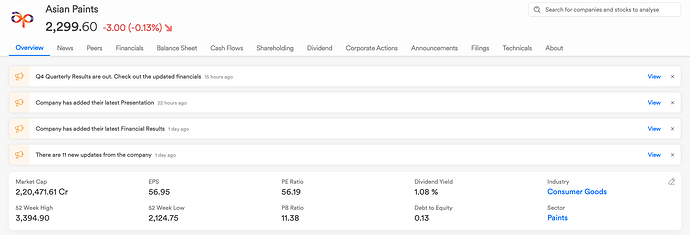

Asian Paints, the long-standing leader in India’s paint industry, has reported its Q4 results, falling short of market expectations amid rising competition. With the aggressive entry of Birla Opus Paints, the competitive landscape is heating up. The question now is: can Asian Paints hold its dominance, or is the market ready for a major shift?

You can see all the quarterly updates on Scanx:

Financial Performance Overview:

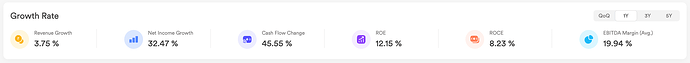

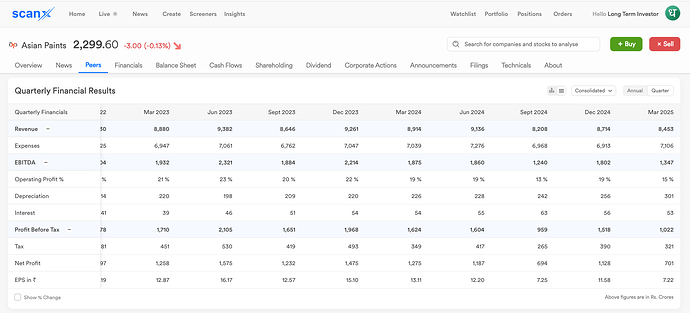

- Revenue Decline: Asian Paints reported a 4.5% decline in consolidated net sales for FY’25 at ₹33,797 crores and a 5.4% drop in standalone net sales at ₹29,421 crores.

- Profit Impact: PAT (Profit After Tax) excluding exceptional items was down 26.7% year-on-year.

- Dividend Announcement: Final dividend declared at ₹20.55 per share, bringing the total to ₹24.80 per share for FY’25.

Segment-wise Analysis:

- Decorative Business: Marginal volume growth of 1.8%, revenue declined by 5.2% in Q4 FY’25. Downtrading and competitive intensity have significantly impacted the sector.

- Industrial Business: Grew by 6.1%, with strong performance in General Industrial and Automotive segments.

- Home Décor: Muted performance due to pressure on household disposable incomes. There was an impairment loss on investments in White Teak.

- International Markets: Value decline of 1.5%, but in constant currency terms, there was a growth of 6%. Middle East and Asia markets performed well, while Africa faced challenges.

Margin and Cost Analysis:

- Standalone PBDIT Margin: 18.5%, down by 210 basis points YoY.

- Consolidated PBDIT Margin: 17.2%, a drop of 220 basis points YoY.

- Operational Challenges: Margin compression primarily due to muted demand and increased competitive pricing pressures in the decorative segment.

The Birla Opus Paints Challenge

Birla Opus, the new heavyweight entry, is backed by the financial might and business expertise of the Aditya Birla Group. The strategic focus areas for Birla Opus include:

- Premium Product Lines: Targeting the high-value decorative paints segment.

- Aggressive Marketing: Industry experts predict a high-decibel marketing campaign, leveraging the Birla brand.

- Distribution Network Expansion: Rapid scaling of distribution to match Asian Paints’ massive network.

- Advanced Technology: Birla Opus is investing heavily in cutting-edge paint technology for enhanced durability and finish.

Head-to-Head: Asian Paints vs. Birla Opus:

| Parameter | Asian Paints | Birla Opus Paints |

|---|---|---|

| Revenue (FY25) | ₹33,797 crores (Consolidated) | Expected to cross ₹5,000 crores in the first 2 years |

| Product Range | Decorative, Industrial, Home Decor | Focused on Decorative with high-end finishes |

| Market Share | Dominant leader in India | New entrant, aggressive expansion |

| Distribution Network | Pan-India, over 50,000 dealers | Rapidly scaling, aiming to match within 3 years |

| Technology | Wide R&D focus, automation in operations | Advanced tech for better quality and efficiency |

| Competitive Edge | Brand Loyalty, Established Network | Aggressive pricing, Marketing Focus |

Market Dynamics and Future Outlook

- Price Wars: With Birla Opus stepping in aggressively, expect price cuts and higher promotional spends.

- Innovation vs. Legacy: Birla Opus is leaning heavily on new technologies, while Asian Paints will need to innovate rapidly to maintain its edge.

- Distribution Push: Birla Opus is targeting Tier 2 and Tier 3 cities to carve out market share, a territory Asian Paints has long dominated.

The entry of Birla Opus has undoubtedly set the stage for a “Paint War” in 2025. Asian Paints may be facing its toughest competition yet with Birla Opus entering the fray. However, the market leader is not stepping back; it continues to expand its product line and invest in capacity expansion to maintain its edge. The recent announcement of a dividend of ₹20.55 per share is also a testament to its stable financial performance and commitment to shareholders.

The paint war is heating up—will Asian Paints continue to dominate, or is a shake-up on the horizon?

Interested to know more about the company’s results? You can directly access it from scanx - under company filings to exchange.