RBI Cuts Repo Rate After 2 Years – What It Means for You!

RBI Cuts Repo Rate After 2 Years – What It Means for You!

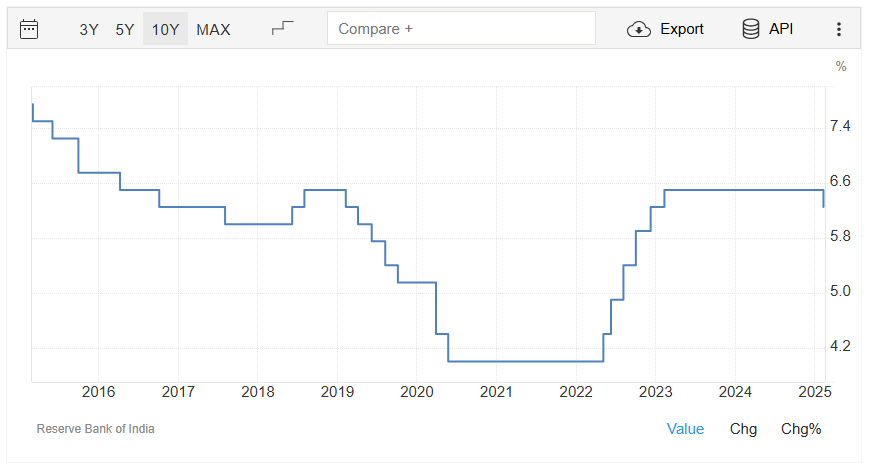

The Reserve Bank of India (RBI) has cut the repo rate by 25 bps to 6.25%, marking its first rate cut since May 2020. This move comes just a week after the government slashed personal income tax, signaling a clear push to boost economic growth.

What is the Repo Rate?

What is the Repo Rate?

It’s the rate at which RBI lends to banks. With this cut, borrowing becomes cheaper, encouraging spending and investment.

Why Now?

Why Now?

RBI Governor Sanjay Malhotra emphasized that while India’s economy remains resilient, global uncertainties persist. Inflation has stayed in check under the monetary policy framework, giving room for easing.

Global Impact & Market Reactions

Global Impact & Market Reactions

- US tariffs on China, Canada, and Mexico have fueled trade war fears, causing currency fluctuations.

- The rupee hit an all-time low of ₹87/USD before recovering to ₹87.43.

How Does This Affect You?

How Does This Affect You?

All external benchmark lending rates (EBLRs) linked to the repo rate will drop, relieving borrowers. Loans may get cheaper, potentially boosting housing and auto demand.

A big move by the RBI—how do you see this impacting the markets? Drop your thoughts below!

A big move by the RBI—how do you see this impacting the markets? Drop your thoughts below!

2 Likes

Market has given its view. Now what do we say above that

1 Like

@t7support Haha, this happens when the market has already priced in the 25 basis point rate cut, leaving no room for further impact

1 Like

I haven’t come across a single story from near and dear ones where someone decided to buy a house or a car on loan simply because interest rates fell by 0.25%.

It seems like a logical idea, but it just doesn’t play out in real life.

Do you know anyone who actually took out a new loan just because the interest rates dropped?

I think this opens up chances for real estate investors to acquire more homes with loans ( buy to rent out ). This reduces the number of available houses in the market and drives up the prices of homes even more.

I haven’t encountered a single story from near and dear ones where someone decided to buy a house or a car on loan simply because interest rates fell by 0.25%.

However, such rate cuts do have a significant impact in two key ways:

They benefit those with existing loans, leading to noticeable savings (something I’ve personally experienced).

They benefit those with existing loans, leading to noticeable savings (something I’ve personally experienced).

They make top-up loans more appealing, encouraging people to purchase more.

They make top-up loans more appealing, encouraging people to purchase more.

@Brishide These cuts don’t impact the new loans but the existing ones as @RahulDeshpande said. Only when the rate cuts are significant over the times, the real estate market booms (2019 to 2022)!

Personally even i purchased a home in that period when the Housing Loan Interest was around 6.7%. Post covid, the interest rate began to rise. By default in these cases, the banks increase the tenure. In my case, the tenure became 55 years! Such rate cuts help reduce the tenure.

1 Like

![]() RBI Cuts Repo Rate After 2 Years – What It Means for You!

RBI Cuts Repo Rate After 2 Years – What It Means for You!![]() What is the Repo Rate?

What is the Repo Rate?![]() Why Now?

Why Now?![]() Global Impact & Market Reactions

Global Impact & Market Reactions![]() How Does This Affect You?

How Does This Affect You?![]() A big move by the RBI—how do you see this impacting the markets? Drop your thoughts below!

A big move by the RBI—how do you see this impacting the markets? Drop your thoughts below! ![]()