Options Trading can be overwhelming for beginners. With complex and different strategies circulating everywhere, it might become difficult to make decisions.

Here are 9 popular strategies that every options trader needs to know!

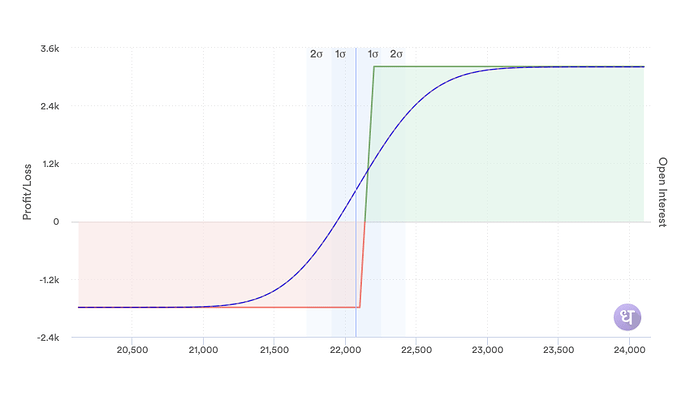

1.Bull Call Spread

A Bull Call Spread strategy ![]()

![]() is a type of options trading where you buy a call option and, at the same time, sell another call option with a higher strike price & same expiry date. It’s used when you expect the price of the underlying asset to increase and want to hedge against the unlimited loss.

is a type of options trading where you buy a call option and, at the same time, sell another call option with a higher strike price & same expiry date. It’s used when you expect the price of the underlying asset to increase and want to hedge against the unlimited loss.

Buying a call option allows you to buy the underlying asset at a predetermined price within a specified timeframe, while selling a call option with a higher strike price generates immediate income but caps potential profits.![]()

![]()

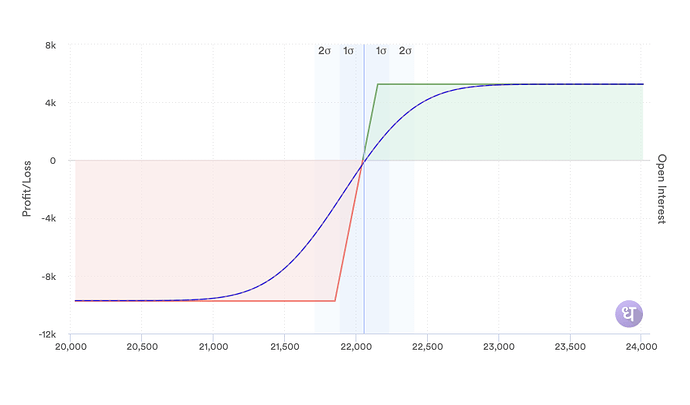

2.Bull Put Spread

In a Bull Put Spread, traders sell a put option at a certain strike price and simultaneously buy another put option with a lower strike price. This strategy aims to profit from bullish market movements while minimizing risk.

By selling a put option, the trader receives a premium upfront, but they also agree to buy the underlying asset at the strike price if the market price falls below it.

However, to limit potential losses, they buy a put option with a lower strike price, providing them with the right to sell the asset at a higher price if needed. This strategy offers limited risk because the maximum loss is capped, but it also limits potential profits.

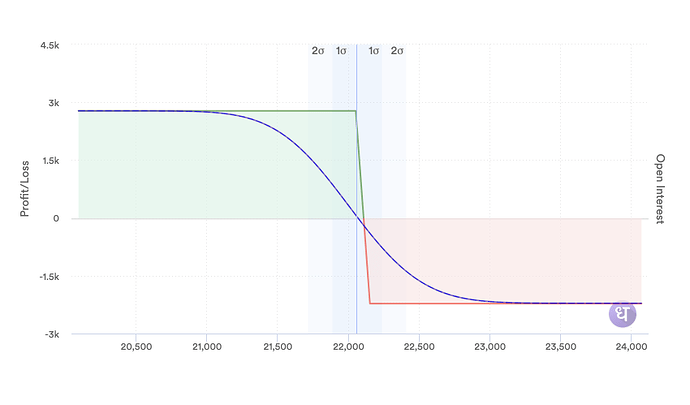

3.Bear Call Spread

The Bear Call Spread strategy involves selling a call option and simultaneously buying another call option with a higher strike price. This is done in anticipation of the underlying asset’s price decreasing.

By employing this bearish strategy, traders aim to make a profit from the asset’s decline while also minimizing potential losses. It’s essentially a way to bet on the price of the asset going down, but with a built-in safety net to limit any losses if the market moves unexpectedly.

