@Tradehull_Imran Hello sir, Need you thoughts on this.

Strategy

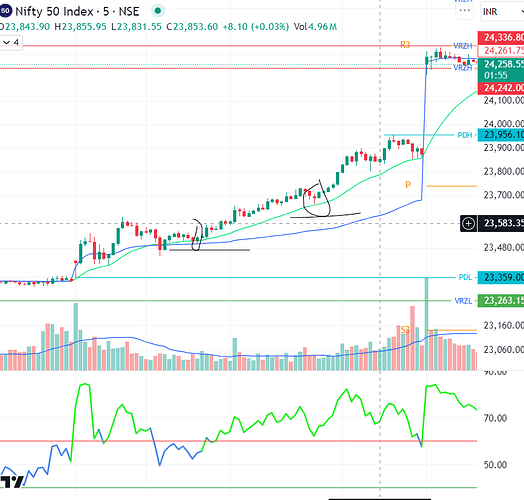

Uptrend :

Time frame 5 mins

Price is above VWAP

Price is above 20 EMA

RSI is equal to or grater than 60

Downtrend

Time frame 5 mins

Price is blow VWAP

Price is below 20 EMA

RSI is equal to or less than 40

Buy condition

If all the above condition met and price reject from 20 EMA buy

Load your data into a DataFrame

Ensure your DataFrame has columns: [‘timestamp’, ‘open’, ‘high’, ‘low’, ‘close’, ‘volume’]

df = pd.read_csv(‘your_data.csv’, parse_dates=[‘timestamp’])

Calculate indicators

df[‘VWAP’] = ta.volume.volume_weighted_average_price(df[‘high’], df[‘low’], df[‘close’], df[‘volume’])

df[‘EMA20’] = ta.trend.ema_indicator(df[‘close’], window=20)

df[‘RSI’] = ta.momentum.rsi(df[‘close’], window=14)

Define conditions

uptrend = (df[‘close’] > df[‘VWAP’]) & (df[‘close’] > df[‘EMA20’]) & (df[‘RSI’] >= 60)

downtrend = (df[‘close’] < df[‘VWAP’]) & (df[‘close’] < df[‘EMA20’]) & (df[‘RSI’] <= 40)

Implement buy conditions for Call (CE) and Put (PE) options

df[‘Buy_CE’] = uptrend & (df[‘low’] < df[‘EMA20’]) & (df[‘close’] > df[‘EMA20’])

df[‘Buy_PE’] = downtrend & (df[‘high’] > df[‘EMA20’]) & (df[‘close’] < df[‘EMA20’])

Results

print(“Call Buy Signals (CE):”)

print(df[df[‘Buy_CE’]])

print(“\nPut Buy Signals (PE):”)

print(df[df[‘Buy_PE’]])