Dear Investors,

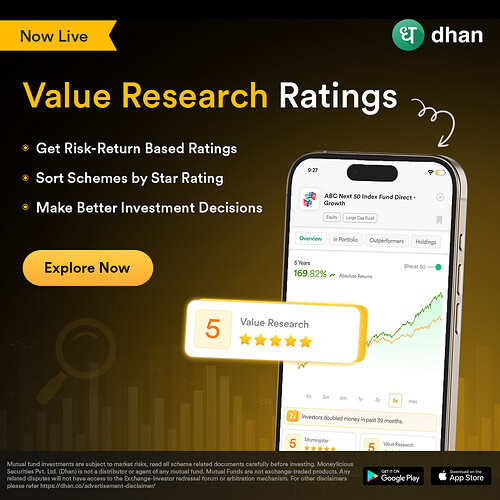

Investors frequently rely on star ratings to evaluate Mutual funds and ETFs, tracking their performance based on past returns. That’s why we’re excited to announce that, in addition to Morningstar, you can now view Value Research Ratings on the Dhan App! This gives you even more insight into how your investments are doing & choosing the right schemes.

How Value Research Ratings Work:

Value Research Ratings focus on Risk and Return, combined to give a simple star rating for each fund.

How they’re calculated:

Equity and Hybrid Funds: Rated based on 3- and 5-year performance.

Debt Funds: Based on 18 months of weekly performance.

What do the star ratings mean?

| Star Rating | Description |

|---|---|

| ⭐️⭐️⭐️⭐️⭐️ | Top 10% – The best performers in their category. |

| ⭐️⭐️⭐️⭐️ | Next 22.5% – Above-average performance. |

| ⭐️⭐️⭐️ | Middle 35% – Average risk-adjusted performance. |

| ⭐️⭐️ | Next 22.5% – Below-average performance. |

| ⭐️ | Bottom 10% – Weakest performance. |

Comparison Morningstar vs Value Research Ratings

| Aspect | Morningstar Ratings | Value Research Ratings |

|---|---|---|

| Calculation Method | Risk-adjusted metrics, costs, volatility | Risk-adjusted returns |

| Update Frequency | On Monthly basis ratings get updated | Ratings get updated based on market conditions |

| Historical Performance | Minimum three years required | Equity/hybrid: 3 years; Debt: 18 months |

| Portfolio Use | Identifies funds with strong past performance | Compares funds based on historical risk and returns |

| Investment Decision | Assesses long-term performance and stability | Identifies strong performers using risk-adjusted metrics |

Where can you find these Ratings?

Simply head over to the Mutual Fund section in the Dhan App. Search for any fund, and you’ll see the Value Research Rating displayed on the details page, giving you a clear snapshot of its performance.

This new feature is to provide you with more insights into your investments, making it easier to evaluate and manage your portfolio. Stay tuned for more exciting updates coming soon!

Happy Investing.

Saurav Parui