Hello Everyone,

Tracking market actions and deriving insights are always difficult for a trader or investor. It involves looking at the macro and micro of sector, company and market mood. Not just this, tracking overall market valuation or what big guys (FIIs & DIIs) are doing today in the market, all becomes part of daily research for a user. This makes you as a trader equipped with information, to analyse markets and take positions accordingly.

When we are building ScanX, we realise how important it is to track broader markets and the trends that emerge there. This is why we build Insights on ScanX - a place to track overall markets, whether that be via Heatmaps or Market Valuation charts. Our early users on ScanX love this section, where they can track the entire market from a single screen.

We already have introduced the following for our users:

- Heatmap - track all stock actions or sector action in any index.

- Market Valuation - key valuation ratios of all indices, with their historical ranges to identify overvalued/undervalued zones

- Bulk/Block Deals - track transactions by big players either on exchange or off exchange

- F&O Ban List (MWPL) - possible entrants/exits to Exchange F&O Ban list

In our pursuit of making more information available to all traders & investors in a single place, we are adding another metric to this section.

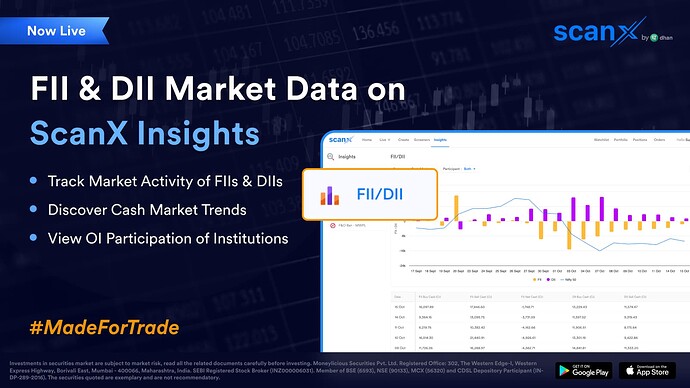

Introducing FII & DII Market Data on ScanX Insights

Institutional money and activity drives the market in a certain direction, and it is monitored actively by investors as well as traders. This is why market activity of Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) becomes an important indicator of market sentiment.

With this, you will be able to track trends Cash Market activity as well as OI participation in Derivative markets of Institutions. You will be able to track this data for the last 6 months along with the current month, right from ScanX Insights.

Not just this, we also have added data points here. You can also track market activity in the Derivatives segment of Pro and Client category. Pro includes proprietary trading firms and Client includes all clients of brokerage firms. This combined with FII & DII market activity gives overall market participation by different market participants. This data is highly indicative of market mood and where the markets are heading towards.

With ScanX, we are aiming to add more such insights with the coming time, for making broader analysis as well as micro analysis simpler. As always, we are looking forward to your feedback to keep improving our products.

At the moment we have kept this data available for all users (when those who are unlogged), in the coming days the same will be available only to Dhan customers who are registered on exchanges and active investors / traders on its platform

Happy Trading!

Hardik

Product