Hi all,

Thursdays have been the most action-packed day of the week for traders - Nifty expiry day. It’s the day when volumes spike, premiums melt, and every move in OI or IV gets magnified.

But from September 1, 2025, NSE is moving all F&O contract expiries from Thursday to Tuesday. So, now: NIFTY expiry will now take place on Tuesdays, while SENSEX expiry will be on Thursdays.

What does this mean for traders? In reality, it’s not the day of the week that matters, but how participants build their positions ahead of expiry. The market pulse - OI trends, PCR, IV shifts, and strike-wise moves - is what drives the action.

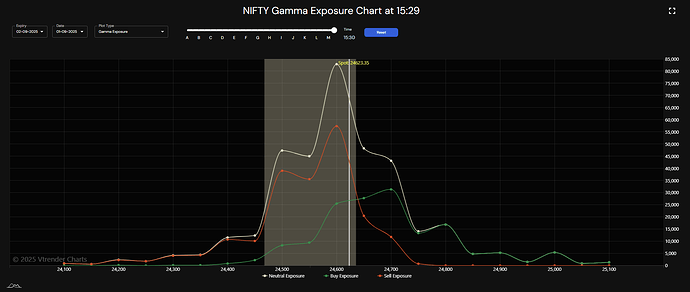

Here’s how things are shaping up on Nifty today:

![]() Nifty at Close: 24,625.05 (holding steady near last expiry’s levels but with a slight dip)

Nifty at Close: 24,625.05 (holding steady near last expiry’s levels but with a slight dip)

Here are some details you can see on the Nifty Option Summary page on Dhan:

OI: 36,25,14,700

PCR: 1.13

ATM IV: 07.57

Change in OI: -20.84%

When expiry is around the corner, every data point counts. That’s where the Nifty Options Summary on Dhan comes in - your one-stop view of OI trends, PCR, IVs, strike-wise moves, and expiry positioning.

Here’s what you can dive into before tomorrow:

- Expiry-Wise OI Breakup – see how traders are positioning across contracts.

- 21st Aug Expiry Highlights – track PCR, IVs, OI build-up & ITM vs OTM shifts.

- Strike-Wise Option Chain – zoom in on the most active strikes with OI & price changes together.

So while the calendar date of expiry may soon change, the signals you need to track remain the same, and with Dhan, they’re always clear and accessible.

Tomorrow is expiry. The signals are already here! Log in to Dhan.