About Ola Electric:

They are a pure EV player in India, building vertically integrated technology and manufacturing capabilities for EVs and EV components. They manufacture EVs and certain core components at the Ola Futurefactory. Having delivered seven products and announced four new ones, they are developing their EV hub in Tamil Nadu, which includes the Ola Futurefactory for EV manufacturing, the Ola Gigafactory for cell manufacturing, and co-located suppliers. They operate a direct-to-customer omnichannel distribution network across India, with 870 experience centres, 431 service centres as of March 31, 2024, and their Ola Electric website.

About the Industry in which Ola Electric operates:

E2Ws are leading India’s shift towards electrified mobility, thanks to their low total cost of ownership and supportive government incentives and subsidies for domestic EV manufacturing and adoption. E2W market penetration in India is expected to rise from around 5.4% of domestic 2W registrations in Fiscal 2024 to 41-56% of domestic 2W sales by Fiscal 2028. The Indian E2W sector is projected to grow at a CAGR of 11%, reaching between US$35 billion (₹2.8 trillion) and US$45 billion (₹3.6 trillion) by Fiscal 2028. Moreover, regions like Africa, LATAM, and South East Asia present substantial export opportunities for Indian E2W OEMs.

| Important Information and Timelines of the IPO of Ola Electric: | |

|---|---|

| Open Date | 2 August 2024 |

| Close Date | 6 August 2024 |

| Total Issue Size – Number of Shares | 808626207 |

| Minimum Bid Price | 72 |

| Maximum Bid Price | 76 |

| Lot Size | 195 |

| Basis of Allotment | 7 August 2024 |

| Initiation of Refunds and Credit of Shares to Demat | 8 August 2024 |

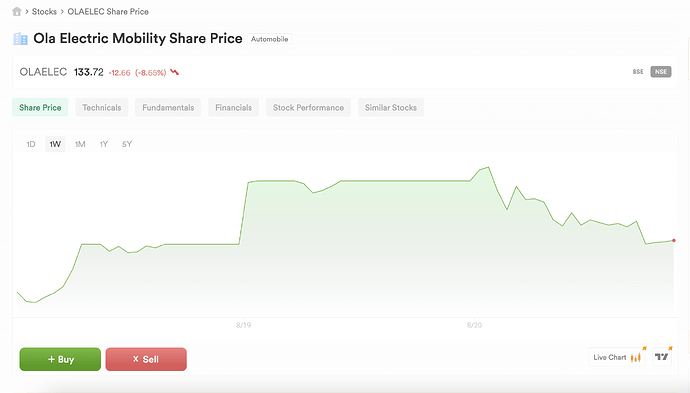

| Listing Date | 9 August 2024 |

| Listing Exchange(s) | NSE and BSE |

Minimum and Maximum Lot Sizes for the IPO of Ola Electric:

| Category | Lots | Shares | Amount (in ₹) |

|---|---|---|---|

| Retail – Minimum | 1 | 195 | 14820 |

| Retail – Maximum | 13 | 2535 | 192660 |

| sHNI – Minimum | 14 | 2730 | 207480 |

| sHNI – Maximum | 67 | 13065 | 992940 |

| bHNI – Minimum | 68 | 13260 | 1007760 |

Objective of the IPO of Ola Electric:

-

Capital expenditure to be incurred by our Subsidiary, OCT for the Project.

-

Repayment or pre-payment, in full or part, of the indebtedness incurred by our Subsidiary, OET.

-

Investment into research and product development.

-

Expenditure to be incurred for organic growth initiatives.

-

General corporate purposes.

Financials of Ola Electric:

| Particulars | As at and for the Financial Year ended March 31, 2024 | As at and for the Financial Year ended March 31, 2023 | As at and for the Financial Year ended March 31, 2022 |

|---|---|---|---|

| Equity share capital | 19,554.50 | 19,554.50 | 19,554.50 |

| Total income | 52,432.70 | 27,826.97 | 4,562.60 |

| Loss for the year | (15,844.00) | (14,720.79) | (7,841.50) |

| Basic earnings per equity share | (4.35) | (3.91) | (2.23) |

| Diluted earnings per equity share | (4.35) | (3.91) | (2.23) |

| Total borrowings | 23,892.10 | 16,457.53 | 7,504.07 |

| Net Worth | 20,193.39 | 23,564.44 | 36,614.52 |

| Return on Net Worth | (78.46) | (62.47) | (21.42) |

| Net Asset Value per Equity Share | 5.54 | 6.26 | 10.43 |

For more details on the IPO, refer to the DRHP here.

Did you know that you can now Pre-Apply for an IPO on Dhan? You can place your IPO Bid on Dhan and the order will be pushed to the Exchange as soon as the Bidding starts for Ola Electric. You will receive a UPI mandate after 10:00 AM on 2 August 2024.

###1. How to apply for the IPO of Ola Electric on Dhan?

You can apply for the IPO of Ola Electric from either Dhan Mobile App or Web

On Dhan Mobile App you can find the IPO under the Money Section > IPO Tab

On Dhan Web you can find the IPO under Markets Tab > IPOs

###2. In case of successful allotment, when the IPO shares of Ola Electric be visible on Dhan?

The CDSL will intimate you regarding the credit of shares into your Demat account by 8 August 2024. However, you will be able to see the shares of Ola Electric on Dhan before the market starts on the listing date which is 9 August 2024.