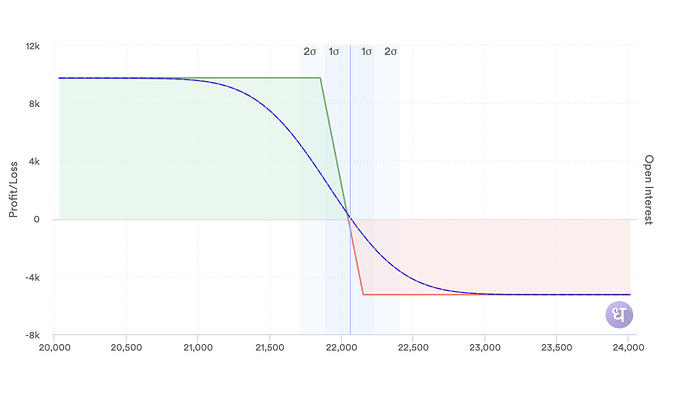

4.Bear Put Spread

A Bear Put Spread is a trading strategy where a trader buys a put option while simultaneously selling another put option with a lower strike price. This approach is typically adopted by traders who anticipate a decrease in the price of the underlying asset.

It provides a way to profit from a downward market movement while limiting potential losses. The maximum profit achievable with this strategy is predetermined and capped, offering traders a defined risk-reward profile.

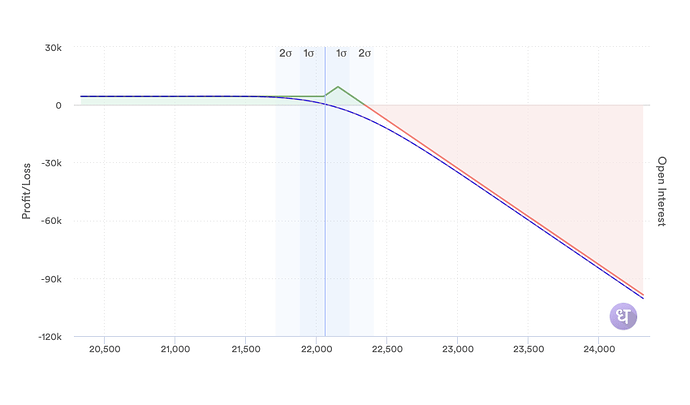

5.Call Ratio Spread

The Call Ratio Spread strategy involves buying a certain number of call options while selling more call options at a higher price. Traders use it when they think the stock price will stay the same or go up a bit. It’s a way to potentially make money if the stock price goes up, but it’s risky if the price drops a lot. So, it’s important to be careful and understand the risks before using this strategy.

This strategy can offer potential profits if the stock price rises but carries the risk of unlimited losses if the stock price drops significantly. It’s important to carefully consider your risk tolerance and market outlook before implementing this strategy.

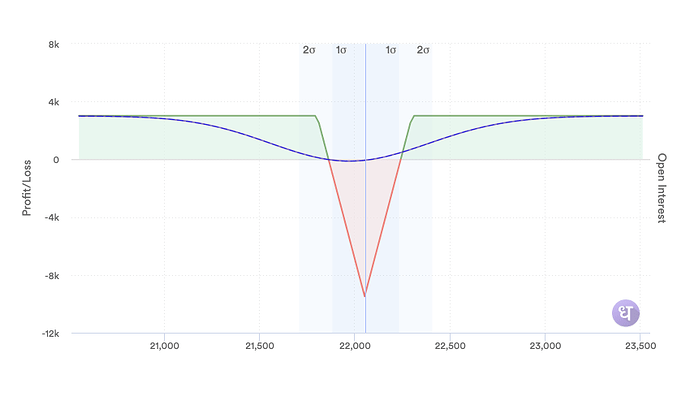

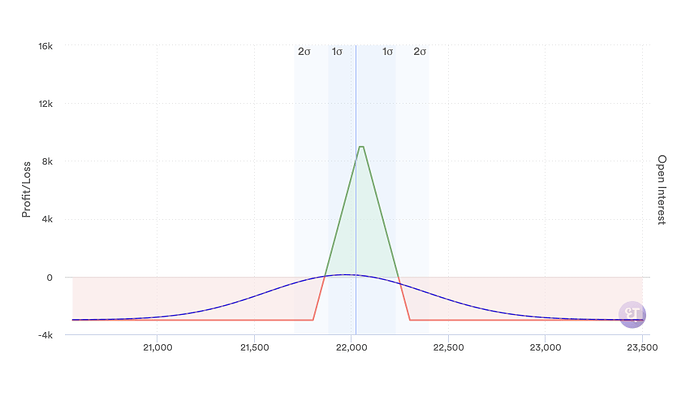

6.Long Iron Butterfly

The Long Iron Butterfly is a trading strategy where you use options to try and make money when the price of a stock stays in a certain range. You do this by buying one call option and selling another with a higher price, while also selling one put option and buying another with a lower price.

