Trading,

Jay