If the stock price stays within this range until the options expire, you can make a profit. It’s a way to benefit from calm markets without needing the stock price to move a lot.

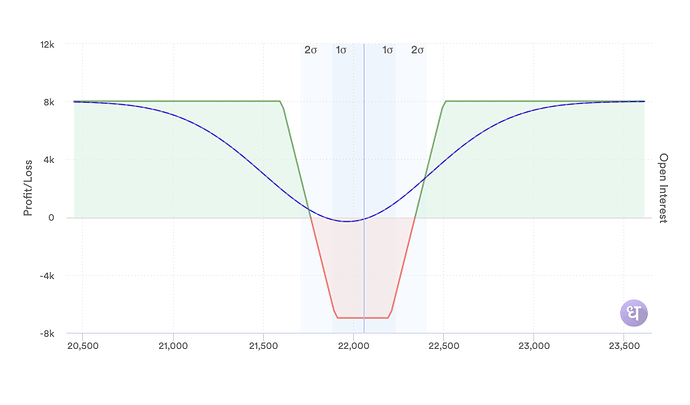

7.Long Iron Condor

Long Iron Condor strategy is an options trading approach where you simultaneously buy a call spread and a put spread with different strike prices. This strategy is used when you expect the price of the underlying asset to remain within a certain range. It’s called “long” because you’re buying options, not selling them.

You buy one call option with a higher strike price and sell another call option with an even higher strike price. At the same time, you buy one put option with a lower strike price and sell another put option with an even lower strike price.

The goal of the Long Iron Condor is to profit from low volatility. If the price of the underlying asset stays within the range defined by the strike prices of the options you’ve bought and sold, you can make a profit. This strategy allows you to generate income while keeping your risk limited.

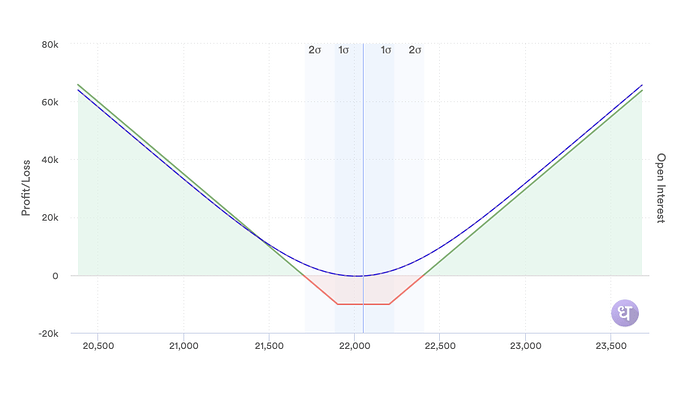

8.Long Strangle

The Long Strangle strategy involves buying both an out-of-the-money call option and an out-of-the-money put option at the same time. This is done in anticipation of a big price movement in either direction.

When the market makes a significant move, either up or down, the value of one of the options increases while the other decreases. This allows the trader to profit from the movement regardless of its direction.

The key benefit of the Long Strangle is its ability to capitalize on volatility, as it doesn’t require the market to move in a specific direction to be profitable. However, it’s important to note that this strategy carries the risk of loss if the market remains relatively stable, as both options could lose value over time.

9.Short Iron Butterfly

The Short Iron Butterfly strategy is a neutral options trading approach. It starts by selling an at-the-money call option and an at-the-money put option. At the same time, it involves buying a call option with a higher strike price and a put option with a lower strike price.

This creates a “wing” on both sides of the central strike price. The goal is to benefit from low volatility in the underlying asset. This strategy caps both potential losses and potential gains. It’s often used when traders expect the price of the underlying asset to remain relatively stable within a certain range.

For a seamless options trading experience, explore these popular strategies to enhance your trading journey on Options Trader by Dhan.

We have also created a detailed guide to learn how to leverage these strategies effectively and achieve your trading goals with confidence, on our youtube channel, you can watch it here ![]()

Check out more info only on: Option Trading Strategies - Trade with FREE Pre-Built Strategies | Dhan